CA Affidavit of Exemption from Documentary Transfer Tax - County of San Joaquin 2022-2026 free printable template

Show details

This document is used to declare exemptions from the Documentary Transfer Tax when recording a property transfer, detailing various exemptions and requiring completion before recording.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA Affidavit of Exemption from Documentary Transfer Tax

Edit your CA Affidavit of Exemption from Documentary Transfer Tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA Affidavit of Exemption from Documentary Transfer Tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA Affidavit of Exemption from Documentary Transfer Tax online

Follow the steps down below to benefit from a competent PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CA Affidavit of Exemption from Documentary Transfer Tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA Affidavit of Exemption from Documentary Transfer Tax - County of San Joaquin Form Versions

Version

Form Popularity

Fillable & printabley

4.8 Satisfied (60 Votes)

4.0 Satisfied (50 Votes)

4.4 Satisfied (41 Votes)

How to fill out CA Affidavit of Exemption from Documentary Transfer Tax

How to fill out CA Affidavit of Exemption from Documentary Transfer Tax

01

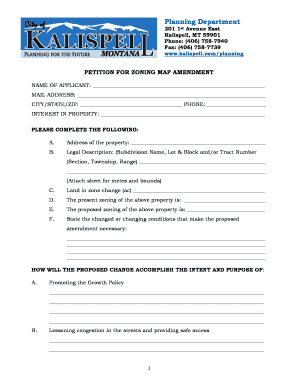

Obtain the CA Affidavit of Exemption from Documentary Transfer Tax form, either online or from your local government office.

02

Fill in the property address in the designated field.

03

Indicate the type of transaction that qualifies for exemption by checking the appropriate box.

04

Provide the name and contact information of the grantor (seller) and grantee (buyer).

05

Describe the exemption reason in detail, ensuring it aligns with the qualifying criteria.

06

Review the completed form for accuracy and completeness.

07

Sign and date the affidavit where indicated.

08

Submit the completed affidavit along with any required documents to the county recorder's office.

Who needs CA Affidavit of Exemption from Documentary Transfer Tax?

01

Individuals or entities engaged in property transactions that meet specific exemption criteria under California law.

02

Sellers and buyers of real estate who qualify for exemption from paying documentary transfer taxes.

Fill

form

: Try Risk Free

People Also Ask about

What is the Los Angeles County Declaration of Documentary transfer tax?

In addition to the Countywide documentary transfer tax of $1.10 per $1,000.00 an additional City documentary transfer tax has been imposed on all documents that convey real property within the cities of Culver City, Los Angeles, Pomona, Redondo Beach and Santa Monica (R&T 11911C).

What is the documentary transfer tax in Los Angeles?

Effective April 1, 2023, a new documentary-transfer tax will be imposed on residential and commercial real-property sales and transfers within the City of Los Angeles where the consideration or value is greater than $5 million.

How much is documentary transfer tax in California?

California's Revenue and Taxation Codes calls for the payment of a County Documentary Transfer Tax on the value of all real property of which ownership is being transferred. All counties have the same tax amount, which is 0.11% of the value.

What is the affidavit of transfer tax in San Francisco?

The purpose of this form is to explain the nature of the transaction and to determine if the transfer is taxable. Transfer tax is based on the purchase price if it is a purchase. Otherwise, it is based on the fair market value of the property being transferred.

What is documentary transfer tax in California?

The Documentary Transfer Tax (DTT) imposes a tax on each deed, instrument, or writing by which any lands, tenements, or any other realty sold, shall be granted, transferred, or otherwise conveyed to another person. The State Revenue and Taxation Code 11902 - 11934 governs this tax.

Who pays documentary transfer tax in California?

The payment of the transfer tax can be negotiated between the Buyer and the Seller. Normally, in Southern California, the Seller pays. In Northern California, the Buyer pays.

How is the documentary transfer tax calculated in California?

How much is the Documentary Transfer Tax? It depends on the location of the property. The County Transfer Tax is a standard of $1.10 per $1,000 of the sales price throughout the State. However, there are certain cities that also collect their own City Transfer Tax and those differ.

What is the declaration of documentary transfer tax in California?

The City documentary transfer tax rate is computed on consideration or value of the property conveyed, exclusive of existing liens and encumbrances, and is added to the Countywide $1.10 per $1,000.00 documentary transfer tax.

What is the transfer tax in San Francisco?

Transfer Tax If entire value or consideration is Tax rate for entire value or consideration is More than $250,000 but less than $1,000,000$3.40 for each $500 or portion thereof$1,000,000 or more but less than $5,000,000$3.75 for each $500 or portion thereof4 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify CA Affidavit of Exemption from Documentary Transfer Tax without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your CA Affidavit of Exemption from Documentary Transfer Tax into a dynamic fillable form that you can manage and eSign from anywhere.

How can I get CA Affidavit of Exemption from Documentary Transfer Tax?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific CA Affidavit of Exemption from Documentary Transfer Tax and other forms. Find the template you want and tweak it with powerful editing tools.

How do I fill out CA Affidavit of Exemption from Documentary Transfer Tax using my mobile device?

Use the pdfFiller mobile app to fill out and sign CA Affidavit of Exemption from Documentary Transfer Tax on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is CA Affidavit of Exemption from Documentary Transfer Tax?

The CA Affidavit of Exemption from Documentary Transfer Tax is a legal document used in California to claim an exemption from the payment of documentary transfer taxes when transferring property.

Who is required to file CA Affidavit of Exemption from Documentary Transfer Tax?

Parties involved in a property transfer that qualify for an exemption from documentary transfer taxes, such as certain government entities or non-profit organizations, are required to file this affidavit.

How to fill out CA Affidavit of Exemption from Documentary Transfer Tax?

To fill out the CA Affidavit, the filer must provide their name, the nature of the transaction, the reason for the exemption, and any necessary supporting documentation to substantiate the claim.

What is the purpose of CA Affidavit of Exemption from Documentary Transfer Tax?

The purpose of the CA Affidavit of Exemption is to formally document and justify a request to waive the documentary transfer tax on property transfers that meet specific criteria for exemption.

What information must be reported on CA Affidavit of Exemption from Documentary Transfer Tax?

The affidavit must report the parties involved in the transaction, the description of the property, the type of transaction, the exemption claimed, and any relevant dates.

Fill out your CA Affidavit of Exemption from Documentary Transfer Tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA Affidavit Of Exemption From Documentary Transfer Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.