Get the free Credit Card Collections

Show details

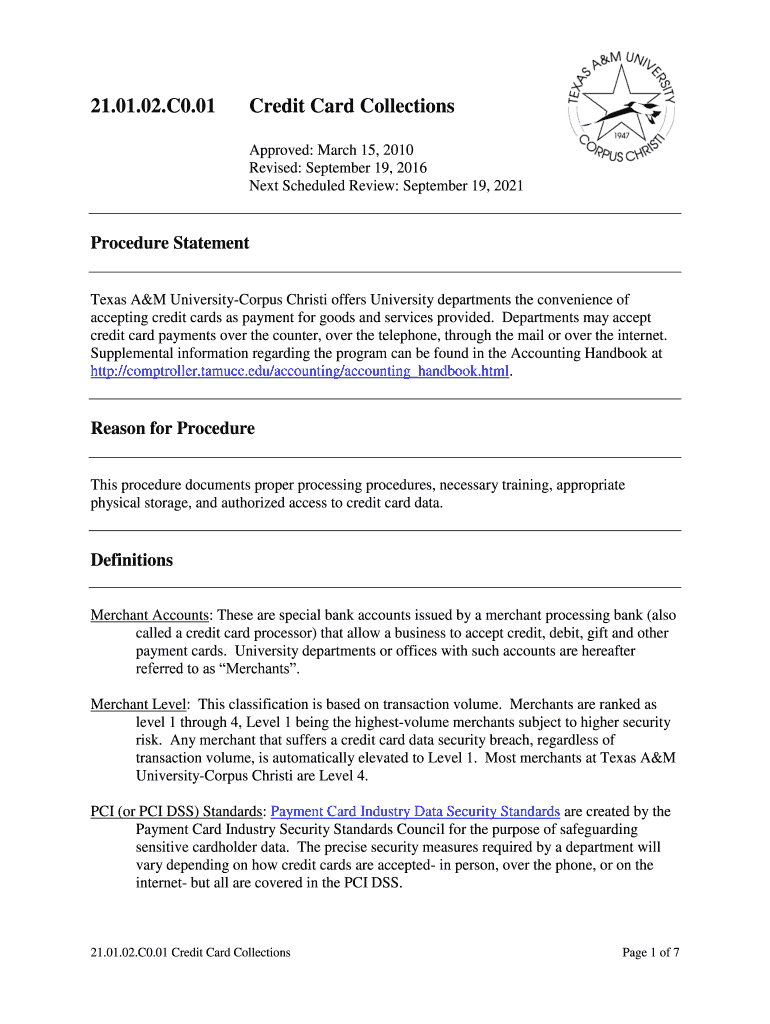

21.01.02. C0.01Credit Card Collections Approved: March 15, 2010, Revised: September 19, 2016, Next Scheduled Review: September 19, 2021Procedure Statement Texas A&M UniversityCorpus Christi offers

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit card collections

Edit your credit card collections form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit card collections form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit card collections online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit credit card collections. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit card collections

How to fill out credit card collections

01

Gather all the necessary information: You will need the credit card statement, the collection agency contact information, and any supporting documentation that proves your case.

02

Verify the debt: Before filling out the credit card collections, make sure the debt is valid and accurate. Review the statement and any other relevant information to ensure its legitimacy.

03

Fill out the credit card collections form: Provide all the required information on the form, including your personal details, account information, and the reason for disputing the debt, if applicable.

04

Attach supporting documentation: If you have any proof or evidence that supports your dispute, make sure to include it with the collections form. This can help strengthen your case and increase your chances of a successful resolution.

05

Review and double-check: Before submitting the collections form, carefully review all the information you have provided. Make sure it is accurate and complete to avoid any potential delays or issues.

06

Submit the collections form: Once you are confident that everything is filled out correctly, submit the credit card collections form to the appropriate authority or collection agency. Follow any specific instructions provided to ensure proper submission.

07

Keep copies for your records: Make copies of the collections form and all supporting documentation for your own records. This will serve as proof of your dispute and can be helpful in case of any further inquiries or disputes.

08

Follow up: After submitting the collections form, follow up with the relevant authority or collection agency to track the progress of your dispute. Stay informed and be prepared to provide any additional information or support if required.

09

Await resolution: Depending on the complexity of the dispute and the procedures involved, it may take some time to reach a resolution. Patience is key during this process.

10

Take further action if necessary: If the dispute is not resolved satisfactorily, consider seeking legal advice or exploring other options to protect your rights and interests.

Who needs credit card collections?

01

Credit card collections can be needed by individuals or businesses who are owed money by individuals or other businesses. It is commonly used by creditors, collection agencies, or legal departments of companies to recover outstanding debts.

02

Some specific examples of who may need credit card collections include:

03

- Banks and financial institutions who want to collect unpaid credit card bills

04

- Collection agencies who specialize in debt collection on behalf of their clients

05

- Retailers or service providers who want to recover unpaid balances from customers

06

- Landlords or property management companies who need to pursue rent arrears from tenants

07

- Lawyers or legal professionals who handle debt collection cases for their clients

08

- Credit card companies or issuers who want to recover outstanding balances from cardholders

09

- Individuals or businesses who have been personally harmed or financially affected by non-payment and are seeking to recover what is owed to them.

10

Credit card collections are an important tool for these entities to ensure the recovery of debts owed to them and maintain their financial stability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete credit card collections online?

With pdfFiller, you may easily complete and sign credit card collections online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit credit card collections in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your credit card collections, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit credit card collections on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share credit card collections on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is credit card collections?

Credit card collections refer to the process of pursuing and collecting overdue balances on credit card accounts.

Who is required to file credit card collections?

Credit card companies or financial institutions are required to file credit card collections.

How to fill out credit card collections?

Credit card collections are typically filled out by compiling a list of delinquent accounts and the amounts owed.

What is the purpose of credit card collections?

The purpose of credit card collections is to recover outstanding debts and reduce financial losses.

What information must be reported on credit card collections?

Information such as account numbers, customer names, outstanding balances, and collection efforts must be reported on credit card collections.

Fill out your credit card collections online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Card Collections is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.