PA Schedule UE 2017 free printable template

Show details

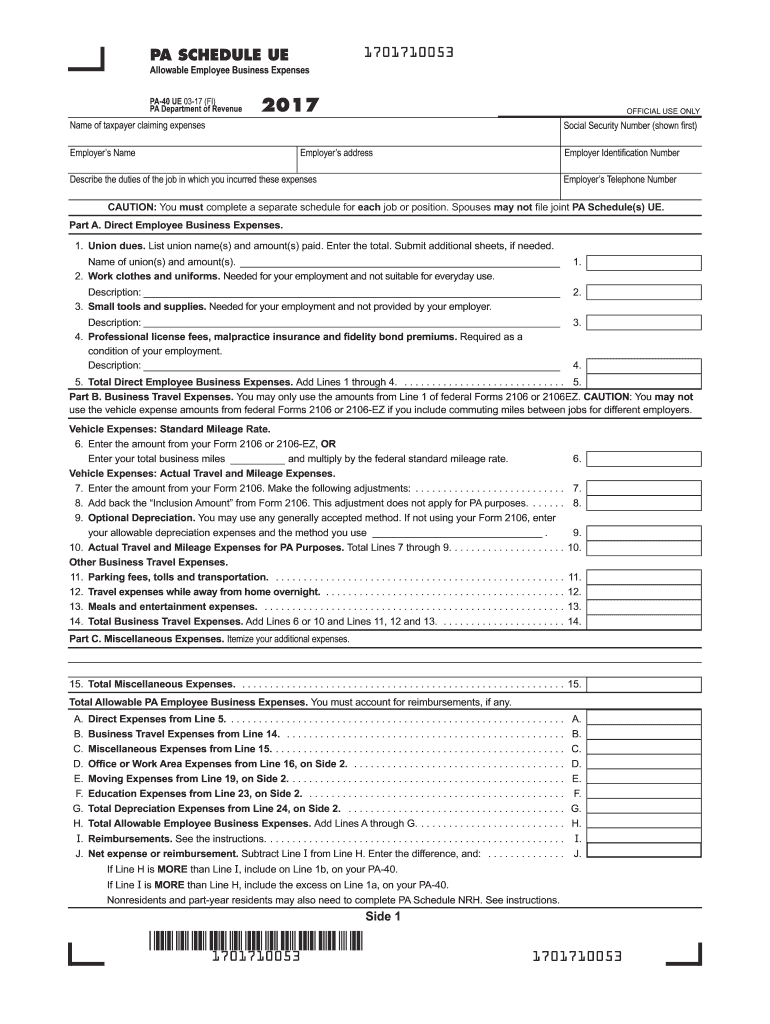

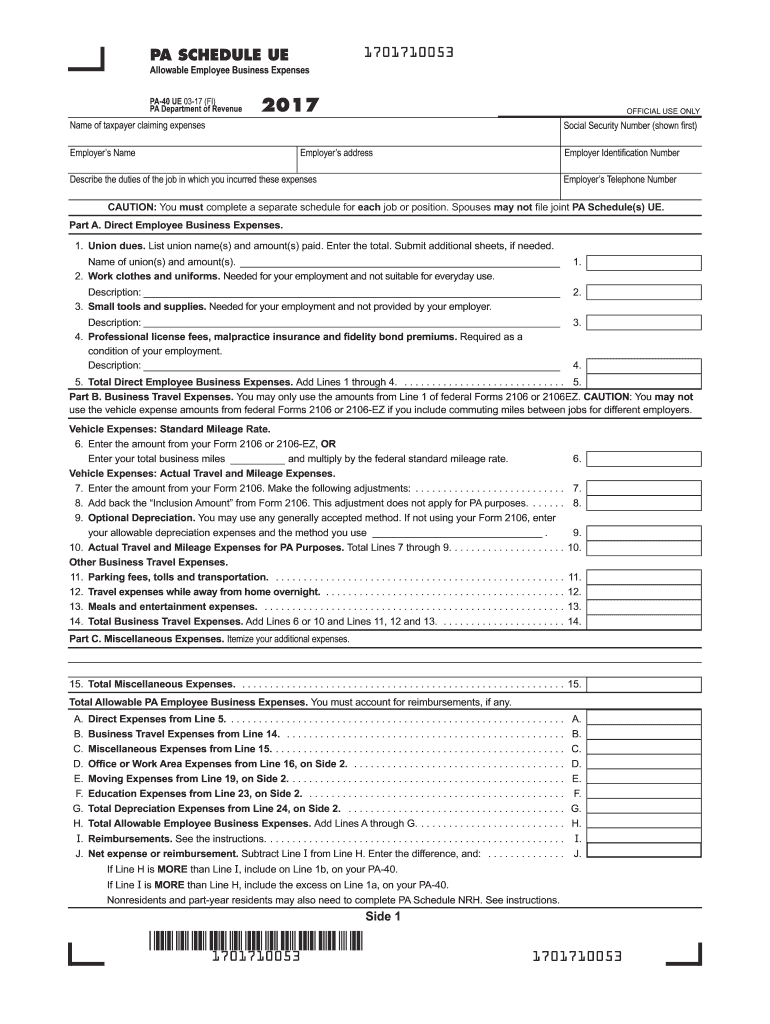

PA SCHEDULE UE. Allowable Employee Business Expenses. 2017. OFFICIAL USE ONLY. Describe the duties of the job in which you incurred these expenses.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA Schedule UE

Edit your PA Schedule UE form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA Schedule UE form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA Schedule UE online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit PA Schedule UE. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA Schedule UE Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA Schedule UE

How to fill out PA Schedule UE

01

Gather all relevant income information that is reportable on PA Schedule UE.

02

Obtain your federal tax return to reference your total income.

03

Fill out your personal information at the top of the form, including your Social Security number and filing status.

04

Report your income from self-employment or other non-employee compensation in the designated section.

05

Include any eligible unreimbursed employee expenses (work-related expenses not reimbursed by your employer).

06

Calculate the total unreimbursed expenses and enter the amount on the designated line.

07

Double-check all entries for accuracy to ensure you qualify for any credits or deductions.

08

Sign and date the form before submitting it along with your Pennsylvania tax return.

Who needs PA Schedule UE?

01

Taxpayers who are self-employed or have unreimbursed employee expenses.

02

Individuals who work in occupations where they incur costs that are necessary for their job but are not reimbursed by their employer.

03

Residents of Pennsylvania who must report these specific expenses for state income tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What qualifies as office supplies?

Office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file folders, and markers. All of these items are 100% consumable, meaning that they're purchased to be used.

What are considered supplies on Schedule E?

These include items such as printer ink, paper clips, paper, pens, staples, record keeping supplies, janitorial supplies, break room supplies, etc.

What are supplies for tax deduction?

The regulations define materials and supplies as tangible items that are used or consumed in the taxpayer's operations, not considered inventory and that: Are components acquired to maintain, repair or improve another. Consists of fuel, lubricants and similar items that will be consumed in 12 months or less.

What is considered as supply for rental property?

The difference between Supply and Maintenance Expenses for rental properties. The items you listed would be considered Maintenance Expenses. Supplies would be more like cleaning products or rakes. Supplies would be something that you use but don't leave at the house.

Can I deduct expenses on Schedule E?

Expenses such as HOA fees, bank fees, subscriptions, meals (50%), and other miscellaneous expenses related to your rental business are also deductible on IRS Form Schedule E.

What expense category is supplies?

They are usually charged to expense as incurred, in which case the supplies expense account is included within the cost of goods sold category on the income statement.

What are Schedule E expenses?

Use Schedule E (Form 1040) to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in real estate mortgage investment conduits (REMICs).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send PA Schedule UE to be eSigned by others?

When your PA Schedule UE is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I fill out PA Schedule UE using my mobile device?

Use the pdfFiller mobile app to complete and sign PA Schedule UE on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit PA Schedule UE on an Android device?

You can make any changes to PDF files, such as PA Schedule UE, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is PA Schedule UE?

PA Schedule UE is a tax form used in Pennsylvania for reporting employee business expenses that can be deducted from state income tax.

Who is required to file PA Schedule UE?

Taxpayers who are employees and have unreimbursed business expenses that they wish to claim as deductions must file PA Schedule UE.

How to fill out PA Schedule UE?

To fill out PA Schedule UE, taxpayers should list their unreimbursed employee expenses, providing details such as the type of expense and the amount for each category.

What is the purpose of PA Schedule UE?

The purpose of PA Schedule UE is to allow employees to report and claim deductions for certain business expenses that are not reimbursed by their employer.

What information must be reported on PA Schedule UE?

On PA Schedule UE, taxpayers must report information including the types of business expenses incurred, amounts spent, and any relevant details that support the deduction claims.

Fill out your PA Schedule UE online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA Schedule UE is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.