PA Schedule UE 2020 free printable template

Show details

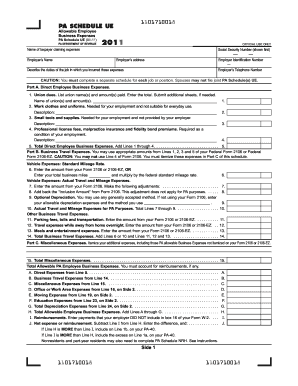

2001710058PA SCHEDULE Unallowable Employee Business ExpensesSTARTPA40 UE (EX) MOD 0820 (FI)

PA Department of Revenue2020OFFICIAL USE Online of taxpayer claiming expenses

Employers Asocial Security

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA Schedule UE

Edit your PA Schedule UE form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA Schedule UE form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA Schedule UE online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit PA Schedule UE. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA Schedule UE Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA Schedule UE

How to fill out PA Schedule UE

01

Obtain a copy of the PA Schedule UE form from the Pennsylvania Department of Revenue website.

02

Fill in your personal information at the top, including your name, address, and Social Security number.

03

Review the instructions for each section of the form to understand what information is required.

04

Complete Section A by providing details of your unreimbursed employee business expenses.

05

In Section B, list any other qualifying expenses that are not included in Section A.

06

Make sure to keep all receipts and documentation for your expenses as they may be needed for verification.

07

Calculate the total amounts for each section and enter them in the appropriate boxes.

08

Review your completed form for accuracy and completeness.

09

Submit the form along with your Pennsylvania tax return.

Who needs PA Schedule UE?

01

Employees in Pennsylvania who incur unreimbursed business expenses as part of their job.

02

Taxpayers who need to report expenses related to their employment that are not covered by their employer.

03

Individuals who are itemizing deductions on their Pennsylvania tax return.

Fill

form

: Try Risk Free

People Also Ask about

Is the extra $300 unemployment over in PA?

The final week of eligibility for payments, which are up to an extra $300 a week, is the week ending Sept. 4. The department said the state's normal unemployment compensation program is not affected.

Is PA still offering extended unemployment benefits?

If you exhaust PEUC, Pennsylvania has its own unemployment extension called Extended Benefits (EB). Workers are eligible for up to 13 weeks of EB in Pennsylvania. Your EB benefit will be half the weeks of your regular claim.

What is UC tax in PA?

The Interest Factor for 2022 is 0.00% effective January 1st, 2022. A 0.06 percent (. 0006) tax on employee gross wages, or 60 cents on each $1,000 paid.

Is Pua coming back to PA 2022?

a. Review Details The PUA Review will be conducted during two one (1)-week sessions: August 14 – 20, 2022; and ▪ September 18 – 24, 2022.

Will pandemic unemployment be extended in Pennsylvania?

Extended Benefits (EB) are not triggered on in any state. Additional weeks of pandemic federal benefits ended in all states on September 6, 2021.

How much is unemployment in pa 2022?

Your weekly benefit amount will be about 50% of your average weekly wages, subject to a weekly maximum of $572 (or $580 with dependents).

Who pays UC in PA?

Content Editor [1] Employer contributions — in the form of their quarterly tax payments — are the primary funding source for PA's unemployment compensation benefits. That's why it's important for businesses employing workers in Pennsylvania to make timely and accurate payments into the system.

Is Pa ending federal unemployment?

Harrisburg, PA – Labor & Industry Secretary Jennifer Berrier is reminding Pennsylvanians that federal unemployment benefit programs, including Pandemic Emergency Unemployment Compensation (PEUC), Pandemic Unemployment Assistance (PUA), and Federal Pandemic Unemployment Compensation (FPUC), will end Sept. 4.

How do I find my UC number in PA?

If you do not know your PA UC account number, please call the Unemployment Compensation Resource Center at 833-728-2367. If an account number has not been assigned, please register with the department by submitting the Pennsylvania Enterprise Registration Form (PA-100) at .pa100.state.pa.us.

What is the maximum unemployment benefit in PA for 2022?

2022-2023 Maximum Unemployment Benefits By State StateMax. Weekly Benefit AmountMax Weeks*Oklahoma$53926Oregon$64826Pennsylvania$594 + $8 max dependent allowance26Puerto Rico$1902648 more rows • 06-Nov-2022

Will unemployment be extended again after September in PA?

Extended Benefits (EB) are not triggered on in any state. Additional weeks of pandemic federal benefits ended in all states on September 6, 2021. The federal-state unemployment insurance (UI) system helps many people who have lost their jobs by temporarily replacing part of their wages.

Did the $300 unemployment stop in PA?

Pennsylvania's regular 26-week unemployment compensation benefits will continue, without the extra $300 federal benefit on top.

Did Pennsylvania stop unemployment benefits?

PITTSBURGH — Heads up if you've been receiving unemployment benefits in Pennsylvania: a number of temporary federal benefits put in place during the COVID-19 pandemic will end in September. ATTN PA'ians: The federal unemployment benefit programs listed below will end Sept. 4, 2021.

How long is unemployment in PA 2022?

How long can I receive benefits? If you are eligible for UC, you may receive benefits until you have been paid the maximum benefit amount (MBA) allowed on your claim or until your benefit year has expired. Your benefit year expires one year (52 weeks) after your application for benefits (AB) date.

When did the extra $300 end in pa?

The Department of Labor and Industry announced Friday that it resumed the additional $300 weekly payment in unemployment benefits for regular unemployment beneficiaries and those receiving extended benefits. The additional payment will continue through March 13, 2021.

What is PA UEC on w2?

Unemployment Compensation (UC)

Is PA still giving extra unemployment?

The Pandemic Unemployment Assistance (PUA) provided up to 79 weeks of unemployment benefits to individuals not eligible for regular unemployment compensation or extended benefits due to COVID-19. PUA benefits ceased on September 4, 2021.

How much will I receive on unemployment in PA?

Your Weekly Benefit Rate should equal about one-half of your full-time weekly wage.

Does PA still have 300 extra unemployment?

Federal unemployment benefits for 558,000 Pennsylvanians will end Sept. 4, including the $300 additional weekly payment for all claimants, and state officials are again urging residents to seek help for whatever assistance they might need.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify PA Schedule UE without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your PA Schedule UE into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit PA Schedule UE online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your PA Schedule UE to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I sign the PA Schedule UE electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is PA Schedule UE?

PA Schedule UE is a form used by Pennsylvania taxpayers to report unreimbursed employee business expenses.

Who is required to file PA Schedule UE?

Employees who incur unreimbursed business expenses in the course of their job duties may be required to file PA Schedule UE.

How to fill out PA Schedule UE?

To fill out PA Schedule UE, taxpayers should gather all relevant documentation of business expenses, and complete the form by detailing each expense and corresponding amounts.

What is the purpose of PA Schedule UE?

The purpose of PA Schedule UE is to allow taxpayers to report and potentially deduct business expenses that were not reimbursed by their employer.

What information must be reported on PA Schedule UE?

Taxpayers must report detailed information including the type of expense, the amount, and the business purpose for each unreimbursed expense incurred.

Fill out your PA Schedule UE online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA Schedule UE is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.