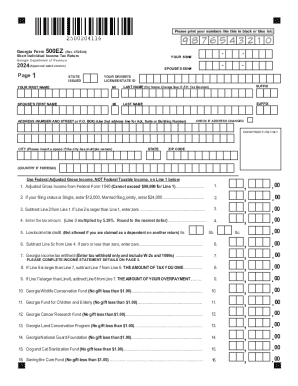

GA 500EZ 2017 free printable template

Show details

DUALTTIVTWCBEXWVRBGSCU

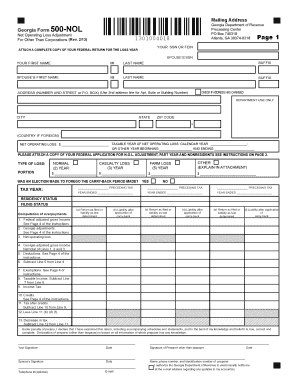

DUALTTPRINTPLEASE, USE THE blueprint BUTTON TO PRINT THIS FORM. THANK YOU. Georgia Form500EZ(Rev. 06/22/17)Short Individual Income Tax Return Page 1YOUR SSN×Georgia Department

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign GA 500EZ

Edit your GA 500EZ form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your GA 500EZ form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing GA 500EZ online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit GA 500EZ. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GA 500EZ Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out GA 500EZ

How to fill out GA 500EZ

01

Obtain the GA 500EZ form from the Georgia Department of Revenue website or at your local office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Indicate your filing status (e.g., single, married filing jointly, etc.).

04

Report your income from various sources on the appropriate lines.

05

Calculate the total deductions and credits you are eligible for.

06

Compute your total tax liability based on the provided tax tables.

07

Enter any payments made and any refund or amount due.

08

Sign and date the form before submitting it to the state.

Who needs GA 500EZ?

01

Individuals who are residents of Georgia and have taxable income.

02

Taxpayers who qualify for the simplified filing process due to their income level.

03

Those who are filing for the current tax year and do not need to submit a more complex tax form.

Fill

form

: Try Risk Free

People Also Ask about

Can a single person claim head of household?

You might be able to claim head of household (HOH) filing status if you meet these requirements: You're unmarried or considered unmarried on the last day of 2022. You paid more than half the cost of keeping up a home for the year. A qualifying person lived with you in the home for more than half the year.

What is the difference between single and head of household?

Head of household (HOH) filing status allows you to file at a lower tax rate and a higher standard deduction than the filing status of single. But to qualify, you must meet specific criteria. Choosing this status by mistake may lead to your HOH filing status being denied at the time you file your tax return.

Is it better to file head of household or single?

Head of household filing status has a more favorable standard deduction amount and lower tax brackets than filing single, but not as favorable as married filing joint. Head of household filers can have a lower taxable income and greater potential refund than when using the single filing status.

Will I get a bigger tax refund if I make more money?

Specifying more income on your W-4 will mean smaller paychecks, since more tax will be withheld. This increases your chances of over-withholding, which can lead to a bigger tax refund. That's why it's called a “refund:” you are just getting money back that you overpaid to the IRS during the year.

How can I get maximum tax refund?

6 Ways to Get a Bigger Tax Refund Try itemizing your deductions. Double check your filing status. Make a retirement contribution. Claim tax credits. Contribute to your health savings account. Work with a tax professional.

How to get a $10,000 tax refund?

Individuals who are eligible for the Earned Income Tax Credit (EITC) and the California Earned Income Tax Credit (CalEITC) may be able to receive a refund of more than $10,000. “If you are low-to-moderate income and worked, you may be eligible for the Federal and State of California Earned Income Tax Credits (EITC).

How do I fill out an income tax form?

0:56 11:47 How to Fill Out Form 1040 for 2022 | Taxes 2023 | Money Instructor YouTube Start of suggested clip End of suggested clip Finally you will determine your tax bill or refund. This will tell you whether you have already paidMoreFinally you will determine your tax bill or refund. This will tell you whether you have already paid any or all of your tax bill and whether you are eligible for a refund if you have overpaid.

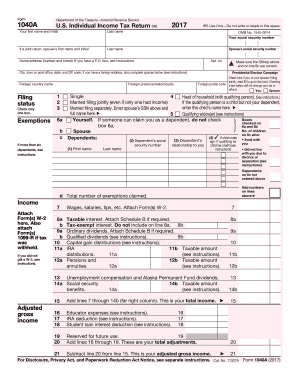

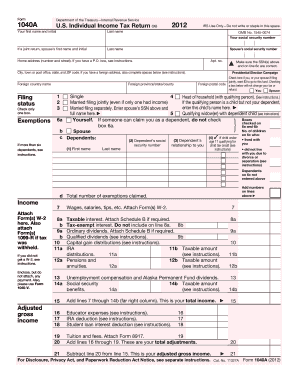

Who should file 1040-EZ and why?

You could use Form 1040-EZ if all of the following apply: You file as single or married filing jointly. Your taxable income was less than $100,000. You don't claim any dependents.

What is Form 1040 EZ?

The 1040EZ is a simplified form used by the IRS for income taxpayers that do not require the complexity of the full 1040 tax form. Simply select your tax filing status and enter a few other details to estimate your total taxes.

What is the difference between a 1040 and a 1040EZ?

The simplest IRS form is the Form 1040EZ. The 1040A covers several additional items not addressed by the EZ. And finally, the IRS Form 1040 should be used when itemizing deductions and reporting more complex investments and other income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get GA 500EZ?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific GA 500EZ and other forms. Find the template you want and tweak it with powerful editing tools.

Can I edit GA 500EZ on an iOS device?

Create, modify, and share GA 500EZ using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I edit GA 500EZ on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as GA 500EZ. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is GA 500EZ?

GA 500EZ is a simplified tax return form used by certain individuals in Georgia to report their income and calculate their tax liability.

Who is required to file GA 500EZ?

Individuals with a simple tax situation, such as those with standard deductions and no complex income sources, are typically required to file GA 500EZ.

How to fill out GA 500EZ?

To fill out GA 500EZ, taxpayers need to provide personal information, report their income, claim any deductions or credits, and calculate their tax due using the provided instructions.

What is the purpose of GA 500EZ?

The purpose of GA 500EZ is to provide a straightforward and efficient method for eligible Georgia residents to file their state income taxes.

What information must be reported on GA 500EZ?

GA 500EZ requires reporting personal identification details, total income, any adjustments or deductions, tax credits, and the tax amount owed or refund due.

Fill out your GA 500EZ online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

GA 500ez is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.