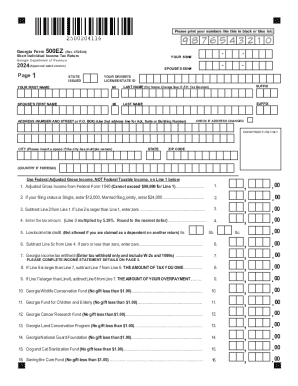

GA 500EZ 2020 free printable template

Get, Create, Make and Sign GA 500EZ

Editing GA 500EZ online

Uncompromising security for your PDF editing and eSignature needs

GA 500EZ Form Versions

How to fill out GA 500EZ

How to fill out GA 500EZ

Who needs GA 500EZ?

Instructions and Help about GA 500EZ

Los dot-com legal forms guide form 500 easy short individual income tax full-year Georgia residents whose income is not over 99,999 dollars who do not itemize deductions who are not blind or 65 or older who are filing as a single individual or married filing jointly and do not claim any exemptions other than themselves and their spouse who do not have adjustments to their federal adjusted gross income who only derived income from wages salaries tips dividends and interest income and who are not claiming or being paid a credit for estimated tax payment can file their state tax due using a form 500 easy this documents is found on the website of the Georgia Department of Revenue step 1 at the top right-hand corner enter your social security number and that of your spouse if filing jointly step to enter your first name middle initial last name and suffix if applicable as well as that of your spouse if applicable step 3 enter your full address step 4 enter your federal adjusted gross income online one step 5 if single enter $5,000 on line 2 if filing jointly enter eight thousand four hundred dollars here step 6 subtract line two from line one and enter the difference on line three if this results in a negative number enter zero step 7 consult the tax table in the separate instruction booklet to determine your tax and enter this online for step 8 if you are not claimed as a dependent on another form and are eligible for a low income tax credit enter this on line five step 9 follow instructions on lines six through nine to determine the balance owed or refund due step 10 voluntary donations to various funds can be noted on lines 10 through 17 totaled on line 18 and applied to your balance due on line 19 or refund owed on line 20 sign and date the bottom of the form provide all required contact information to watch more videos please make sure to visit laws calm

People Also Ask about

Can a single person claim head of household?

What is the difference between single and head of household?

Is it better to file head of household or single?

Will I get a bigger tax refund if I make more money?

How can I get maximum tax refund?

How to get a $10,000 tax refund?

How do I fill out an income tax form?

Who should file 1040-EZ and why?

What is Form 1040 EZ?

What is the difference between a 1040 and a 1040EZ?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete GA 500EZ online?

How do I edit GA 500EZ in Chrome?

Can I create an eSignature for the GA 500EZ in Gmail?

What is GA 500EZ?

Who is required to file GA 500EZ?

How to fill out GA 500EZ?

What is the purpose of GA 500EZ?

What information must be reported on GA 500EZ?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.