OK Form EF 2017 free printable template

Show details

Generally, once you have e-filed your income tax return you do not need to mail anything to the Oklahoma Tax Commission. ... However, there are some situations when the Oklahoma Tax Commission will

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK Form EF

Edit your OK Form EF form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK Form EF form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OK Form EF online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit OK Form EF. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK Form EF Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OK Form EF

How to fill out OK Form EF

01

Gather all necessary information such as personal details, financial data, and supporting documents.

02

Download or obtain a copy of OK Form EF from the official website or relevant authority.

03

Fill in the personal information section with accurate data including name, address, and contact information.

04

Provide detailed financial information in the specified sections, ensuring all figures are correct.

05

Attach any required supporting documents that verify the information provided.

06

Review the entire form for any errors or omissions.

07

Sign and date the form where required.

08

Submit the form according to the provided instructions (online, by mail, in-person).

Who needs OK Form EF?

01

Individuals applying for specific benefits or services linked to the OK Form EF.

02

Financial institutions or organizations that require this form for processing applications.

03

Government agencies needing it for record-keeping or eligibility determination.

Fill

form

: Try Risk Free

People Also Ask about

What is Oklahoma form 511?

Instructions for Completing the 511-NR Income Tax Return • Oklahoma Nonresident and Part-Year Resident Income Tax Return Form 511-NR • 2022 Income Tax Table • This form is also used to file an amended return. See page 7. Filing date: Generally, your return must be postmarked by April 15, 2023.

What is Oklahoma form 512 S?

All corporations having an election in effect under Subchapter S of the IRC engaged in business or deriving income from property located in Oklahoma and that are required to file a federal income tax return using Form 1120-S, must file an Oklahoma income tax return on Form 512-S.

Can I file my Oklahoma state taxes for free?

E-File your Federal and State Return for FREE, if: Adjusted Gross Income is $73,000 or less. Active Duty Military Adjusted Gross Income is $73,000 or less.

What is 511TX tax?

OK - Form 511TX Credit for Taxes Paid to Another State.

Where can I get hard copies of tax forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676). Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time — except Alaska and Hawaii which are Pacific time.

Can you efile an Oklahoma extension?

The 2022 Oklahoma State Income Tax Return forms for Tax Year 2022 (Jan. 1 - Dec. 31, 2022) can be e-Filed together with the IRS Income Tax Return by the April 18, 2023 deadline. If you file a tax extension you can e-File your Taxes until October 16, 2023 without a late filing penalty.

WHAT IS A Oklahoma 511 form?

• Form 511: Oklahoma Resident Income Tax Return Form. • Form 538-S: Sales Tax Relief Credit Form. • Instructions for the Direct Deposit option. • 2021 Income Tax Tables.

Does an LLC have to file an Oklahoma Franchise tax return?

Since LLCs aren't subject to Oklahoma's Franchise Tax, they are required to submit the Oklahoma Annual Certificate. Like an annual report, the annual certificate ensures that the state has up-to-date contact and ownership information for your LLC. LLCs submit a report each year to Oklahoma's Secretary of State.

What happens if you owe Oklahoma state taxes?

The Tax Commission will automatically apply a penalty when unpaid taxes are due. If at least 90% of the original tax liability has not been paid by the due date, a penalty of 5% will be assessed. You'll also be assessed interest on the balance due at a rate of 1.25% per month.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute OK Form EF online?

Completing and signing OK Form EF online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit OK Form EF in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your OK Form EF, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I complete OK Form EF on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your OK Form EF, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

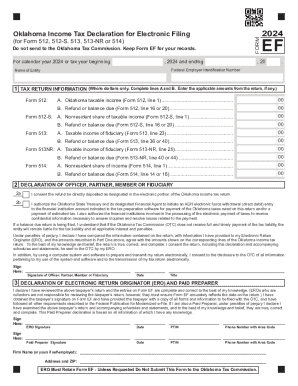

What is OK Form EF?

OK Form EF is a specific tax form used in Oklahoma for filing certain income tax information related to estates and trusts.

Who is required to file OK Form EF?

Entities such as estates and trusts that generate taxable income in Oklahoma are required to file OK Form EF.

How to fill out OK Form EF?

To fill out OK Form EF, one should provide detailed information regarding the income, deductions, and beneficiaries of the estate or trust as specified in the form's instructions.

What is the purpose of OK Form EF?

The purpose of OK Form EF is to report income and tax liability for estates and trusts to the Oklahoma Tax Commission.

What information must be reported on OK Form EF?

OK Form EF requires reporting of income distributions, revenue receipts, expenses, deductions, and information about beneficiaries, among other financial details related to the estate or trust.

Fill out your OK Form EF online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK Form EF is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.