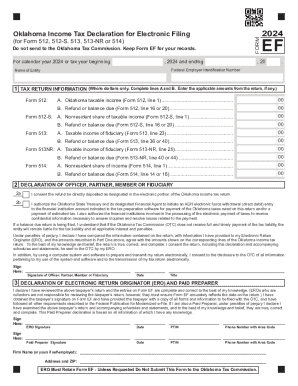

OK Form EF 2022 free printable template

Show details

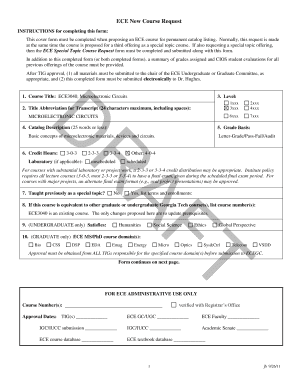

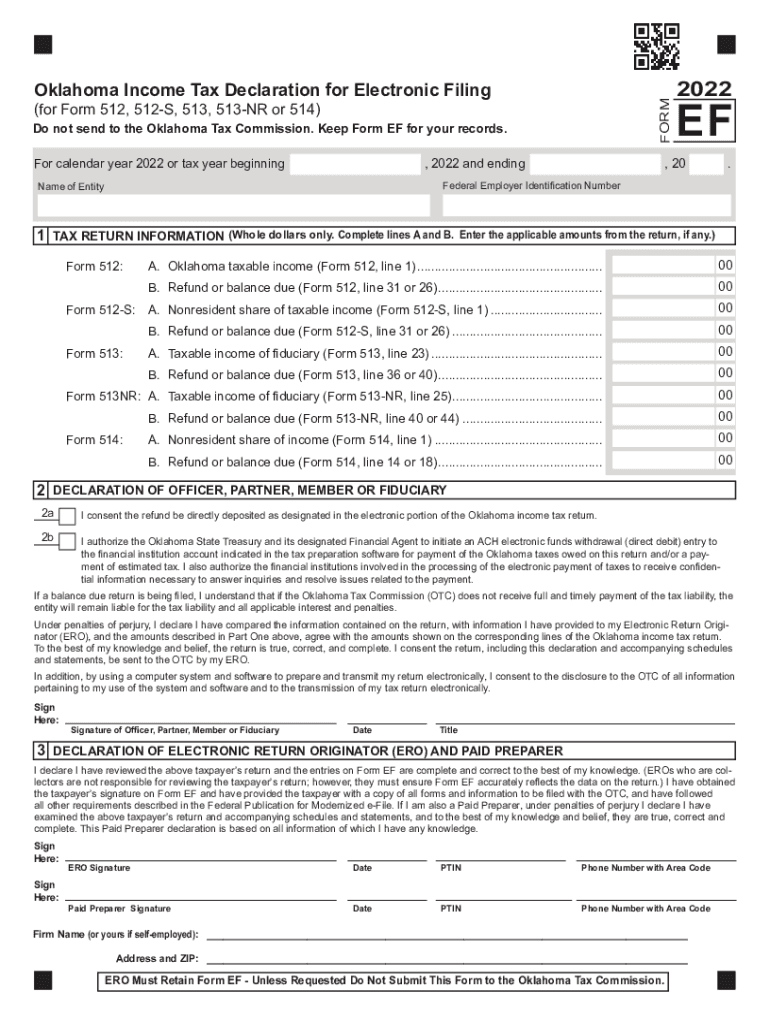

FORM Oklahoma Income Tax Declaration for Electronic Filing (for Form 512, 512S, 513, 513NR or 514)Do not send to the Oklahoma Tax Commission. Keep Form EF for your records. For calendar year 2022

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK Form EF

Edit your OK Form EF form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK Form EF form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OK Form EF online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit OK Form EF. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK Form EF Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OK Form EF

How to fill out OK Form EF

01

Obtain a copy of OK Form EF from the appropriate source.

02

Read the instructions provided on the form carefully.

03

Fill out the personal information section with your name, address, and contact details.

04

Provide the necessary identification or reference numbers as required.

05

Answer any specific questions related to your situation as prompted on the form.

06

Review your answers for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form to the designated office or department.

Who needs OK Form EF?

01

Individuals applying for a specific program or benefit that requires OK Form EF.

02

Organizations or entities that need to report or submit information as outlined in the form.

03

Anyone required by regulatory authorities to complete this form for compliance.

Fill

form

: Try Risk Free

People Also Ask about

What is Oklahoma form 511?

Instructions for Completing the 511-NR Income Tax Return • Oklahoma Nonresident and Part-Year Resident Income Tax Return Form 511-NR • 2022 Income Tax Table • This form is also used to file an amended return. See page 7. Filing date: Generally, your return must be postmarked by April 15, 2023.

What is Oklahoma form 512 S?

All corporations having an election in effect under Subchapter S of the IRC engaged in business or deriving income from property located in Oklahoma and that are required to file a federal income tax return using Form 1120-S, must file an Oklahoma income tax return on Form 512-S.

Can I file my Oklahoma state taxes for free?

E-File your Federal and State Return for FREE, if: Adjusted Gross Income is $73,000 or less. Active Duty Military Adjusted Gross Income is $73,000 or less.

What is 511TX tax?

OK - Form 511TX Credit for Taxes Paid to Another State.

Where can I get hard copies of tax forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676). Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time — except Alaska and Hawaii which are Pacific time.

Can you efile an Oklahoma extension?

The 2022 Oklahoma State Income Tax Return forms for Tax Year 2022 (Jan. 1 - Dec. 31, 2022) can be e-Filed together with the IRS Income Tax Return by the April 18, 2023 deadline. If you file a tax extension you can e-File your Taxes until October 16, 2023 without a late filing penalty.

WHAT IS A Oklahoma 511 form?

• Form 511: Oklahoma Resident Income Tax Return Form. • Form 538-S: Sales Tax Relief Credit Form. • Instructions for the Direct Deposit option. • 2021 Income Tax Tables.

Does an LLC have to file an Oklahoma Franchise tax return?

Since LLCs aren't subject to Oklahoma's Franchise Tax, they are required to submit the Oklahoma Annual Certificate. Like an annual report, the annual certificate ensures that the state has up-to-date contact and ownership information for your LLC. LLCs submit a report each year to Oklahoma's Secretary of State.

What happens if you owe Oklahoma state taxes?

The Tax Commission will automatically apply a penalty when unpaid taxes are due. If at least 90% of the original tax liability has not been paid by the due date, a penalty of 5% will be assessed. You'll also be assessed interest on the balance due at a rate of 1.25% per month.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in OK Form EF without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your OK Form EF, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out OK Form EF using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign OK Form EF and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete OK Form EF on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your OK Form EF, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is OK Form EF?

OK Form EF is a specific form used for reporting information related to emergency funds in the state of Oklahoma.

Who is required to file OK Form EF?

Entities that manage or oversee emergency funds, such as local government agencies or organizations, are required to file OK Form EF.

How to fill out OK Form EF?

To fill out OK Form EF, collect all required financial data related to emergency funds, complete each section of the form accurately, and submit it to the appropriate state department by the specified deadline.

What is the purpose of OK Form EF?

The purpose of OK Form EF is to ensure transparency and accountability in the management of emergency funds and to provide a clear record of fund usage and allocation.

What information must be reported on OK Form EF?

The information that must be reported on OK Form EF includes the total amount of emergency funds, sources of funding, expenditures, and any planned future uses of the funds.

Fill out your OK Form EF online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK Form EF is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.