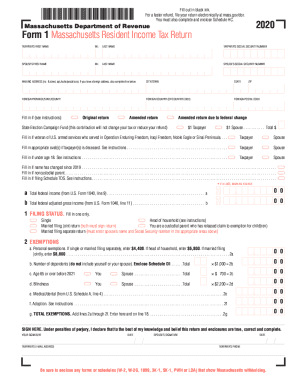

MA DoR 1 Instructions 2017 free printable template

Get, Create, Make and Sign MA DoR 1 Instructions

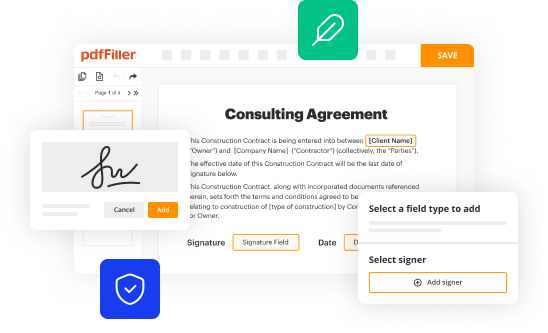

How to edit MA DoR 1 Instructions online

Uncompromising security for your PDF editing and eSignature needs

MA DoR 1 Instructions Form Versions

How to fill out MA DoR 1 Instructions

How to fill out MA DoR 1 Instructions

Who needs MA DoR 1 Instructions?

Instructions and Help about MA DoR 1 Instructions

Welcome to tax UK the practical tax channel in today's video I'm going to show you the process from start to finish completing the self-assessment tax return as a self-employed individual I'll assume no income other than the self-employed profits and that you need to declare those profits to HMRC this information is not financial or tax advice, but you may find it very useful to follow through this example before you submit your own return and if you do have specific questions that you need answered then you can use our pay-as-you-go service by emailing your question to the address shown down in the description below you'll then be sent a price to have your question answered and a link to a video called giving you face-to-face time with a qualified accountant perfect for having those smaller questions answered giving you the peace of mind you need for as little as 10 pounds I'll start by getting logged into my government gateway account and clicking on the link to complete and file tax year 2020 to 2021 self-assessment return once you have logged in you're going to land on a page that is simply explaining who can and...

People Also Ask about

What is a MA form 1?

Who must file a Massachusetts fiduciary return?

Who must file Massachusetts partnership return?

How do I get a ST 1 form in Massachusetts?

Who must file MA form 2?

Who must file MA form 1?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit MA DoR 1 Instructions online?

Can I sign the MA DoR 1 Instructions electronically in Chrome?

Can I edit MA DoR 1 Instructions on an Android device?

What is MA DoR 1 Instructions?

Who is required to file MA DoR 1 Instructions?

How to fill out MA DoR 1 Instructions?

What is the purpose of MA DoR 1 Instructions?

What information must be reported on MA DoR 1 Instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.