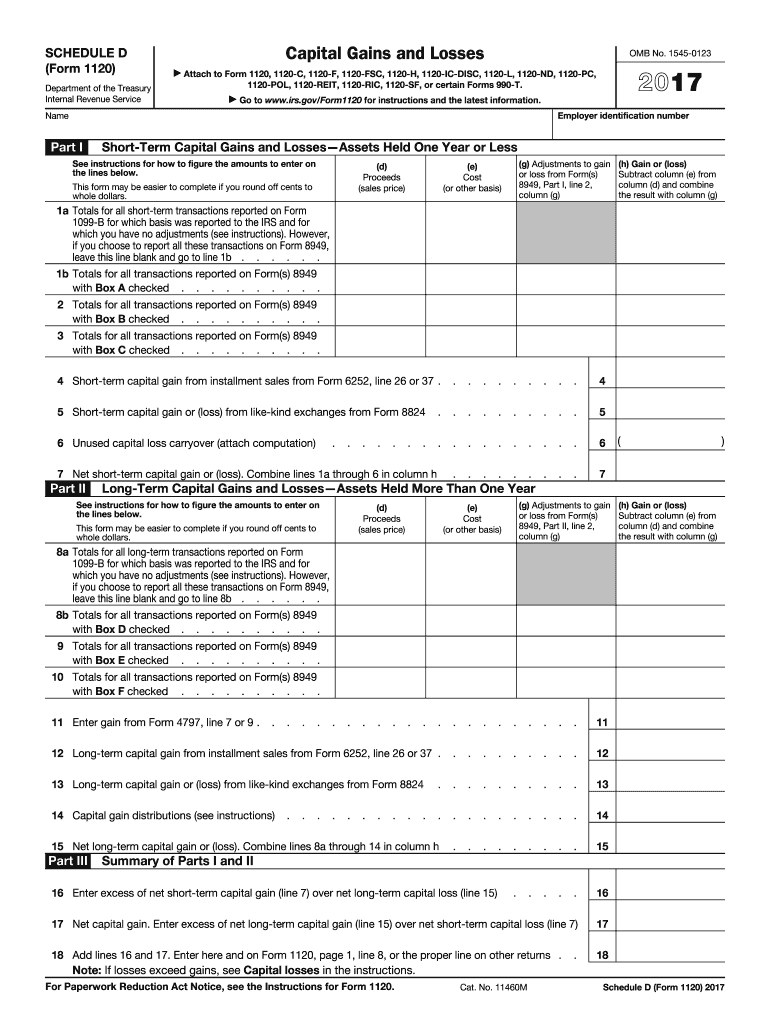

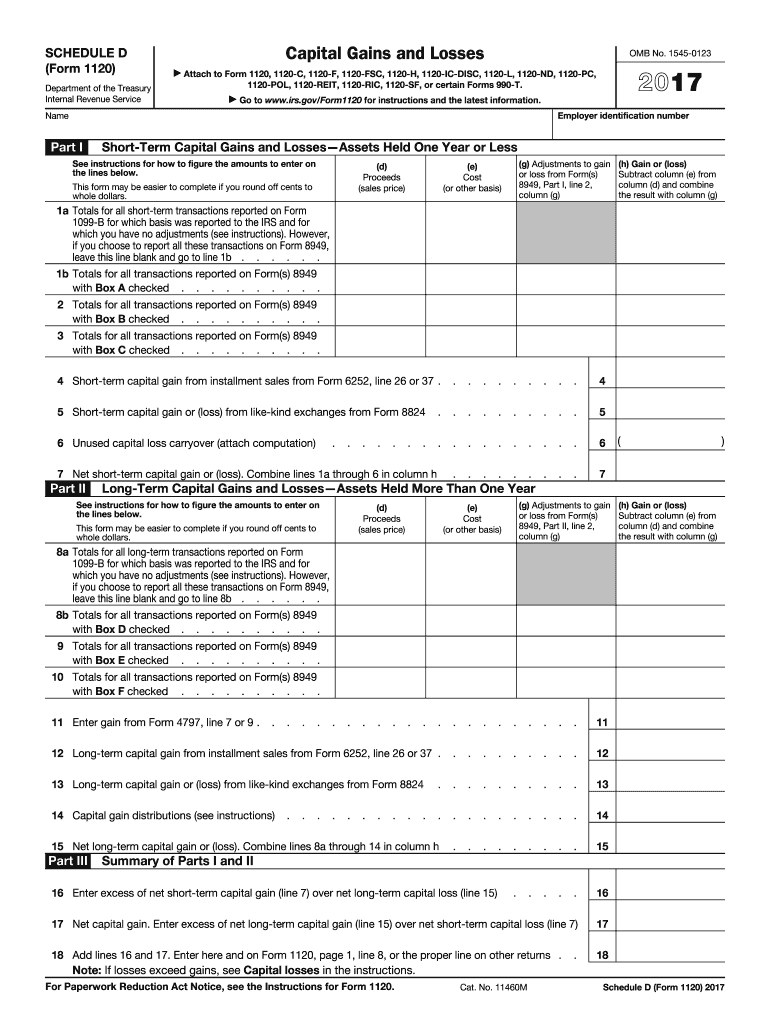

IRS 1120 - Schedule D 2017 free printable template

Get, Create, Make and Sign IRS 1120 - Schedule D

Editing IRS 1120 - Schedule D online

Uncompromising security for your PDF editing and eSignature needs

IRS 1120 - Schedule D Form Versions

How to fill out IRS 1120 - Schedule D

How to fill out IRS 1120 - Schedule D

Who needs IRS 1120 - Schedule D?

Instructions and Help about IRS 1120 - Schedule D

After reporting small business or self-employment income on Schedule C report any capital gains or losses on Schedule D a lot of people won't have any capital gains transactions but if you sell securities or other capital assets held outside a retirement account you'll have to fill out Schedule D and don't worry the IRS has devised a system to help remind you of the need to report capital gains transactions if you sell any securities your broker or mutual fund should send you a 1099 B which lists the proceeds of the sale since the 1099 B lists the proceeds of the sale you'll have to include at least the gross proceeds on Schedule D however the 1099 B currently doesn't show the actual gain or loss you realized for that you're largely on your own when it comes to capital gains calculations your so-called basis in the property is important in its simplest sense your basis is the cost of the property, but your basis can be adjusted up or down depending on circumstances let's say you invested one thousand dollars in a mutual fund whose shares were selling for $10 your one thousand dollar investment gives you 100 shares further assume that you made this investment in early January the fund moved up over the year and on December 15th of the same year the fund distributed to you $60 in dividends you reinvested these dividends in five shares of the fund when the fund was $12 a share a few days later on December 20th you sold all your holdings in the fund because you thought the market would go down assume your selling price was $12 a share so your sale of 105 shares at $12 a share yielded 1260 dollars your mutual fund then sends you a 1099 B which shows 1260 dollars in gross proceeds so what's your total gain on the sale you invested $1,000 back in January, so your reportable gain is 260 dollars right wrong your reportable gain is actually only $200 not two hundred and sixty dollars that's because the $60 in reinvested dividends are added to the basis of your holdings like any additional purchase, so your cost basis in the mutual fund is the original $1000 investment plus the $60 in reinvested dividends or one thousand and sixty dollars when you subtract this from your gross proceeds of one thousand two hundred and sixty dollars you get a net gain of two hundred dollars and in case you're wondering you do have to pay taxes on the $60 in distributed dividends that you received the $60 in dividends are reported on a 1099 — div and our taxed on Schedule B so if you reinvest your mutual fund dividends but don't adjust your cost basis up you'll wind up paying taxes twice on that dividend you'll pay ordinary income taxes once when the dividend is distributed and capital gains taxes once when you sell if you don't adjust your cost basis up unfortunately calculating your capital gains can get difficult the example I gave was simple but imagine if your mutual fund makes monthly distributions, and you buy and sell chunks of the fund during the year determining...

People Also Ask about

What is the IRS form for losses?

What is the form for casualty loss 2017?

What is the pub 547 for 2017?

What is the IRS Form 4684 for 2017?

What is the 4684 casualty form?

What is the form 4684 theft loss?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS 1120 - Schedule D directly from Gmail?

How do I make edits in IRS 1120 - Schedule D without leaving Chrome?

How do I edit IRS 1120 - Schedule D on an Android device?

What is IRS 1120 - Schedule D?

Who is required to file IRS 1120 - Schedule D?

How to fill out IRS 1120 - Schedule D?

What is the purpose of IRS 1120 - Schedule D?

What information must be reported on IRS 1120 - Schedule D?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.