CA FTB 540 2EZ 2017 free printable template

Show details

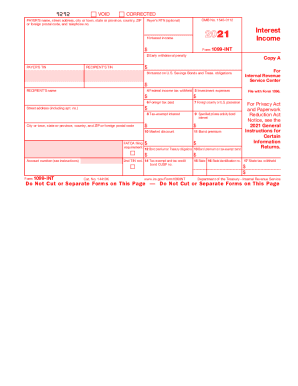

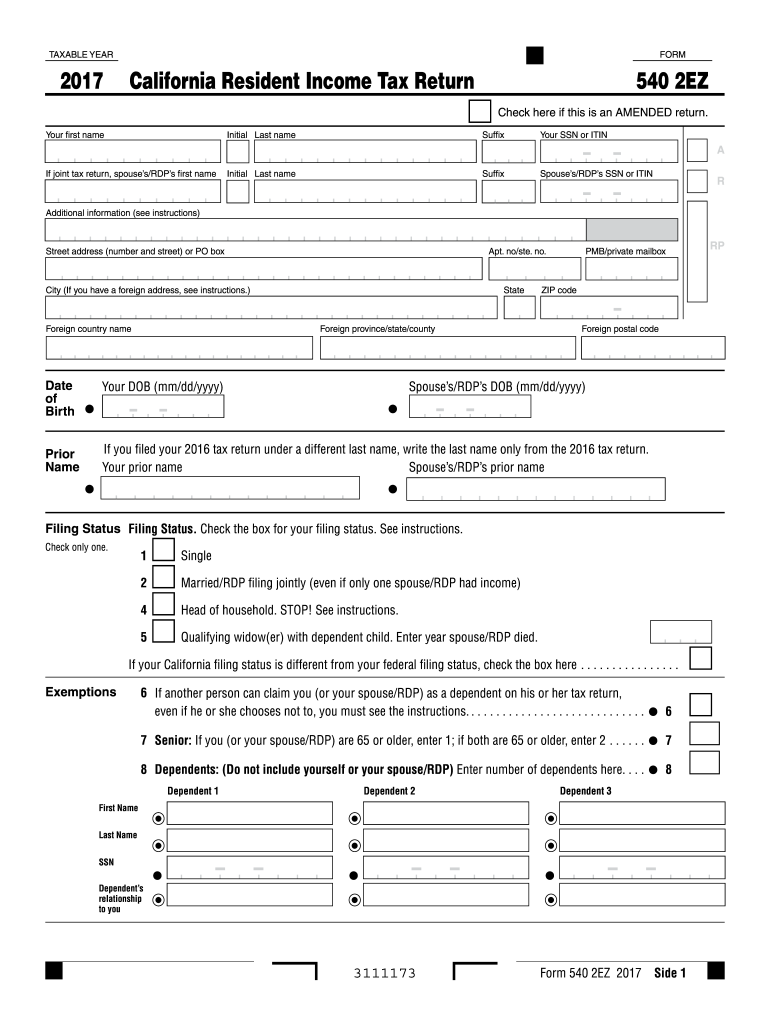

TAXABLE YEAR2017FORMCalifornia Resident Income Tax Return540 2EZ

Check here if this is an AMENDED return.Your first nameInitial Last nameSuffixYour SSN or ITINA

If joint tax return, spouses/RDPs first

pdfFiller is not affiliated with any government organization

Instructions and Help about CA FTB 540 2EZ

How to edit CA FTB 540 2EZ

How to fill out CA FTB 540 2EZ

Instructions and Help about CA FTB 540 2EZ

How to edit CA FTB 540 2EZ

To edit the CA FTB 540 2EZ tax form, users can utilize pdfFiller’s tools, which allow for easy modifications. Start by uploading the existing form to pdfFiller. Then, use the editing features to click on the areas you wish to modify. You can add text, make corrections, or adjust any necessary information directly on your form. Once edits are complete, ensure to save the updated version before proceeding to submission.

How to fill out CA FTB 540 2EZ

Filling out the CA FTB 540 2EZ form involves several clear steps. Begin by gathering necessary information, including your Social Security Number, filing status, and income details. Follow these steps:

01

Download the form from the California Franchise Tax Board website or use pdfFiller to access it.

02

Provide your personal information in the designated sections at the top of the form.

03

Report all income sources accurately, following the guidelines provided on the form.

04

Enter any applicable credits or deductions.

05

Review the form for accuracy before submitting it.

Be attentive to detail and ensure all numbers are correct to avoid processing delays.

About CA FTB 540 2EZ 2017 previous version

What is CA FTB 540 2EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CA FTB 540 2EZ 2017 previous version

What is CA FTB 540 2EZ?

The CA FTB 540 2EZ is a simplified income tax form used by residents of California for filing their state tax returns. This form is specifically designed for taxpayers with straightforward tax situations, making it faster and easier to complete compared to the standard CA FTB 540 form.

What is the purpose of this form?

The purpose of the CA FTB 540 2EZ is to provide an efficient way for eligible California residents to report their income, claim deductions, and compute their state income tax due or refund. This form streamlines the filing process for those who qualify, allowing for quicker tax filing and processing.

Who needs the form?

Taxpayers who can use the CA FTB 540 2EZ typically have total income below a specific threshold and do not have complex financial situations. To qualify, you must be an individual taxpayer with no dependents, no self-employment income, and limited adjustments or credits.

When am I exempt from filling out this form?

You may be exempt from filing the CA FTB 540 2EZ if your income exceeds the maximum thresholds defined by the California Franchise Tax Board or if you have more complex tax situations, such as varying income sources or significant adjustments. Consult the instructions provided by the FTB to determine your eligibility.

Components of the form

The CA FTB 540 2EZ consists of several sections, including personal information, income, adjustments, tax and credits, and payment information. Each section is laid out clearly to facilitate easy completion, focusing on the essentials necessary for straightforward tax filings.

Due date

The due date for submitting the CA FTB 540 2EZ is generally April 15th of each tax year, aligning with federal income tax deadlines. If this date falls on a weekend or holiday, the deadline extends to the next business day. Additional extensions may be available under certain circumstances.

What are the penalties for not issuing the form?

Failing to file the CA FTB 540 2EZ when required can result in penalties from the California Franchise Tax Board. Penalties typically include a monetary fine and possible interest on any unpaid taxes. It is critical to adhere to deadlines and filing requirements to avoid incurring these charges.

What information do you need when you file the form?

When filing the CA FTB 540 2EZ, you will need your Social Security Number, details of your income, any applicable deductions, and other tax-relevant information. Ensure you have a record of all necessary documentation to accurately report your income and calculations.

Is the form accompanied by other forms?

The CA FTB 540 2EZ may not need to be accompanied by additional forms for most simple tax situations. However, if you claim certain tax credits or have specific income sources, you may be required to include supplementary documentation. Review the instructions for guidance on necessary attachments.

Where do I send the form?

The completed CA FTB 540 2EZ should be mailed to the address specified in the filing instructions, which may vary depending on whether you are enclosing payment or not. Ensure you verify the correct address on the California Franchise Tax Board website or in the form instructions.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Awesome; just what I needed. Easy to use and the costs is very affordable.

this is way too expensive for how basic it is...

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.