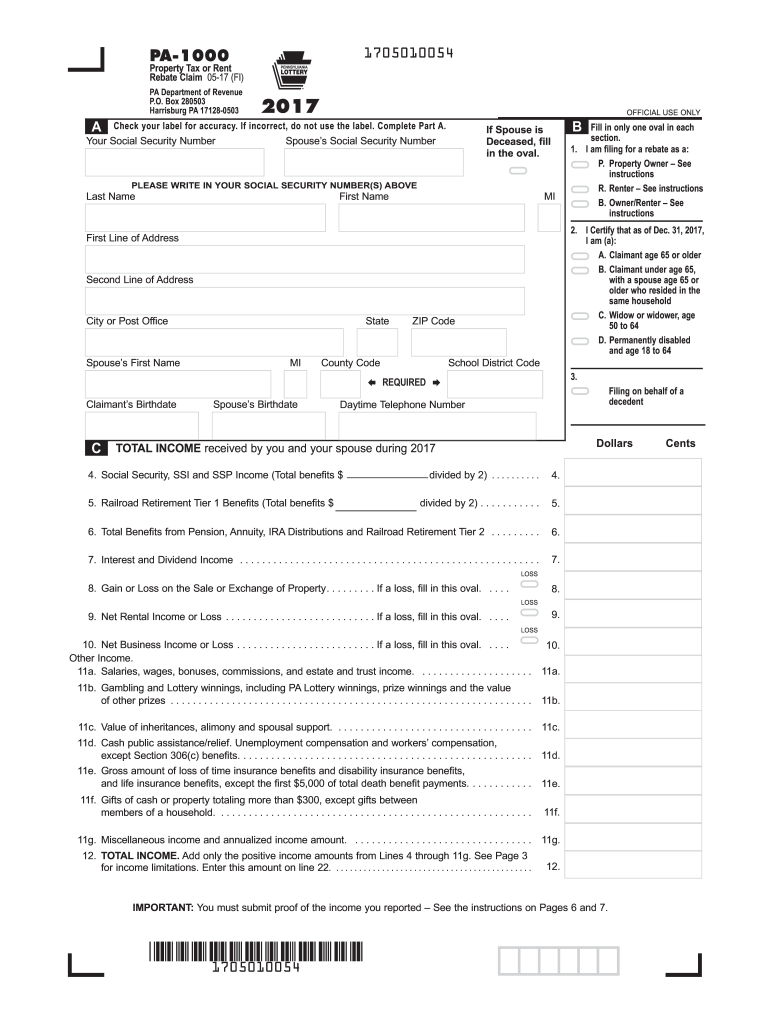

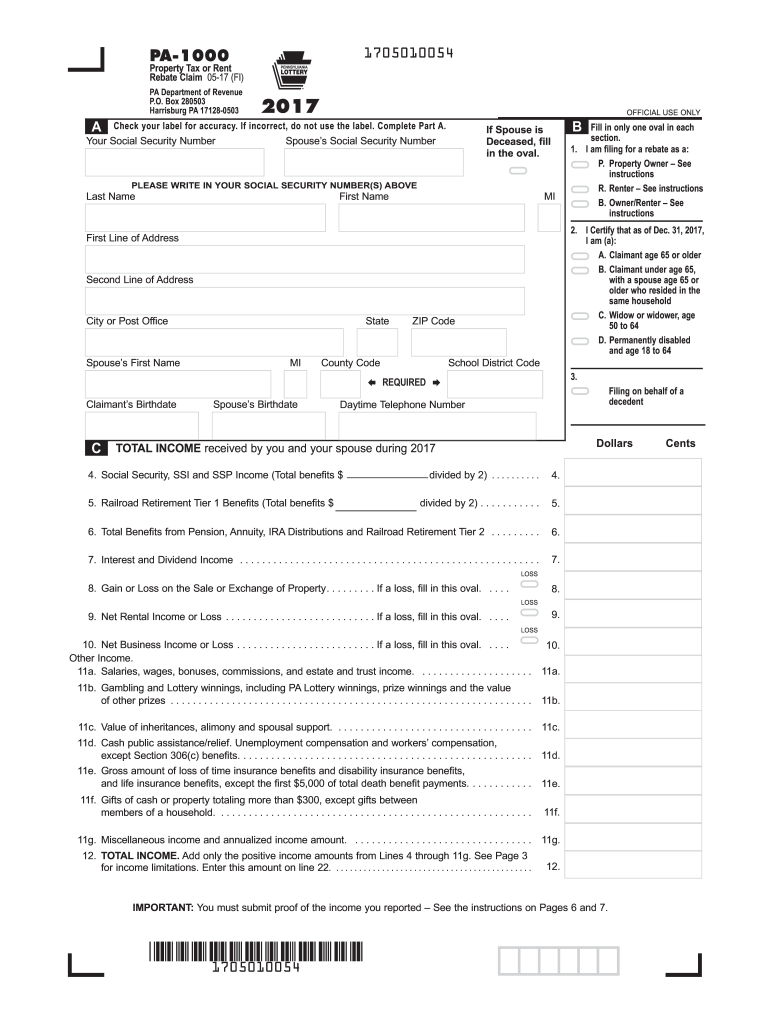

PA PA-1000 2017 free printable template

Get, Create, Make and Sign PA PA-1000

How to edit PA PA-1000 online

Uncompromising security for your PDF editing and eSignature needs

PA PA-1000 Form Versions

How to fill out PA PA-1000

How to fill out PA PA-1000

Who needs PA PA-1000?

Instructions and Help about PA PA-1000

This video is brought to you by a mare Viacom where you can screen tenants 24 hours a day seven days a week in this episode we will be discussing Pennsylvania landlord tenant laws the following is a summary of landlord tenant laws in the state of Pennsylvania as they apply to residential rental property topics include disclosures withholding rent the right to enter security deposits eviction increasing rent and more security deposit limit the equivalent of up to two months rent may be charged for the security deposit for the first year and then a maximum of one month's rent should tenancy lasts more than a year deposits collected for more than 100 must be deposited into a federally or state regulated institution and the name and address must be provided to the tenant if the tenancy lasts for more than two years interest must be paid deadline for returning a security deposit the security deposit must be returned within 30 days after the tenant has vacated the property late fees Pennsylvania state laws do not address late fees, so it is up to both parties to agree usually by having such terms specified in the lease agreement Music increasing rent Pennsylvania state laws also do not cover rent increases so the only way to change the rent is by having both parties agree either when the lease is executed or modified withholding rent if any local or state government department certifies a rental unit to be uninhabitable during tenancy the tenant has the right to either terminate tenancy or stay in pay rent into a government approved escrow account while repairs are being made by the landlord terminating tenancy and eviction a 10-day unconditional notice to quit may be used for non-payment of rent a 10-day unconditional notice to quit may also be used if a tenant is convicted for the illegal sale manufacture or distribution of an illegal drug repeated use of an illegal drug or seizure by law enforcement of an illegal drug within the rental unit a 15-day unconditional notice to quit may be used for violations of a lease of one year or less or a lease term of an unspecified amount of time if the tenancy was for more than a year a 30-day unconditional notice to quit may be used for any violation of the terms of the lease the right to enter, although Pennsylvania doesn't address a particular amount of time a landlord should be able to provide the tenant a reasonable notice of entry before being permitted inside the unit for more information additional laws and articles can be found at American landlord dot-com Music you

People Also Ask about

How do I appeal a rent rebate in pa?

Where can I get a pa property tax rebate form?

Who qualifies for pa 1000?

What is the pa 1000 property tax rebate form?

How do you qualify for Pennsylvania property tax rebate?

What is the PA 1000 form?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my PA PA-1000 in Gmail?

How can I send PA PA-1000 to be eSigned by others?

How do I complete PA PA-1000 on an iOS device?

What is PA PA-1000?

Who is required to file PA PA-1000?

How to fill out PA PA-1000?

What is the purpose of PA PA-1000?

What information must be reported on PA PA-1000?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.