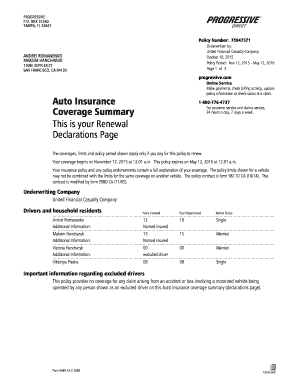

PA PA-1000 2022 free printable template

Get, Create, Make and Sign PA PA-1000

Editing PA PA-1000 online

Uncompromising security for your PDF editing and eSignature needs

PA PA-1000 Form Versions

How to fill out PA PA-1000

How to fill out PA PA-1000

Who needs PA PA-1000?

Instructions and Help about PA PA-1000

Hello my name is Michele Molina I am your business partner with shop comp our by market America, and I'm going to show you in this short tutorial how to complete your form 1000 your for 1000 is a document that we show to the company to show them that we're moving products to the end consumer we must submit this every three months in order for our volume to continue accruing it lets them know that we have a minimum of two customers and moving at least 200 in retail products in the beginning of building your business we understand that this may not be the case, so the system actually allows us a grace period where you'll have the ability to create these documents manually once your business is up and running the system will actually register these receipts automatically for you making your job very easy, so the first step is we're going to sign in with our rep ID into our unfriend Transom which better known as our back-office again you'll need your rep ID and your password and then just click login this is like our online Secretariat notice everything that's going on in our business, so the first step will want to go to my account scroll down to online forms and go over to form 1000 you'll want to see when your 4 is actually due as you can see here this one is due on July 3rd, and it's letting us know that the status is the requirement has not been met, and you can tell because there are no orders listed down below on this page, so we'll have to actually go in there and manually put in a couple of receipts, so the first step is go over to your ordering tab scroll down to order tracking and let's look at what products you've purchased so what you want to do is just click on the order open up the order, and now you're going to want to jot down the product codes once you have enough products in there that would total 200 in sales then we're going to go and complete the customer receipts so again in ordering scroll down to order tracking open that and jot down those codes that you'll need, so the next step is let's go over to the tab that says my customers you'll want to at least have a few customers registered under your customer profile, so we're going to scroll down to sales receipt entry and select our first customer in this case we've selected Karen, and we're just going to wait for the page to populate and then click continue now we're going to add those product codes in which I've already PRE done this, so I know what codes I've half of products to make it quicker but just type those codes in click Add, and it will start to generate that receipt we're going to click continue the next page will load click continue again, and now we will make sure that we don't send Karen a receipt for this because we're using it as a manual order, and then we're going to click Submit to form 1000 then click I agree and submit, so we need two of our sales receipts so let's create a second one again select your customer click continue to add the codes again you're...

People Also Ask about

How much do you get back for a rent rebate in pa?

How do I contact pa rent rebate?

How long does it take to get approved for rent rebate in pa?

Where do I get a pa rent rebate form?

What is the maximum rent rebate in pa?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit PA PA-1000 online?

Can I create an eSignature for the PA PA-1000 in Gmail?

How do I fill out PA PA-1000 using my mobile device?

What is PA PA-1000?

Who is required to file PA PA-1000?

How to fill out PA PA-1000?

What is the purpose of PA PA-1000?

What information must be reported on PA PA-1000?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.