PA PA-1000 2024 free printable template

Show details

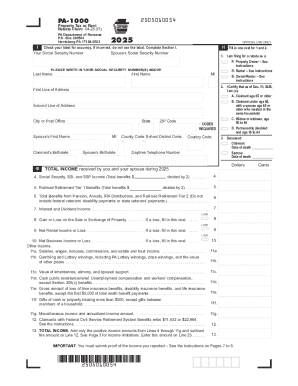

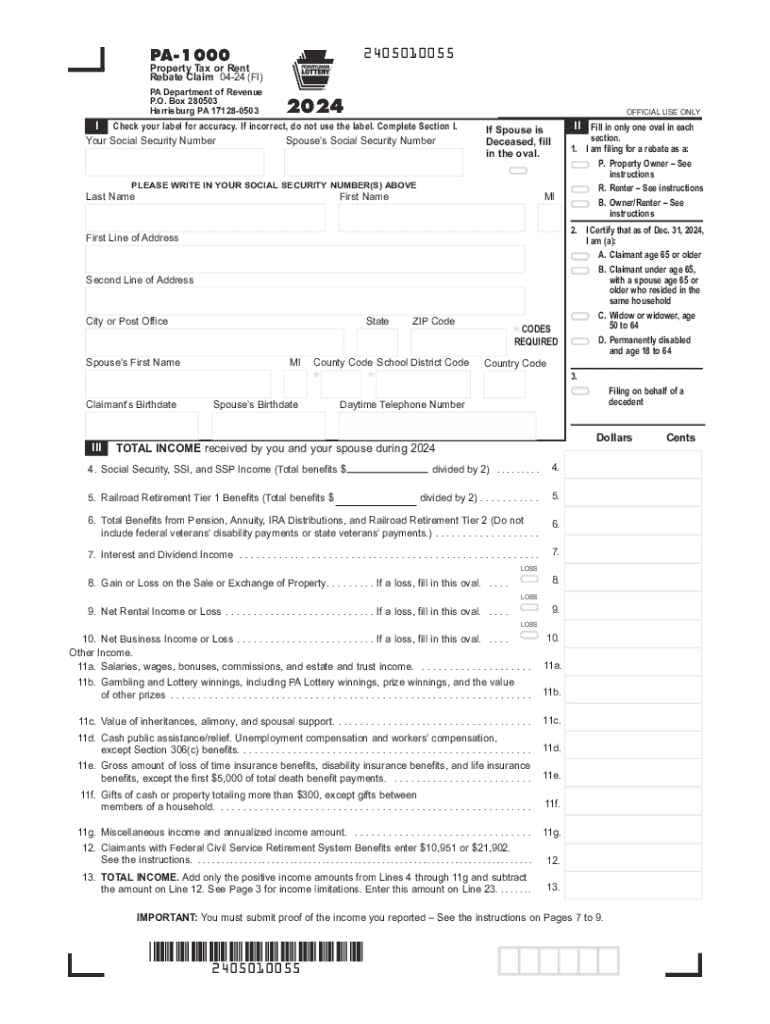

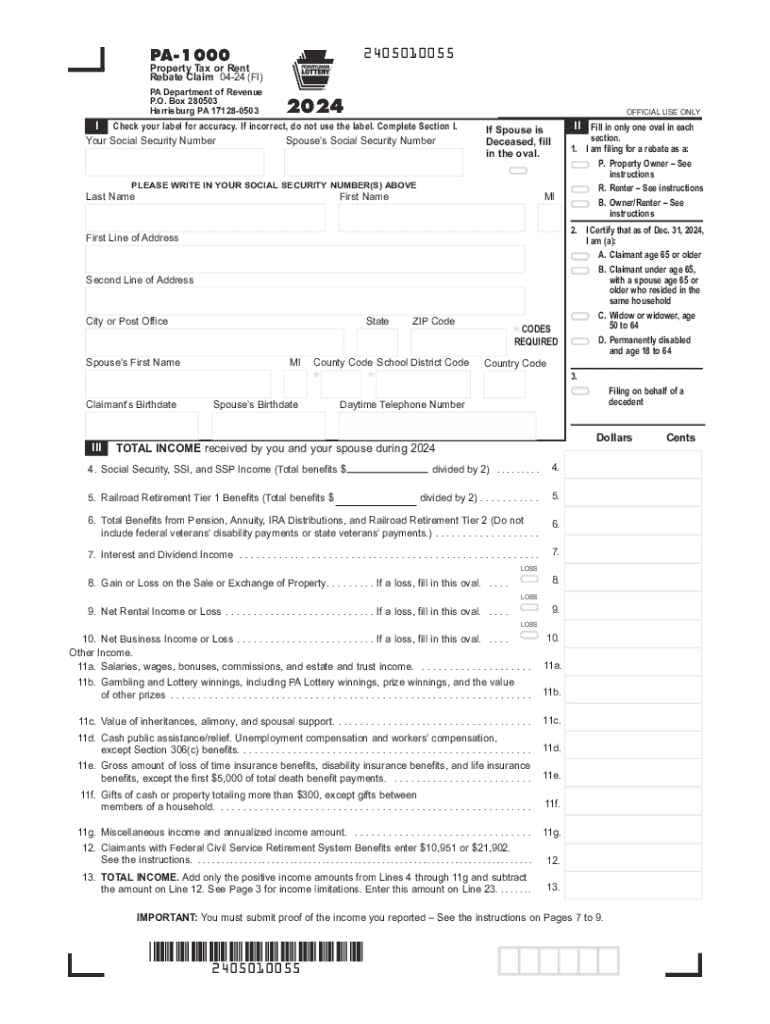

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING 2405010055 PA-1000 Property Tax or Rent Rebate Claim 04-24 (FI) PA Department of Revenue P.O. Box 280503 Harrisburg

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA PA-1000

Edit your PA PA-1000 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA PA-1000 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA PA-1000 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit PA PA-1000. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA PA-1000 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA PA-1000

How to fill out PA PA-1000

01

Download the PA PA-1000 form from the official website.

02

Read the instructions carefully before starting to fill out the form.

03

Provide your personal information, including name, address, and Social Security number.

04

Fill out the income section by listing all sources of income.

05

Complete the section on expenses, detailing monthly or yearly expenses as required.

06

If applicable, provide information regarding dependents and their details.

07

Review all entries for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the completed form according to the instructions, ensuring it goes to the correct department.

Who needs PA PA-1000?

01

Individuals or families seeking financial assistance or benefits in Pennsylvania.

02

Residents of Pennsylvania who are applying for programs related to social services or tax credits.

03

People who need to report changes in income or household status for state benefits.

Fill

form

: Try Risk Free

People Also Ask about

How much do you get back for a rent rebate in pa?

If you earned $0-$8,000 in 2022, the maximum rebate is $650. If you earned $8,001-$15,000 in 2022, the maximum rebate is $500. If you earned $15,001-$18,000 in 2022, the maximum rebate is $300. If you earned $18,001-$35,000 in 2022, the maximum rebate is $250.

How do I contact pa rent rebate?

Contacting the Department by Telephone TopicPhone NumberPersonal Income Tax717-787-8201Property Tax/Rent Rebate Program1-888-222-9190Business Taxes (corporation tax, employer withholding, sales/use tax and registration)717-787-1064Inheritance Tax717-787-83278 more rows

How long does it take to get approved for rent rebate in pa?

Please wait 8-10 weeks from the date you mailed your claim to check the status. To speak to a customer service representative contact our Customer Experience Center at 1-888-222-9190 Monday through Friday between 8:00 am and 5:00 pm.

Where do I get a pa rent rebate form?

Free Assistance Property Tax/Rent Rebate application assistance is available at no cost from Department of Revenue district offices, local Area Agencies on Aging, senior centers and state legislators' offices.

What is the maximum rent rebate in pa?

If you earned $0-$8,000 in 2022, the maximum rebate is $650. If you earned $8,001-$15,000 in 2022, the maximum rebate is $500. If you earned $15,001-$18,000 in 2022, the maximum rebate is $300.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify PA PA-1000 without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like PA PA-1000, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit PA PA-1000 online?

With pdfFiller, the editing process is straightforward. Open your PA PA-1000 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out the PA PA-1000 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign PA PA-1000 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is PA PA-1000?

PA PA-1000 is a form used for reporting certain financial information to the Pennsylvania Department of Revenue.

Who is required to file PA PA-1000?

Individuals and businesses that have income subject to Pennsylvania state taxes are required to file PA PA-1000.

How to fill out PA PA-1000?

To fill out PA PA-1000, gather all required financial information, complete each section of the form accurately, and ensure you have included all necessary schedules and documents.

What is the purpose of PA PA-1000?

The purpose of PA PA-1000 is to provide the Pennsylvania Department of Revenue with essential income and tax-related information to assess and collect state taxes.

What information must be reported on PA PA-1000?

PA PA-1000 must report income details, tax liability, deductions, credits, and any other relevant financial information pertaining to state taxes.

Fill out your PA PA-1000 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA PA-1000 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.