AL PPT Instructions 2018 free printable template

Show details

PPT

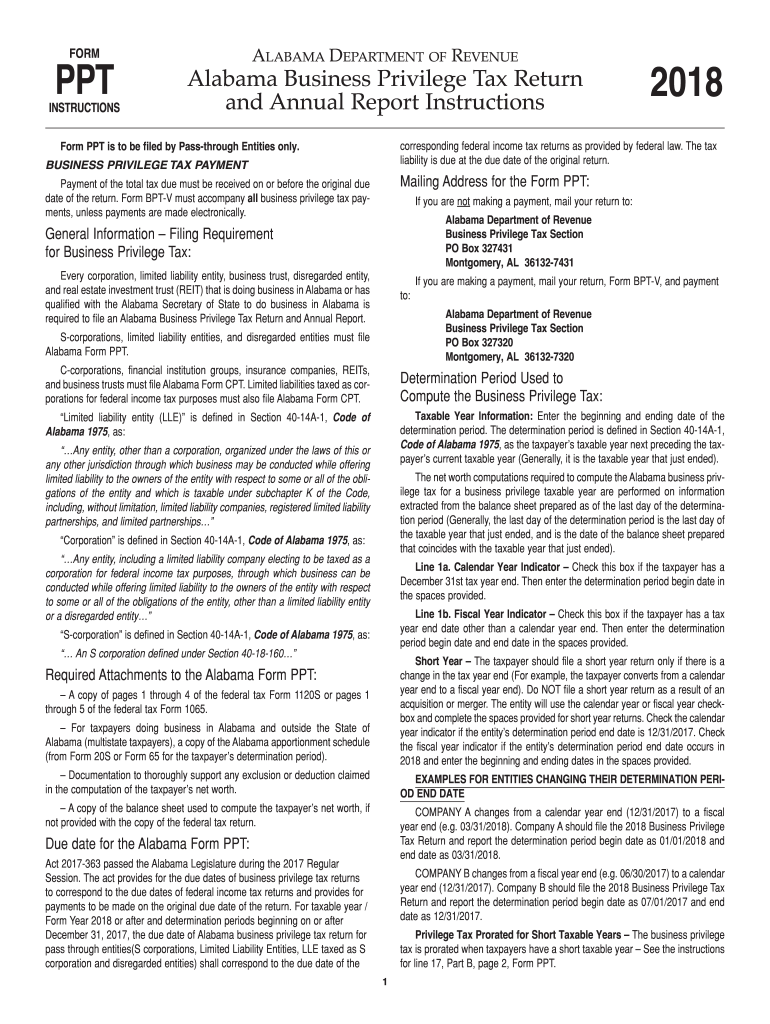

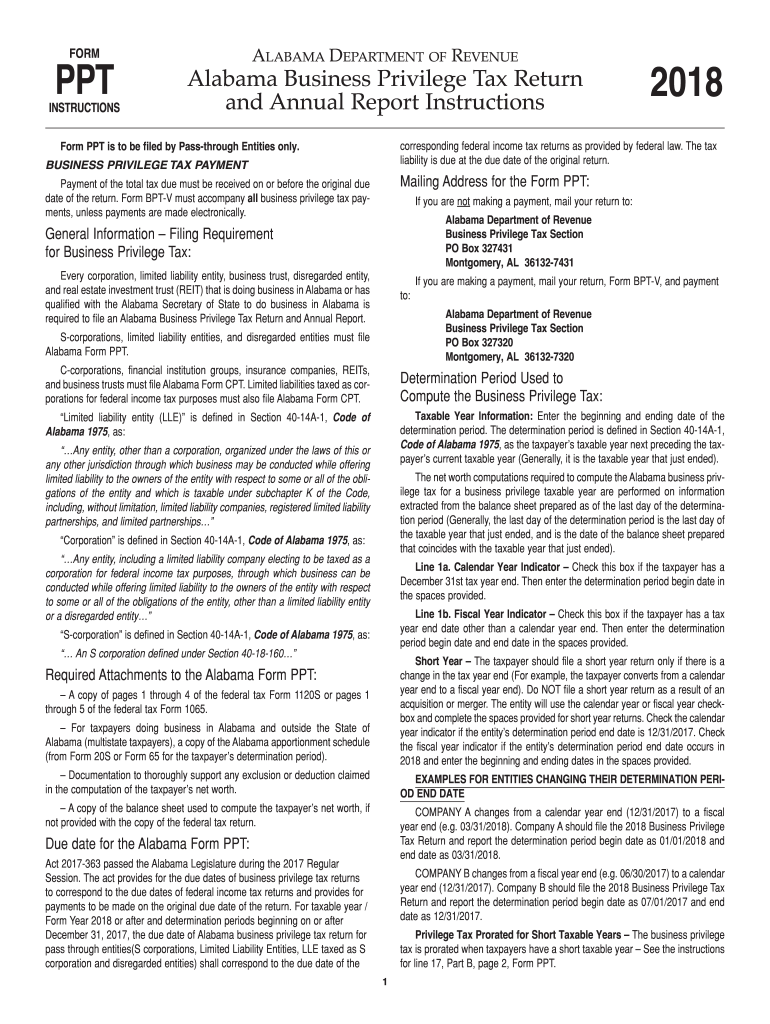

FORMINSTRUCTIONSALABAMA DEPARTMENT OF REVENUE Alabama Business Privilege Tax Return

and Annual Report InstructionsForm PPT is to be filed by Pass through Entities only. Corresponding federal income

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AL PPT Instructions

Edit your AL PPT Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AL PPT Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AL PPT Instructions online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AL PPT Instructions. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL PPT Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AL PPT Instructions

How to fill out AL PPT Instructions

01

Read the AL PPT Instructions document thoroughly to understand its purpose.

02

Gather all necessary information and documents required for filling out the form.

03

Begin by filling out your personal information accurately in the designated fields.

04

Follow the guidelines for each section, ensuring that all details are clear and concise.

05

Double-check each section for completeness and accuracy before submitting.

06

If applicable, attach any additional documents as specified in the instructions.

07

Review the completed form one final time to ensure everything is correct before submission.

Who needs AL PPT Instructions?

01

Individuals or organizations seeking to apply for a program or service related to AL.

02

Applicants who need to provide specific information as part of their application process.

03

Anyone required to complete AL PPT for compliance or reporting purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is due date of submission of return?

ITR Filing Due Date AY 2022-23, FY 2021-22 - Jul 31st is The Last Date to File Income Tax Return.

What is the extension due date for Form 1120?

April 18 is also the deadline to file for an extension to file your corporate tax return. Forms: Form 1120, U.S. Corporation Income Tax Return.

What does return due date mean?

The term “return due date” means, with respect to the taxable year, the date prescribed for filing the partnership return for such taxable year (determined without regard to extensions).

What is the extended due date for C corporations?

As a reminder, the extended due date to file Form 100, California Corporation Franchise or Income Tax Return, is the 15th day of the 11th month after the close of the C Corporation's taxable year. For C Corporations operating under a calendar year, the 2020 taxable year extended due date is November 15, 2021.

What is balance due on return or notice?

You receive a balance due notice. The outstanding amount a taxpayer owes on an account.; Your refund was used to pay another debt. The IRS applied all or part of taxpayer's refund to pay another tax debt.; or.

What is the due date for 2022 taxes?

The due date for filing your tax return is typically April 15 if you're a calendar year filer. Generally, most individuals are calendar year filers. For individuals, the last day to file your 2022 taxes without an extension is April 18, 2023, unless extended because of a state holiday.

What is the tax return due date 2022?

The due date for filing your tax return is typically April 15 if you're a calendar year filer. Generally, most individuals are calendar year filers. For individuals, the last day to file your 2022 taxes without an extension is April 18, 2023, unless extended because of a state holiday.

Are taxes due April 15 2022?

When are taxes due in 2022? The deadline for filing a 2021 federal tax return is April 18, 2022. Residents of Maine and Massachusetts get until April 19, 2022.

What happens if IRS rejects return after due date?

If your return is rejected, you must correct any errors and resubmit your return as soon as possible. If your return is rejected at the end of the filing season, you have 5 days to correct any errors and resubmit your return.

What does return due date mean on my transcript?

It means your return was successfully filed and you are in a daily batch cycle. There is also an estimated processing date of Feb 28th, 2022 noted in the transcript example above.

Can refund be claimed after due date?

Income tax refunds must be claimed within one year from the date on which the assessment year ends. However, in certain cases, assessing officers tend to entertain refund claims that were filed after the specified due date.

What is the due date of submission of return for a company?

The due date to file ITR will be November 30, 2022, for companies which are subject to transfer pricing norms. The Finance Ministry on Wednesday extended the deadline for filing income tax returns for the assessment year 2022-23 by businesses till November 7.

What is the due date for payment of tax?

Presumptive income for Professionals– Independent professionals such as doctors, lawyers, architects etc. come under the presumptive scheme under section 44ADA. They have to pay the whole of their advance tax liability in one instalment on or before 15 March. They can also pay the entire amount by 31 March.

What is the due date for 2022 corporate tax returns?

Calendar tax year: March 15, 2022. Fiscal tax year: the 15th day of 3rd month after end of their tax year.

What is CRA tax filing deadline 2022?

June 15, 2022, is the deadline for self-employed individuals to file their 2021 income tax and benefit return. The Canada Revenue Agency (CRA) is here to support you and your business in meeting your tax obligations.

What does balance due overpayment mean on tax transcript?

An overpayment on your tax return is the amount of refund you would receive. An overpayment occurs when a taxpayer pays too much in income taxes. At the end of the year, if the actual tax return shows that a lesser amount is due than the sum of the payments, an overpayment has occurred.

What is the business tax extension deadline for 2022?

Due dates for corporations If the business is a C corporation then the extension is due by the 15th day of the 4th month after the end of your tax year. For example, if your C corporation is a calendar year taxpayer with a December 31 year end, you need to file a 2022 tax return or extension request by April 18, 2023.

How do I avoid a balance due on my taxes?

If you owe more than $1,000 when you calculate your taxes, you could be subject to a penalty. To avoid this you should make payments throughout the year via tax withholding from your paycheck or estimated quarterly payments, or both.

What does balance due mean?

Balance due is the amount owed on a previous statement for which payment has been required but not been made. It is usually manifested as the amount of a debt still owed on an account or the principal outstanding on a promissory note.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in AL PPT Instructions without leaving Chrome?

AL PPT Instructions can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit AL PPT Instructions on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign AL PPT Instructions on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete AL PPT Instructions on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your AL PPT Instructions from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

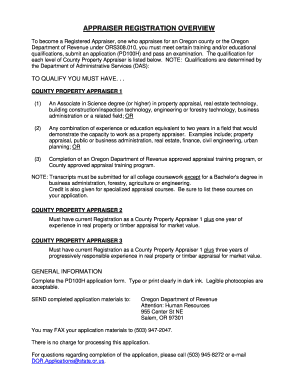

What is AL PPT Instructions?

AL PPT Instructions refer to the guidelines provided for completing the Alabama Pass-Through Entity Tax (PPT) Form. These instructions help taxpayers understand the requirements and procedures for reporting income from pass-through entities.

Who is required to file AL PPT Instructions?

Any partnership, S corporation, or limited liability company (LLC) that has income taxable in Alabama is required to file AL PPT Instructions.

How to fill out AL PPT Instructions?

To fill out AL PPT Instructions, follow the provided guidelines carefully, entering the required financial information, and ensuring that all calculations are accurate before submitting the form to the appropriate tax authority.

What is the purpose of AL PPT Instructions?

The purpose of AL PPT Instructions is to provide clear information on the filing requirements for pass-through entities in Alabama, ensuring compliance with state tax laws.

What information must be reported on AL PPT Instructions?

The information that must be reported on AL PPT Instructions includes the entity's income, deductions, credits, and other relevant financial data pertaining to the pass-through entity.

Fill out your AL PPT Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AL PPT Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.