AL PPT Instructions 2022 free printable template

Show details

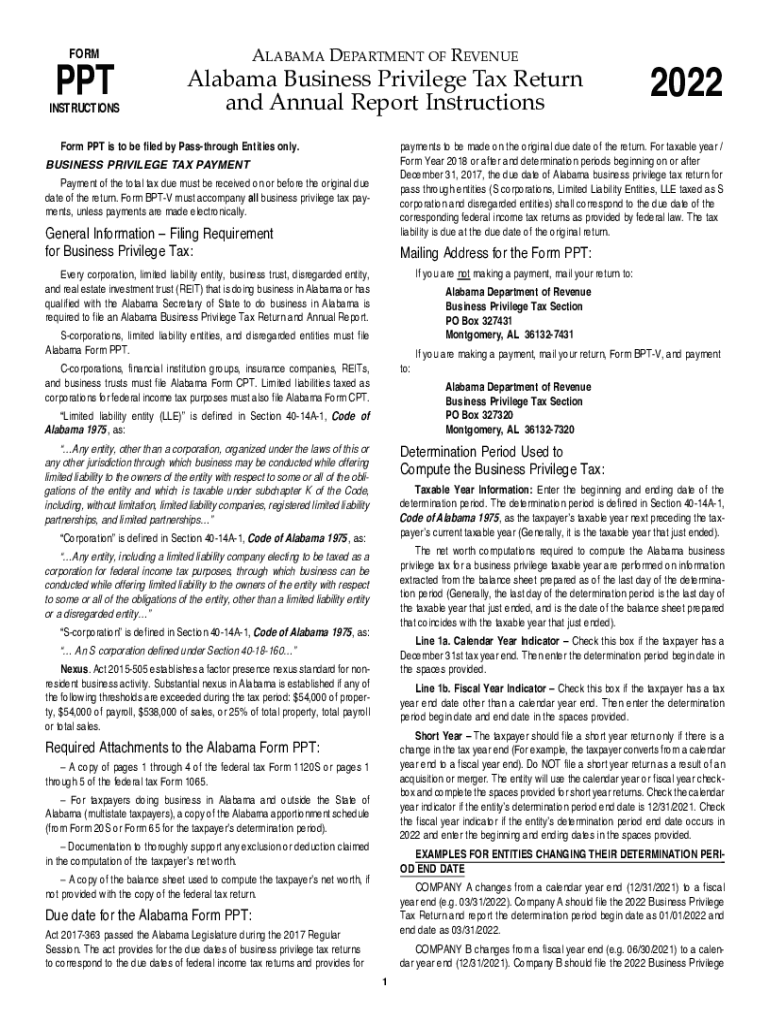

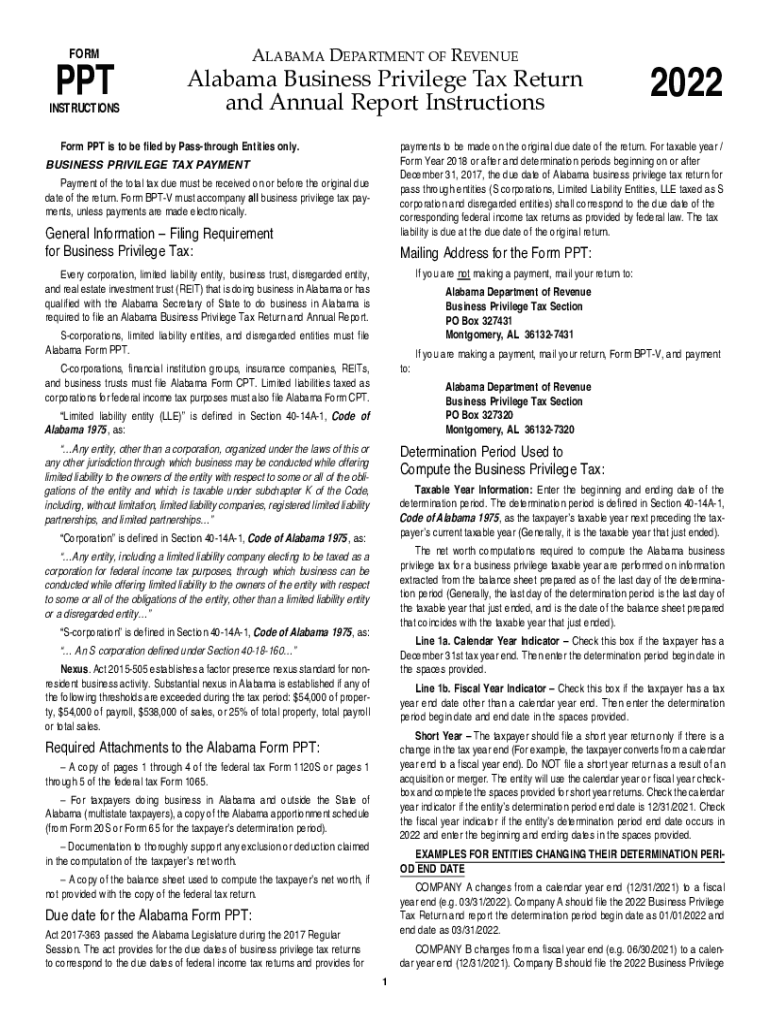

FORMPPTINSTRUCTIONSALABAMA DEPARTMENT OF REVENUE Alabama Business Privilege Tax Return

and Annual Report InstructionsForm PPT is to be filed by Pass through Entities only.2022payments to be made on

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AL PPT Instructions

Edit your AL PPT Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AL PPT Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AL PPT Instructions online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AL PPT Instructions. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL PPT Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AL PPT Instructions

How to fill out AL PPT Instructions

01

Gather the necessary documentation and information required for the AL PPT instructions.

02

Review the form to understand all the sections that need to be filled out.

03

Start filling in your personal information, such as name, address, and contact details.

04

Provide the required financial details as specified in the instructions.

05

Ensure that you fill out any additional sections accurately, such as declarations or certifications.

06

Double-check all entries for accuracy and completeness before submission.

07

Print and sign the completed instruction form if required.

08

Submit the form according to the guidelines provided, whether online or via mail.

Who needs AL PPT Instructions?

01

Individuals or businesses required to submit AL PPT for regulatory compliance.

02

Accountants and financial advisors assisting clients in completing financial forms.

03

Anyone looking for clarity on property tax instructions and obligations.

Fill

form

: Try Risk Free

People Also Ask about

What taxes does a business pay in Alabama?

The Alabama business tax rate for corporate income is 6.5%. The due date for your corporate income tax returns is a little tricky.

Who has to pay Alabama business privilege tax?

The business privilege tax is an annual tax paid by corporations and limited liability entities (including disregarded entities) for the privilege of conducting business in Alabama. The Alabama Business Tax law is found in Chapter 14A, Title 40, Code of Alabama 1975.

Who must file Alabama privilege tax?

A privilege license is a license requirement of every person, firm, company or corporation engaged in any business, vocation, occupation or profession described in Title 40, Chapter 12, Code of Alabama 1975.

Who must pay Alabama privilege tax?

The business privilege tax is an annual tax paid by corporations and limited liability entities (including disregarded entities) for the privilege of conducting business in Alabama. The Alabama Business Tax law is found in Chapter 14A, Title 40, Code of Alabama 1975.

Does Alabama have LLC tax?

(See the IRS website for the form.) The State of Alabama, like most other states, has a corporation income tax. In Alabama, the corporate tax currently is computed at a flat rate of 6.5% of taxable net income. If your LLC is taxed as a corporation you also will need to pay this tax.

What are the benefits of an LLC in Alabama?

Benefits of starting an Alabama LLC: Easy tax filing and potential advantages for tax treatment. Quick and simple filing, management, compliance, regulation and administration. Protect your personal assets from your business liability and debts. Low cost to file ($200)

What is a business privilege tax return?

Privilege taxes are imposed on businesses for the right to conduct business in a given state. Privilege taxes are usually based on the gross receipts or net worth of a business, but some are levied as a flat fee.

Who must file Alabama business privilege tax return?

The business privilege tax is an annual tax paid by corporations and limited liability entities (including disregarded entities) for the privilege of conducting business in Alabama. The Alabama Business Tax law is found in Chapter 14A, Title 40, Code of Alabama 1975.

How many times is income from an LLC taxed?

Any direct payment of your LLC's profits to you are considered a dividend and taxed twice. First, the LLC pays corporate income tax on the profit at the 21% corporate rate on its own corporate return.

What is the Alabama privilege tax?

The tax rate for the Alabama Business Privilege Tax is based on how much revenue your business brings to the state of Alabama. So, your rate will rise and fall depending on how much money your business earns each year. Alabama tax rates range from $0.25 to $1.75 for each $1000 of your entity's Alabama net worth.

How to file a final Alabama business privilege tax return?

How to File Your Alabama Business Privilege Tax Return Find your business entity's due date and determine your filing fees. Download and complete your tax return. File your return and pay your business privilege tax.

What is the example of privilege tax?

A privilege tax is a tax levied in exchange for a privilege or license granted to the taxpayer. The fee for registering a motor vehicle is one example of a privilege tax. Many taxes on businesses are characterized as privilege taxes.

How often is Alabama business privilege tax due?

The return is due three and a half months after the beginning of the taxpayer's taxable year or April 15, 2021. With the exception of the Business Privilege return for Financial Institutions Groups, the Business Privilege tax return due date corresponds to the due date of the corresponding federal return.

What taxes does an LLC pay in Alabama?

LLC members need to pay the federal self-employment tax, which is 15.3% (12.4% for social security and 4.9% for Medicare). Alabama LLCs are subject to the Alabama Business Privilege Tax, which is $100 minimum. There are other state and local taxes to be aware of, including Alabama state income tax and sales tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send AL PPT Instructions to be eSigned by others?

When you're ready to share your AL PPT Instructions, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete AL PPT Instructions online?

pdfFiller has made it easy to fill out and sign AL PPT Instructions. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I fill out the AL PPT Instructions form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign AL PPT Instructions and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is AL PPT Instructions?

AL PPT Instructions are guidelines provided for completing the Alabama Public Prevention Tax (AL PPT) form, which is used to report certain financial transactions and tax obligations in the state of Alabama.

Who is required to file AL PPT Instructions?

Individuals, businesses, and entities that engage in taxable activities or transactions subject to the Alabama Public Prevention Tax are required to file the AL PPT Instructions.

How to fill out AL PPT Instructions?

To fill out AL PPT Instructions, individuals or entities must complete the designated form by providing required information such as total transaction amounts, tax calculations, and any relevant identification details as outlined in the instructions.

What is the purpose of AL PPT Instructions?

The purpose of AL PPT Instructions is to provide a standardized format and guidance for taxpayers to accurately report their transactions and ensure compliance with tax laws in Alabama.

What information must be reported on AL PPT Instructions?

The information that must be reported on AL PPT Instructions includes the taxpayer's identification details, transaction amounts, applicable tax rates, and any deductions or credits that apply to the public prevention tax.

Fill out your AL PPT Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AL PPT Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.