Get the free CUSTOMS Appeal Branch

Show details

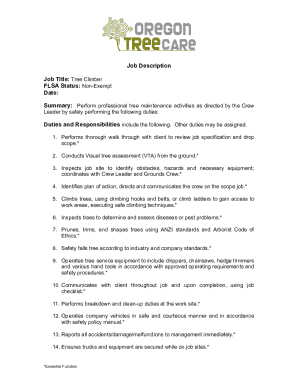

Customs, Excise and Service Tax Appellate Tribunal West Block No.2, R.K. Purim, New Delhi 110066 CUSTOMS Appeal Branch CAUSELESS FOR FINAL HEARING Court No. III CORAL: HOBBLE MR. S. K. SHANTY, MEMBER

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign customs appeal branch

Edit your customs appeal branch form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your customs appeal branch form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing customs appeal branch online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log into your account. It's time to start your free trial.

2

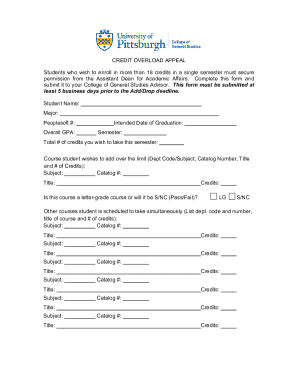

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit customs appeal branch. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out customs appeal branch

How to fill out customs appeal branch

01

To fill out a customs appeal branch, follow these steps:

02

Start by providing your personal information, including your name, address, and contact details.

03

Specify the customs decision you are appealing and include details such as the date and reference number of the decision.

04

Clearly state the grounds for your appeal and provide any supporting documents or evidence that can strengthen your case.

05

Mention any relevant regulations or laws that support your argument and explain why the customs decision should be overturned.

06

Clearly state the outcome you are seeking from the appeal and include any specific remedies or actions you are requesting.

07

Review the form for accuracy and completeness before submitting it to the customs appeal branch.

08

Send the completed form along with any required fees or supporting documents to the designated address or email provided by the customs appeal branch.

09

Follow up with the customs appeal branch to ensure that your appeal has been received and is being processed.

10

Cooperate with any requests for additional information or clarification from the customs appeal branch throughout the appeals process.

11

Stay informed about the progress of your appeal by regularly communicating with the customs appeal branch and promptly responding to any inquiries or requests.

12

By following these steps, you can effectively fill out a customs appeal branch and increase your chances of a successful appeal.

Who needs customs appeal branch?

01

Anyone who disagrees with a customs decision and believes that it should be overturned may need to use the customs appeal branch.

02

This can include individuals, businesses, importers, exporters, or any party involved in international trade that feels the need to challenge a customs decision.

03

The customs appeal branch provides a platform for such individuals or entities to present their case, provide evidence, and seek a fair review of the customs decision.

04

Whether it is a disagreement regarding customs duties, import/export restrictions, classification of goods, or any other customs-related matter, those who believe their rights or interests have been adversely affected can benefit from using the customs appeal branch.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get customs appeal branch?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific customs appeal branch and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete customs appeal branch online?

Completing and signing customs appeal branch online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make edits in customs appeal branch without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing customs appeal branch and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is customs appeal branch?

Customs appeal branch is a department where individuals or companies can appeal decisions made by customs authorities regarding customs duties or taxes.

Who is required to file customs appeal branch?

Any individual or company dissatisfied with a decision made by customs authorities regarding customs duties or taxes may be required to file a customs appeal branch.

How to fill out customs appeal branch?

To fill out a customs appeal branch, individuals or companies typically need to submit a formal written appeal stating the reasons for contesting the decision made by customs authorities.

What is the purpose of customs appeal branch?

The purpose of customs appeal branch is to provide a mechanism for individuals or companies to challenge decisions made by customs authorities regarding customs duties or taxes.

What information must be reported on customs appeal branch?

Information such as the decision being appealed, reasons for contesting the decision, and supporting documentation may need to be reported on a customs appeal branch.

Fill out your customs appeal branch online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Customs Appeal Branch is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.