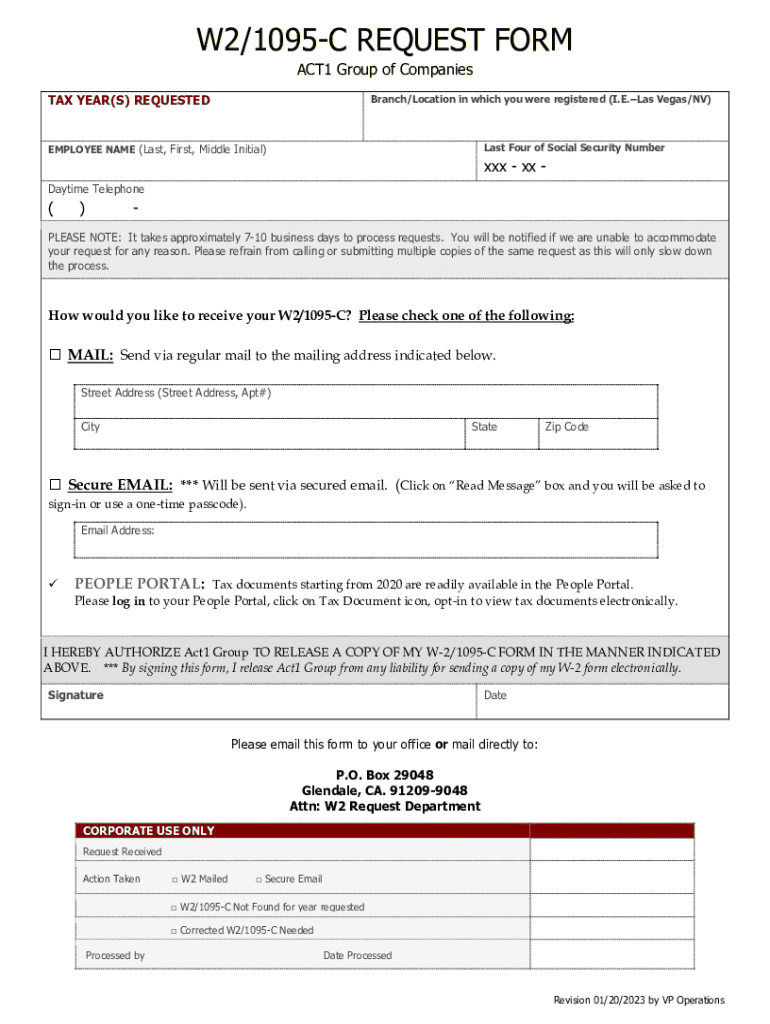

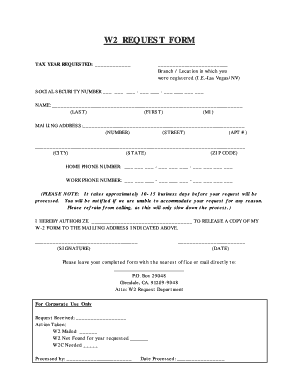

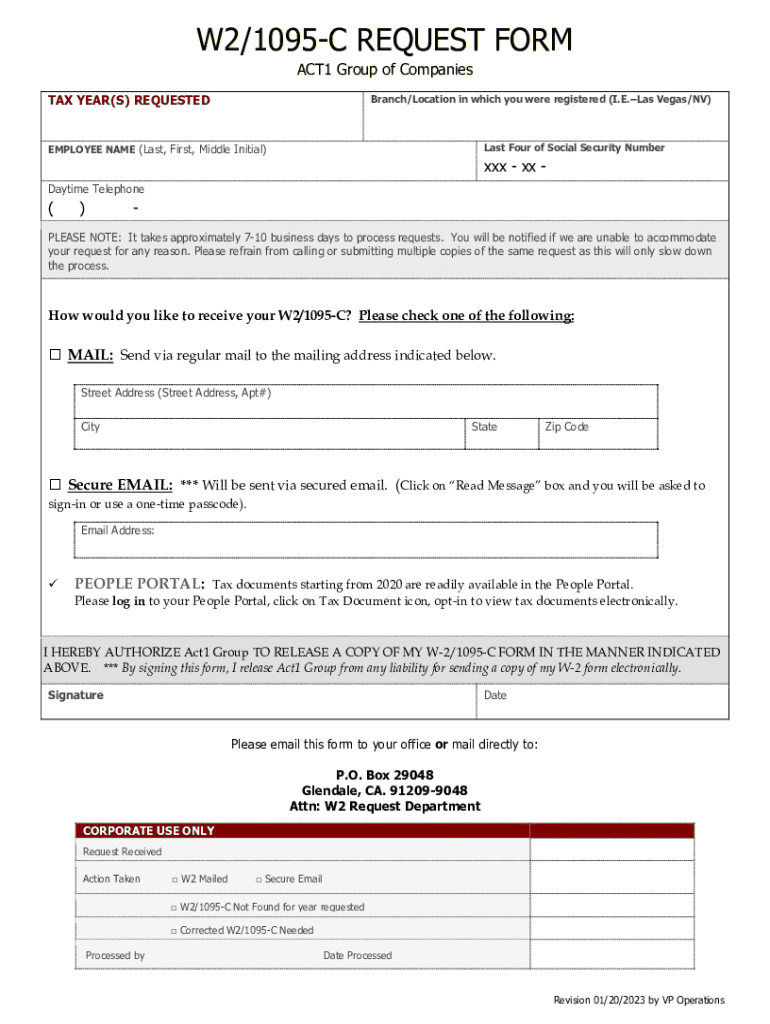

CA W2/1095-C Request Form 2023-2025 free printable template

Get, Create, Make and Sign

How to edit online

Uncompromising security for your PDF editing and eSignature needs

CA W2/1095-C Request Form Form Versions

How to fill out

How to fill out CA W2/1095-C Request Form

Who needs CA W2/1095-C Request Form?

Instructions and Help about

Welcome to this episode of top echelon TV I'm Marc Emery and in this episode we're fortunate enough to have Debbie flutter John president of top echelon contracting with us and Debbie every, so often we'll get questions from our customers on what's the difference between a 1099 contract employee and a w-2 and when should you do that, so we thought well the best way to answer that question is ask the expert so let me ask you straight out what is the difference between a 1099 independent contractor and a w-2 okay mark that's a great question we get that question in our office on a very regular basis and there are occasions when you can classify a worker as an independent contractor, but it's not the norm in today's society in the IRS of actually doing a huge crackdown on this issue they have a new incentive it's called the 2010 IRS employment tax national research project they've actually hired two thousand dollars to go out there and audit companies for the next three years looking for employee miss classification because of the huge tax dollar gap so the main differences when it comes to employees which we're classifying them as workers now versus a true w-2 employee goes to the tax situation if someone's being paid as an independent contractor the client company is not paying into federal unemployment tax they're not paying state unemployment tax they're not paying into Social Security and Medicare they're not paying into unemployment for the worker, and they're not paying into benefits and most importantly there's no workers' compensation coverage so from an employer's perspective or the client company there's a huge tax savings but then from the employee standpoint the worker is not paying federal income tax they're not paying into state income tax they're not paying their share of the FICA which is a Social Security and Medicare, and they don't have access to unemployment workers comp or any of the medical benefits medical dental vision life insurance those sorts of things Wow well let me ask you then how do you know right with all of that how do you know when to pay an employee or somebody on a 1099 okay it all boils down to the right to control the daily work scope and control the worker there's three IRS factors the first one's behavioral control and that involves how the works being performed where it's being performed when the work is taking place additional factors what tools are being provided and is there any training involved for the worker that's the behavioral control then there's financial control that deals with is there a significant investment on part of the worker are there multiple clients for the worker the cost of business expenses is the worker being paid as a flat fee for a job done or an hourly basis and then will the worker actually suffer a loss if something goes wrong in the project that's the financial part of it and then the relationship of the parties what's the tie between the two parties is there a contract are...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in ?

How do I edit in Chrome?

How do I edit straight from my smartphone?

What is CA W2/1095-C Request Form?

Who is required to file CA W2/1095-C Request Form?

How to fill out CA W2/1095-C Request Form?

What is the purpose of CA W2/1095-C Request Form?

What information must be reported on CA W2/1095-C Request Form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.