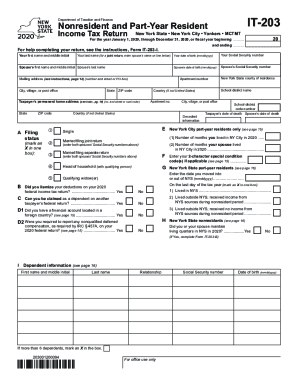

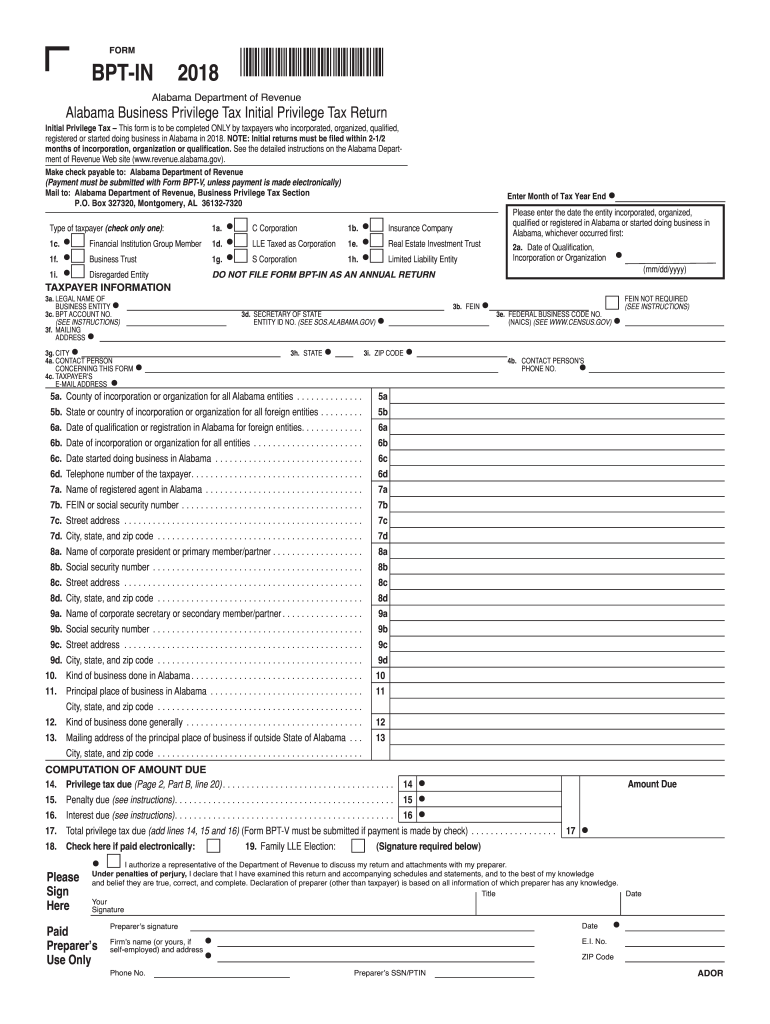

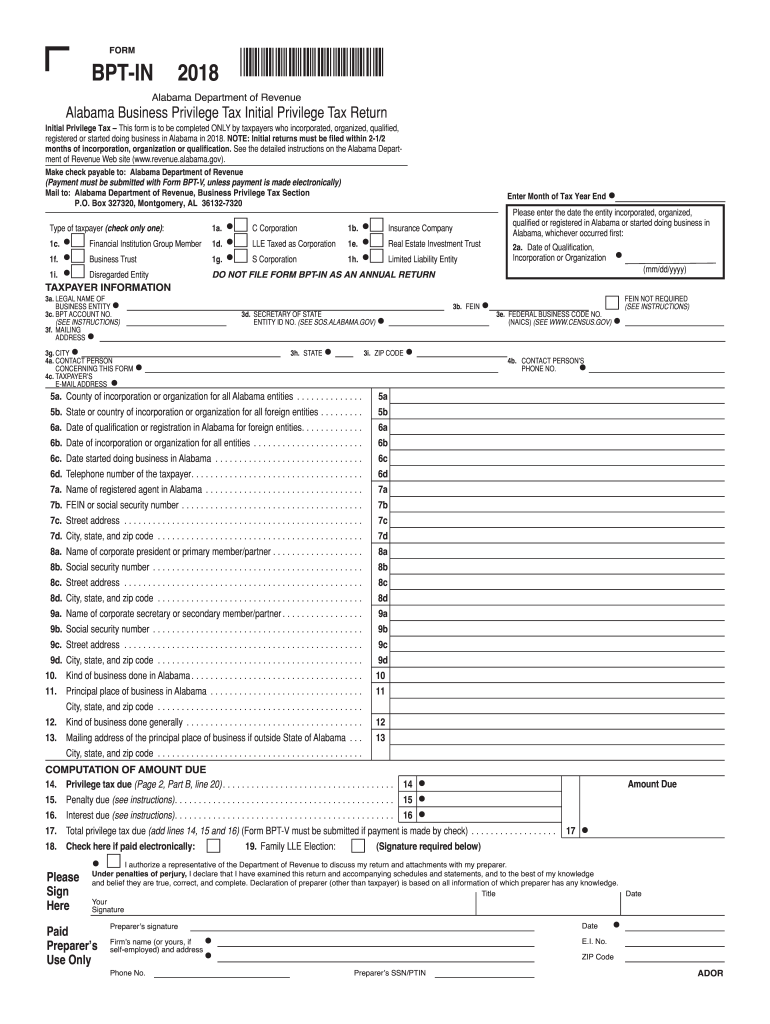

AL BPT-IN 2018 free printable template

Show details

FORMBPTIN2018×180001BN×Alabama Department of Revenue Alabama Business Privilege Tax Initial Privilege Tax ReturnInitial Privilege Tax This form is to be completed ONLY by taxpayers who incorporated,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AL BPT-IN

Edit your AL BPT-IN form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AL BPT-IN form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AL BPT-IN online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AL BPT-IN. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL BPT-IN Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AL BPT-IN

How to fill out AL BPT-IN

01

Obtain the AL BPT-IN form from the official website or your local tax office.

02

Enter your business information, including name, address, and contact details.

03

Provide your business's federal Employer Identification Number (EIN).

04

Fill out the gross receipts section with your total revenue for the year.

05

Complete the deductions section if applicable, based on allowed categories.

06

Calculate your total tax liability based on your net income.

07

Sign and date the form to certify that the information is accurate.

08

Submit the completed form by the designated deadline, either electronically or by mail.

Who needs AL BPT-IN?

01

All businesses operating in Alabama that meet the revenue thresholds.

02

Sole proprietors, partnerships, corporations, and LLCs conducting business in Alabama.

03

Businesses required to pay the Alabama Business Privilege Tax.

Fill

form

: Try Risk Free

People Also Ask about

Who Must File Alabama business privilege tax?

The business privilege tax is an annual tax paid by corporations and limited liability entities (including disregarded entities) for the privilege of conducting business in Alabama. The Alabama Business Tax law is found in Chapter 14A, Title 40, Code of Alabama 1975.

Who must pay Alabama business privilege tax?

The business privilege tax is an annual tax paid by corporations and limited liability entities (including disregarded entities) for the privilege of conducting business in Alabama. The Alabama Business Tax law is found in Chapter 14A, Title 40, Code of Alabama 1975.

Can you file Alabama privilege tax online?

Alabama Business Privilege Tax Returns must be filed by mail. To download and print your tax return, you'll need to visit the Alabama Department of Revenue website. On the state website, click “Forms” on the top menu.

How much is the business privilege tax in Alabama?

Business Privilege Tax Rate BracketRate per $1,000 in AL assets$0$124%$1$200,00025%$200,000$500,00024.8%$500,000$2.5 Million24.67%2 more rows

Who needs to file BPT Alabama?

A privilege license is a license requirement of every person, firm, company or corporation engaged in any business, vocation, occupation or profession described in Title 40, Chapter 12, Code of Alabama 1975.

Who Must File Alabama business privilege tax return?

The business privilege tax is an annual tax paid by corporations and limited liability entities (including disregarded entities) for the privilege of conducting business in Alabama. The Alabama Business Tax law is found in Chapter 14A, Title 40, Code of Alabama 1975.

What is form BPT-in?

Form BPT-IN, Initial Business Privilege Tax Return, is used to file an initial return. Filing Form BPT-IN as an annual Business Privilege Tax Return could result in a failure to timely file penalty. An Alabama Schedule AL-CAR, the cor- porate annual report, is not required for an initial return.

How do I file business privilege tax in Alabama?

How to File Your Alabama Business Privilege Tax Return Find your business entity's due date and determine your filing fees. Download and complete your tax return. File your return and pay your business privilege tax.

What is an initial privilege tax return?

An initial business privilege tax return is the first return due after the taxpayer comes into existence or begins doing business in Alabama.

Who Must file Alabama BPT?

A privilege license is a license requirement of every person, firm, company or corporation engaged in any business, vocation, occupation or profession described in Title 40, Chapter 12, Code of Alabama 1975.

What is Alabama form BPT V?

TAXABLE/FORM YEAR. Alabama Department of Revenue. Business Privilege Tax Payment Voucher. DETACH ALONG THIS LINE AND MAIL VOUCHER WITH YOUR FULL PAYMENT.

How often is Alabama business privilege tax due?

The return is due three and a half months after the beginning of the taxpayer's taxable year or April 15, 2021. With the exception of the Business Privilege return for Financial Institutions Groups, the Business Privilege tax return due date corresponds to the due date of the corresponding federal return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit AL BPT-IN from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including AL BPT-IN. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send AL BPT-IN to be eSigned by others?

AL BPT-IN is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an eSignature for the AL BPT-IN in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your AL BPT-IN and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is AL BPT-IN?

AL BPT-IN is the Alabama Business Privilege Tax Income Tax Return form used by businesses to report their income and calculate their business privilege tax liability in the state of Alabama.

Who is required to file AL BPT-IN?

All corporations and entities doing business in Alabama, as well as certain other businesses that meet specific criteria, are required to file the AL BPT-IN form.

How to fill out AL BPT-IN?

To fill out the AL BPT-IN, businesses should gather their financial information for the tax year, complete the relevant sections of the form, and ensure that all income, deductions, and tax calculations are accurately reported.

What is the purpose of AL BPT-IN?

The purpose of AL BPT-IN is to report business income and pay the appropriate business privilege tax to the state of Alabama, ensuring compliance with state tax laws.

What information must be reported on AL BPT-IN?

The AL BPT-IN requires reporting of business income, deductions, tax credits, and other relevant financial data, including the entity's name, address, and federal identification number.

Fill out your AL BPT-IN online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AL BPT-IN is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.