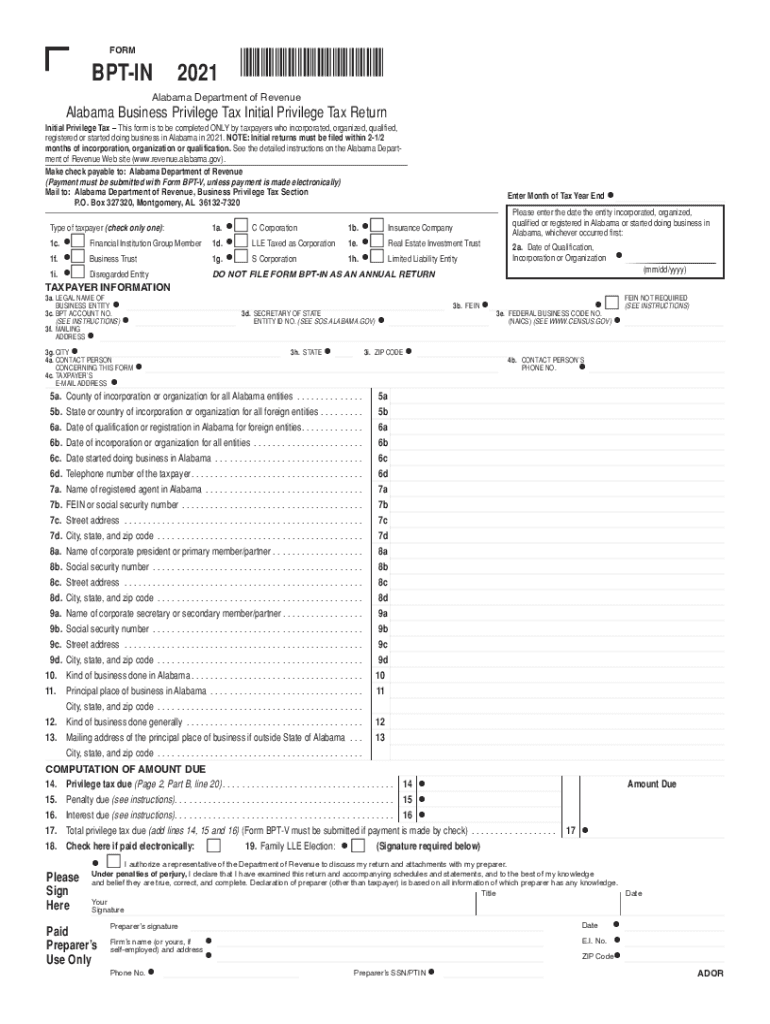

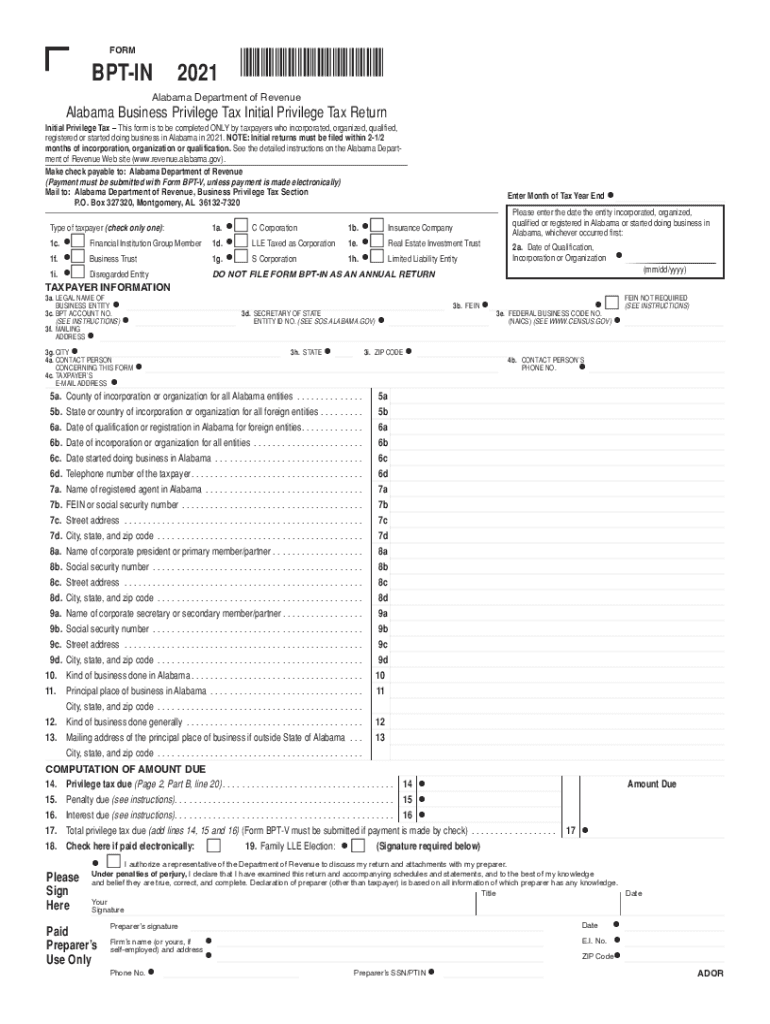

AL BPT-IN 2021 free printable template

Get, Create, Make and Sign AL BPT-IN

How to edit AL BPT-IN online

Uncompromising security for your PDF editing and eSignature needs

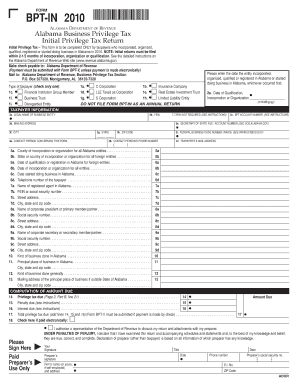

AL BPT-IN Form Versions

How to fill out AL BPT-IN

How to fill out AL BPT-IN

Who needs AL BPT-IN?

Instructions and Help about AL BPT-IN

Hi friends miss Justin are Armageddon enemy Havana heroes with aluminum Oh physiotherapy course you can put the details into things cool now looking up in dimension like their Charley and a challenge an incumbent bucks low BP taking some money 20 feels Vitré Lew Marie you certificate and look you put through religion and challenge a challenge in comment box that is been well across many videos aperture looking up if you don't know you in Dover couldn't a features that having some ingenuity put through oral any could a mere END Allah tells culture and I think I come down you don't like your mother much both content needn't be through are essentially oak elect mother may I don't think I told Adhara Monday and the dad up to 61 percent member so much are only subscriptions coconut juice tomorrow Daniel ah knock it the Nostrum Mike nonetheless to me to contain they depict apathy video mirror to roulette bot you Dan even like Dave's problem i.e. make Cowell Cynthia K now video maker chair at poacher, so you put it them in subscript just Mooney buckets on a bell better new process that up put a mirror now press the media to notification in very easy got alerts through public on that you America lets check USDA BPD that I look you push through Brazil's Kendall let us start our farm again channel turn effects make recovery like their nature papaya e information on Tabata Network NTR University of Health Sciences in each easy schooner 20 puts this thigh information Bowman shop virtue in the lab anger think someone's already website liquid night make a description of robots just on up I could kill him in a director open just culture and miracle combination like they're clearing amends and share but in they be pretty regulation 2019 and 20 any so did me the miracle adjustment like that dynamic evil on that notification like open openly in the lobby Gang Millikan accommodation like there be pretty courses for the academic year after 2099 50ml correctly and get shop from there's only an in the lobby Gang first minima in pattern Dave school into MATLAB Juno, so first mirror there's fish and because they're a notification that brusque a relational data just say 18 men 2019 inch of patch an application online no makeup on the person who 20 data Jesse 1990-2000 meant it, but they are not wanting and to start a sense of much one lost it urges an October 3 any clearing up messenger bird another good evening file open Mira a play chess was called that is someone who Tilly go to make it a clearing immense a chair in the real if websites and look you Lincoln could and in description law understand Oh next to then if someone would take certificate verification and are they dating Kerala to be notified and mentioned chair in the perfect things as fruit in the Arthur Matey marital is to go to rural soon D and finally got web absence room to this so customer online law places called it applies as keynote errata at an October no motor verification handed them to me...

People Also Ask about

Who Must File Alabama business privilege tax?

Who must pay Alabama business privilege tax?

Can you file Alabama privilege tax online?

How much is the business privilege tax in Alabama?

Who needs to file BPT Alabama?

Who Must File Alabama business privilege tax return?

What is form BPT-in?

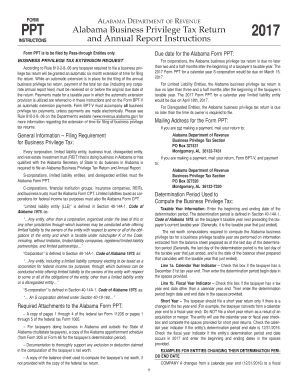

How do I file business privilege tax in Alabama?

What is an initial privilege tax return?

Who Must file Alabama BPT?

What is Alabama form BPT V?

How often is Alabama business privilege tax due?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my AL BPT-IN in Gmail?

How do I edit AL BPT-IN online?

How do I make edits in AL BPT-IN without leaving Chrome?

What is AL BPT-IN?

Who is required to file AL BPT-IN?

How to fill out AL BPT-IN?

What is the purpose of AL BPT-IN?

What information must be reported on AL BPT-IN?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.