CT DRS CT-1041 2017 free printable template

Show details

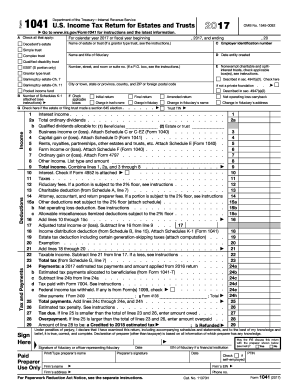

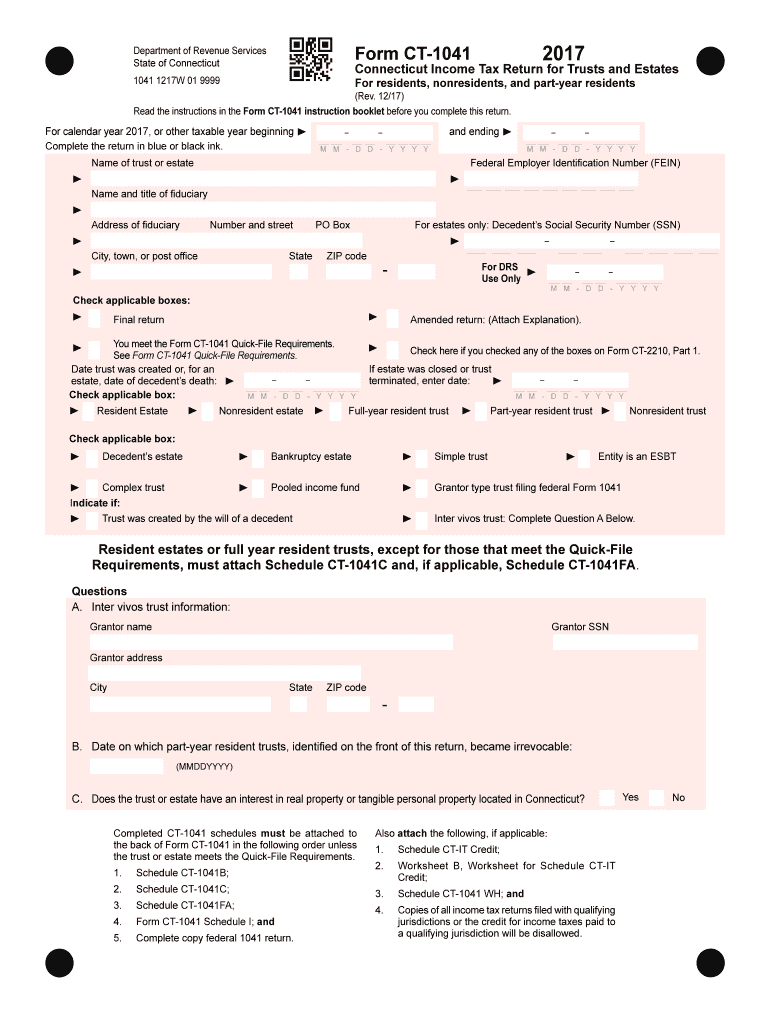

All 2015 estimated tax payments and any overpayment applied from a prior year 12. Payments made with extension request on Form CT-1041 EXT 13. Amount you owe 23 Make check payable to Commissioner of Revenue Services. To ensure payment is applied to your account write the FEIN of the trust or estate and 2015 Form CT-1041 on the front of the check. Read the complete instructions in the Form CT-1041 instruction booklet before completing this form. For calendar year 2015 or other taxable year ...beginning 2015 and ending 20 Name and Address Name of trust or estate Name and title of fiduciary Address of fiduciary Number and street City town or post office PO Box State ZIP code Federal Employer Identification Number FEIN DRS use only Decedent s Social Security Number SSN For estates only Check applicable box Final return Amended return See back page. Department of Revenue Services State of Connecticut Form CT-1041 Connecticut Income Tax Return for Trusts and Estates Rev* 12/15...CT-1041 For residents nonresidents and part-year residents Complete this form in blue or black ink only. Check here if you meet the Form CT-1041 Quick-File Requirements. See Form CT-1041 Quick-File Requirements on Page 14. Resident Status Date trust was created or for an estate date of decedent s death If estate was closed or trust terminated enter date Type of Entity Full-Year Only Nonresident Part-Year Computation of Tax Resident estate Clip check here. Do not staple. 1. Connecticut taxable...income from Schedule CT-1041C Line 14 or to Quick-File see federal Form 1041 Line 22. 2. Connecticut income tax Multiply Line 1 by 6. 99. 0699. 3. Allocated Connecticut income tax from Schedule CT-1041FA Part 1 Line 12 for nonresident estates nonresident trusts or part-year resident trusts only. 4. Credit for income tax paid to qualifying jurisdictions by resident estates resident trusts or part-year resident trusts only See instructions. 5. Subtract Line 4 from Line 2 or Line 3. See...instructions. 7. Add Line 5 and Line 6. 8. Total allowable credits from Schedule CT-IT Credit Part 1 Line 11 Payments 11. Total payments Add Lines 10 11 and 12. 14. If Line 13 is greater than Line 9 enter amount overpaid* Subtract Line 9 from Line 13. 15. Amount of Line 14 you want to be applied to the 2016 estimated tax 16. Balance of overpayment Subtract Line 15 from Line 14. 17. Reserved for future use. Refund or Amount Due Part-year resident trust Full-year resident trust trust Check here...if entity Decedent s estate Bankruptcy estate Simple trust is an ESBT. Complex trust Pooled income fund Grantor type trust filing federal Form 1041 Indicate if Trust was created by the will of a decedent Inter vivos trust Complete Question A on back page. 18. Amount to be refunded Enter the amount from Line 16. For faster refund use Direct Deposit by completing Lines 18a 18b and 18c* 18a* Checking Savings Refund 18 18b. Routing number 18c* Account number 18d. Will this refund go to a...bank account outside the U*S* Yes 19.

pdfFiller is not affiliated with any government organization

Instructions and Help about CT DRS CT-1041

How to edit CT DRS CT-1041

How to fill out CT DRS CT-1041

Instructions and Help about CT DRS CT-1041

How to edit CT DRS CT-1041

To edit the CT DRS CT-1041 form, access it through a platform that allows for document editing, such as pdfFiller. You can easily modify fields, add or remove information, and save your work as you go. Ensure that the edits you make are in compliance with state tax regulations.

How to fill out CT DRS CT-1041

To fill out the CT DRS CT-1041 form, gather all necessary financial information beforehand. Follow these steps:

01

Read the instructions carefully to understand each section.

02

Provide details about the income earned and any taxes withheld.

03

Include identification information for both the payer and recipient as required.

Make sure to double-check for accuracy before finalizing the form. Using a tool like pdfFiller can streamline this process by allowing for quick edits and checks.

About CT DRS CT- previous version

What is CT DRS CT-1041?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CT DRS CT- previous version

What is CT DRS CT-1041?

CT DRS CT-1041 refers to the Connecticut Department of Revenue Services' form used for reporting income earned from various sources. This tax form plays a crucial role in ensuring compliance with state tax laws.

What is the purpose of this form?

The purpose of the CT DRS CT-1041 form is to document income subject to Connecticut taxes. It ensures that all earnings are reported accurately to the state for tax assessment. This helps maintain fair taxation practices among individuals and businesses.

Who needs the form?

Individuals and entities that engage in business activities or earn income in Connecticut may need to complete the CT DRS CT-1041 form. This includes independent contractors, freelancers, and certain businesses that are subject to withholding taxes.

When am I exempt from filling out this form?

You may be exempt from filling out the CT DRS CT-1041 form if your income falls below a certain threshold set by the state or if you are not engaged in business activities that require reporting. Check the latest state guidelines for specific criteria regarding exemptions.

Components of the form

The CT DRS CT-1041 form comprises several key components, including:

01

Payer information

02

Recipient identification

03

Details of income earned

04

Taxes withheld

Each section must be filled out accurately to avoid delays or penalties. Refer to the instructions provided with the form for additional details on each component.

Due date

While specific due dates can vary based on the fiscal year and filing status, the CT DRS CT-1041 form is typically due by January 31 of the following year. Be sure to check for any extensions or changes that may be applicable.

What payments and purchases are reported?

The CT DRS CT-1041 form reports various payments made to individuals for services rendered and certain purchases subject to taxation. This includes gross payments before any deductions or withholdings.

How many copies of the form should I complete?

Generally, you should complete multiple copies of the CT DRS CT-1041 form if you are providing reports for more than one recipient. Ensure that each recipient receives their copy for their tax records, while you maintain a copy for your own records.

What are the penalties for not issuing the form?

Failing to issue the CT DRS CT-1041 form when required can lead to significant penalties. The Connecticut Department of Revenue Services may impose fines based on the amount of taxes owed or on a per-form basis, which can accumulate quickly.

What information do you need when you file the form?

When filing the CT DRS CT-1041 form, you need the following information:

01

Payer and recipient names and addresses

02

Tax identification numbers (or Social Security Numbers)

03

Total payments made during the tax year

04

Withholding amounts, if applicable

Gathering this information in advance facilitates a smoother filing process and reduces the likelihood of errors.

Is the form accompanied by other forms?

The CT DRS CT-1041 form may need to be accompanied by other relevant forms or documentation, depending on the specifics of your situation. It is essential to ensure that any required supplemental forms are submitted alongside the CT DRS CT-1041 to maintain compliance.

Where do I send the form?

The CT DRS CT-1041 form should be sent to the Connecticut Department of Revenue Services. Specific mailing addresses may vary based on the nature of the filing, so it is advisable to consult the latest state guidelines to confirm the correct submission address.

See what our users say