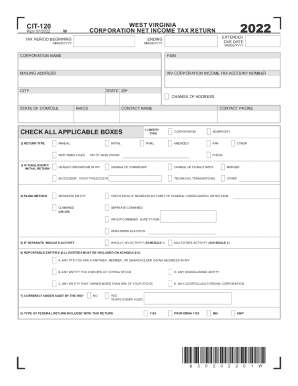

WV CIT-120 2017 free printable template

Show details

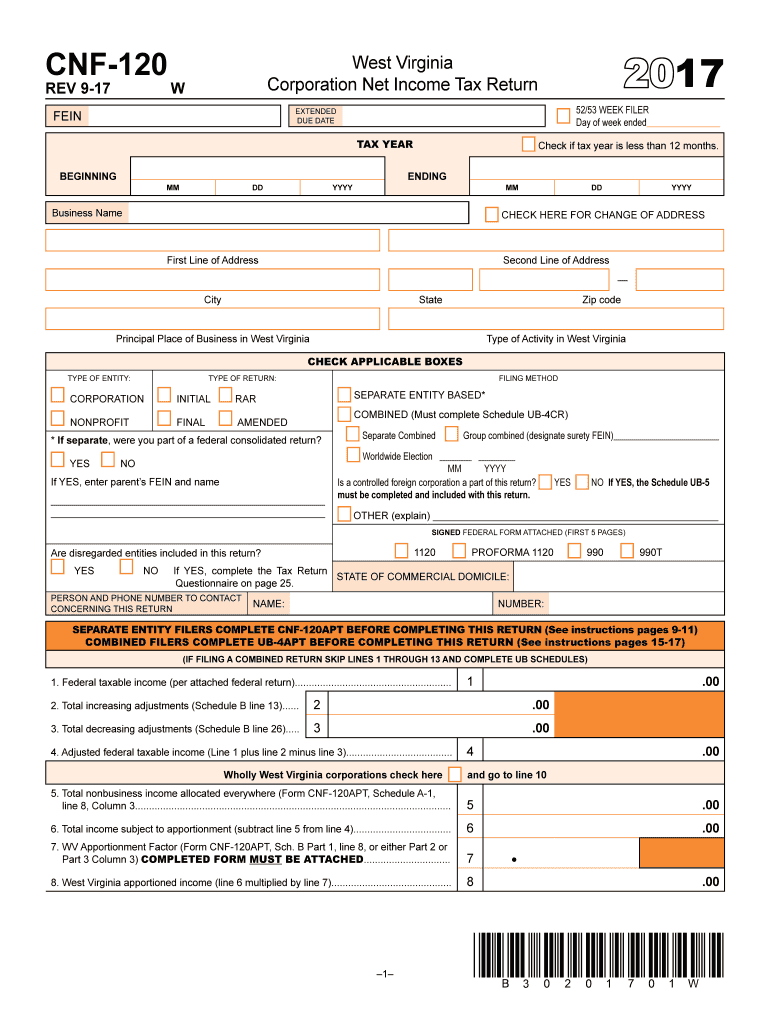

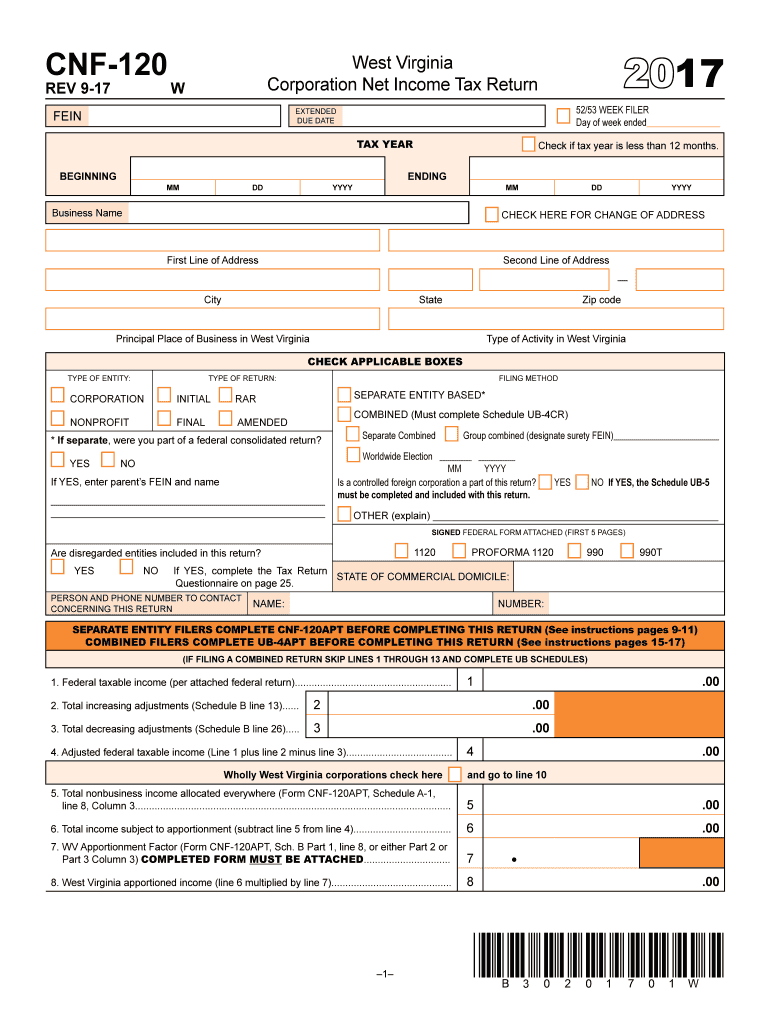

CNF120 REV 9172017West Virginia Corporation Net Income Tax ReturnW52/53 WEEK FILER Day of week ended Extended Due dateFEINtax year BeginningMMDDCheck if tax year is less than 12 months.ENDINGYYYYMMBusiness

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WV CIT-120

Edit your WV CIT-120 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WV CIT-120 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WV CIT-120 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit WV CIT-120. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WV CIT-120 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WV CIT-120

How to fill out WV CIT-120

01

Obtain the WV CIT-120 form from the West Virginia Department of Revenue website or a local office.

02

Fill in your name and contact information at the top of the form.

03

Provide your Social Security number or tax identification number as required.

04

Complete the sections related to income, deductions, and credits according to your financial information.

05

Check all applicable boxes and provide any required documentation to support your claims.

06

Review the filled-out form for accuracy and completeness.

07

Sign and date the form at the designated space at the bottom.

08

Submit the completed form by mail or electronically following the instructions provided.

Who needs WV CIT-120?

01

Individuals or businesses in West Virginia who need to report certain tax information.

02

Taxpayers seeking specific credits or deductions available within the state.

03

Those who have received a notice requiring them to complete this form.

Fill

form

: Try Risk Free

People Also Ask about

What is the corporate income tax apportionment in West Virginia?

Corporations are required to allocate certain types of nonbusiness income to West Virginia and apportion their remaining income. The Corporation Net Income Tax rate is six and one-half percent (. 065). Any corporation exempt from federal income tax is also exempt from West Virginia Corporation Net Income Tax.

What is the WV tax extension form?

Complete WV Form 4868, include a Check or Money Order, and mail both to the address on WV Form 4868. Even if you filed an extension, you will still need to file your WV tax return either via eFile or by paper by Oct.

Does West Virginia have a state income tax form?

For security reasons, the Tax Division suggests you download the fillable Personal Income Tax form to your computer and save it. To download a PDF document, you can: Right-click the link for the PDF document.

What percent is capital gains on property?

The gain or loss is the difference between the amount realized on the sale and your tax basis in the property. The capital gain will generally be taxed at 0%, 15% or 20%, plus the 3.8% surtax for people with higher incomes.

What is the capital gains tax in West Virginia?

West Virginia The state taxes capital gains as income. The rate reaches 6.5%.

How can you avoid paying taxes on capital gains?

9 Ways to Avoid Capital Gains Taxes on Stocks Invest for the Long Term. Contribute to Your Retirement Accounts. Pick Your Cost Basis. Lower Your Tax Bracket. Harvest Losses to Offset Gains. Move to a Tax-Friendly State. Donate Stock to Charity. Invest in an Opportunity Zone.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit WV CIT-120 straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit WV CIT-120.

Can I edit WV CIT-120 on an iOS device?

Create, modify, and share WV CIT-120 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Can I edit WV CIT-120 on an Android device?

You can make any changes to PDF files, like WV CIT-120, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is WV CIT-120?

WV CIT-120 is a tax form used in West Virginia for the Corporate Income Tax Return, which organizations must file to report their income and calculate their tax liability.

Who is required to file WV CIT-120?

Any corporation doing business in West Virginia, including foreign corporations and entities that generate income in the state, is required to file the WV CIT-120.

How to fill out WV CIT-120?

To fill out WV CIT-120, taxpayers need to provide their business information, report their income, claim deductions, and complete the tax calculation as outlined in the instructions provided with the form.

What is the purpose of WV CIT-120?

The purpose of WV CIT-120 is to enable corporations to report their taxable income and calculate the amount of corporate income tax owed to the state of West Virginia.

What information must be reported on WV CIT-120?

The WV CIT-120 requires reporting of total income, deductions, credits, and any applicable taxes. Additionally, corporations must include specific details about their business activities in West Virginia.

Fill out your WV CIT-120 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WV CIT-120 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.