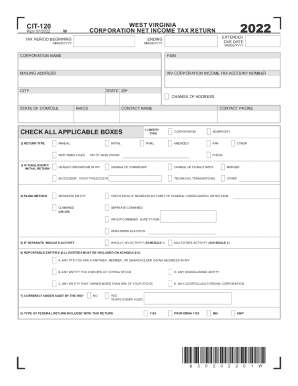

WV CIT-120 2019 free printable template

Get, Create, Make and Sign WV CIT-120

Editing WV CIT-120 online

Uncompromising security for your PDF editing and eSignature needs

WV CIT-120 Form Versions

How to fill out WV CIT-120

How to fill out WV CIT-120

Who needs WV CIT-120?

Instructions and Help about WV CIT-120

Music hello guys welcome to this new video in this case I am going to talk about how to create a sale sign wildcard certificate two important fortigate we open as open ssl we are going to be using the Ubuntu Kali and open SUSE operating operating systems so now lets begin basically what we are going to be talking about are these four points they internet X dot 509 public key infrastructure certificate the self sign it versus global sea ace the step by step to create a wildcard certificate and through shooting certificates lets start with this protocol that its very important on this a on this transaction of the data through the internet we need to check if we need further investigation and we need to look at the request for comments 5280 which is explained which it which it explains how it works basically what we need to check is all the information this video is just to create and give information about how to generate the self signed certificate but if you need better understanding of the protocol I could suggest that you can visit this URL and check about that information theres a lot of data that we can take from this document and have a better understanding of this protocol now if we are going to be talking about self signed certificate we need to understand the vs the global scientific this diagram the intention is just to try to compare the different process that the self sign versus the global certificate is taking through the communication on the first in the first diagram we can see that the self signed certificate is just only for the local connections as we can see here for example the user is going to send that request the FortiGate is going to validate with a local certificate of authority that it in this case is an open ssl and examples is Ubuntu open SUSE and Kali and other operating systems it can be also the Windows operating system then then after that he sends back the information and the FortiGate answers back to the local user that its validate the the information that is taking with this transaction the most important thing that we need to understand is that this is a local connection and there is going to be the public key and the private key from the FortiGate and also in the site of the local certificate authority this is a server there is also a public key and private key this communication will allow that the certificate is correctly encrypted by the communication and what happened if a user tried to connect from outside if he tried to connect from outside he is not going to take the communication and he is he has not changed to validate that the site is with trust site thats what not happens in the global certificate authority we can only we can also identify these connections as truth wrote certificate authority the examples are global sign very sign the desert geo cert among others and this connection it also sends a request the user also put a central quest and then the 48 come sent to the global Authority the...

People Also Ask about

What is the corporate income tax apportionment in West Virginia?

What is the WV tax extension form?

Does West Virginia have a state income tax form?

What percent is capital gains on property?

What is the capital gains tax in West Virginia?

How can you avoid paying taxes on capital gains?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my WV CIT-120 directly from Gmail?

How do I edit WV CIT-120 online?

How do I fill out WV CIT-120 using my mobile device?

What is WV CIT-120?

Who is required to file WV CIT-120?

How to fill out WV CIT-120?

What is the purpose of WV CIT-120?

What information must be reported on WV CIT-120?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.