DE SL-1925-A 2013 free printable template

Show details

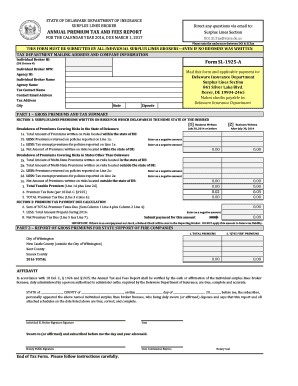

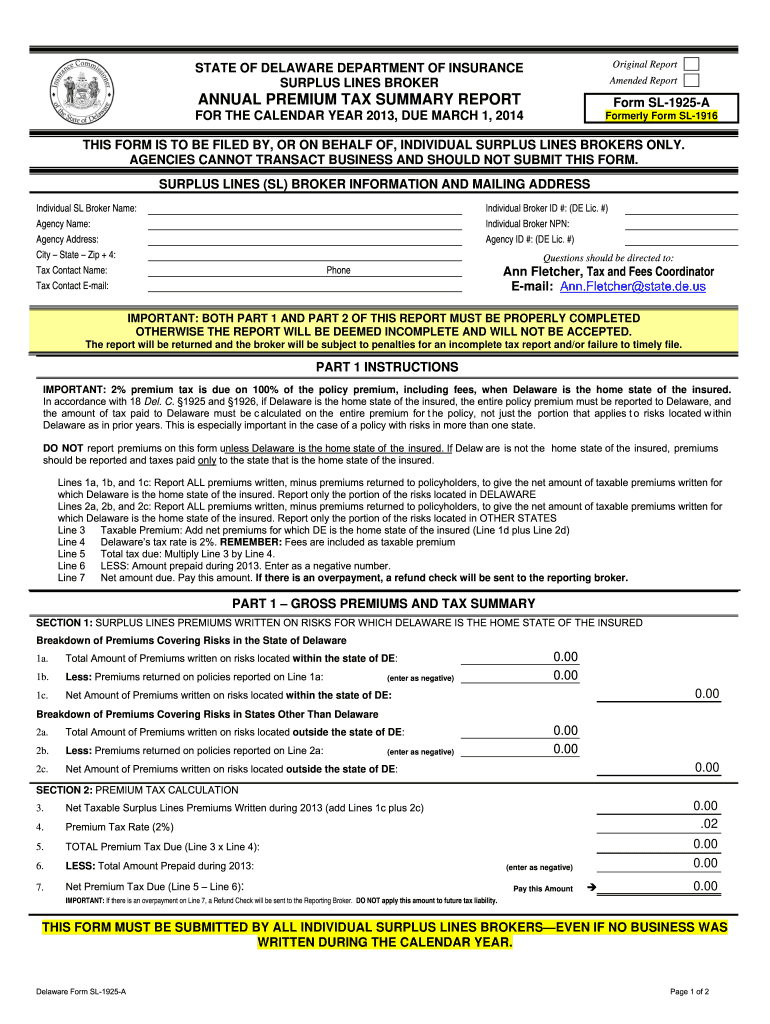

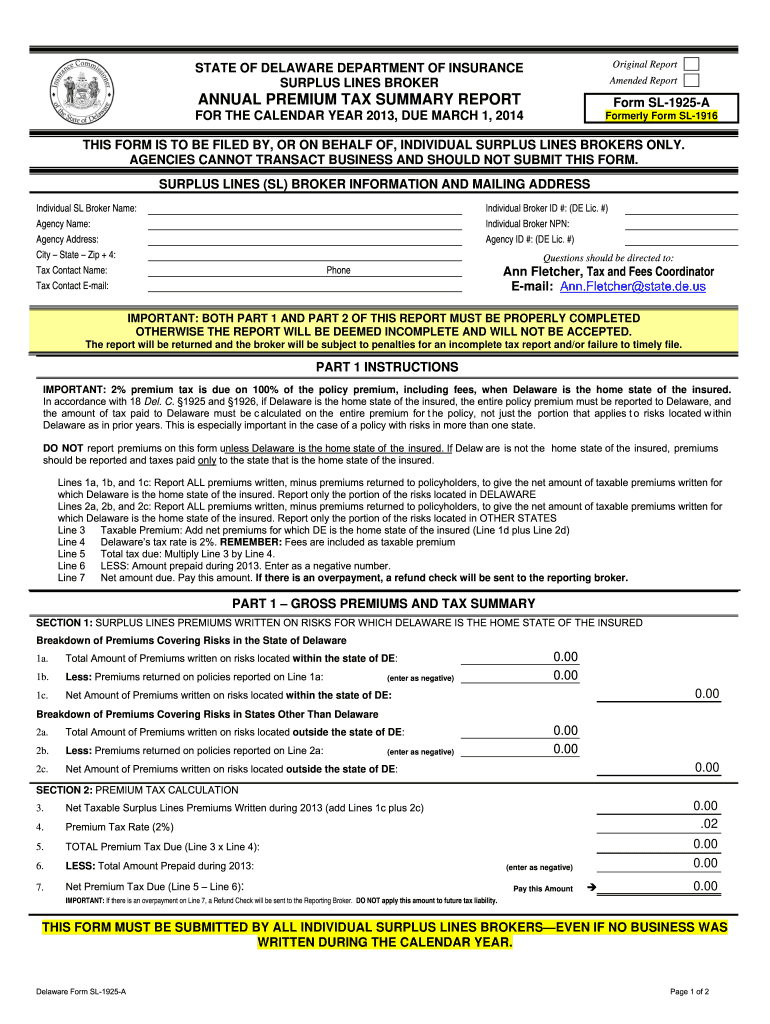

Original Report STATE OF DELAWARE DEPARTMENT OF INSURANCE SURPLUS LINES BROKER Amended Report ANNUAL PREMIUM TAX SUMMARY REPORT Form SL-1925-A FOR THE CALENDAR YEAR 2013, DUE MARCH 1, 2014, Formerly

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign DE SL-1925-A

Edit your DE SL-1925-A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your DE SL-1925-A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing DE SL-1925-A online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit DE SL-1925-A. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DE SL-1925-A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out DE SL-1925-A

How to fill out DE SL-1925-A

01

Obtain the DE SL-1925-A form from the relevant government website or office.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in your personal information in the designated fields, including name, address, and contact details.

04

Provide any required identification numbers, such as Social Security number or state identification number.

05

Complete all sections related to the purpose of the form, ensuring that all required fields are filled out correctly.

06

Review the form for any errors or omissions.

07

Sign and date the form as required.

08

Submit the form according to the provided instructions, either by mail or electronically.

Who needs DE SL-1925-A?

01

Individuals applying for specific state benefits or programs that require this form.

02

Residents who need to update their personal information with state agencies.

03

People seeking to claim certain types of financial assistance or services provided by the state.

Fill

form

: Try Risk Free

People Also Ask about

What are surplus lines?

Surplus lines insurance is a special type of insurance that covers unique risks. It fills a gap in the standard market by covering things that most companies can't or won't insure.

How do you explain surplus lines?

Surplus lines insurance is a special type of insurance that covers unique risks. It fills a gap in the standard market by covering things that most companies can't or won't insure.

Why is there a surplus lines tax?

It essentially serves to warn the insured that they are buying insurance through a surplus lines carrier.

What is the purpose of surplus lines insurance?

Surplus lines insurance is coverage for specific risks that the standard or admitted market is either unable or unwilling to cover. While the admitted market is where most consumers find coverage, the surplus lines market is vital as a supplement for those consumers and businesses that cannot find coverage otherwise.

What is the purpose of surplus lines tax?

The Surplus Lines Deduction allows taxpayers to deduct from their premiums “sums collected to cover federal and other state taxes and examination fees” when calculating the premium amount subject to the tax.

What is the purpose of surplus?

A surplus describes the amount of an asset or resource that exceeds the portion that's actively utilized. A surplus can refer to a host of different items, including income, profits, capital, and goods. In the context of inventories, a surplus describes products that remain sitting on store shelves, unpurchased.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute DE SL-1925-A online?

Easy online DE SL-1925-A completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I sign the DE SL-1925-A electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your DE SL-1925-A and you'll be done in minutes.

How do I edit DE SL-1925-A on an iOS device?

You certainly can. You can quickly edit, distribute, and sign DE SL-1925-A on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is DE SL-1925-A?

DE SL-1925-A is a tax form used in the state of California for reporting certain payroll tax information.

Who is required to file DE SL-1925-A?

Employers who have employees and need to report payroll taxes to the California Employment Development Department (EDD) are required to file DE SL-1925-A.

How to fill out DE SL-1925-A?

To fill out DE SL-1925-A, employers must provide details such as the business information, employee payroll details, and any other required tax information as specified in the form's instructions.

What is the purpose of DE SL-1925-A?

The purpose of DE SL-1925-A is to ensure compliance with California's payroll tax laws and to report employee wages and other payroll-related information.

What information must be reported on DE SL-1925-A?

The information that must be reported on DE SL-1925-A includes employee names, Social Security numbers, wages, and tax withholding amounts, among other payroll data.

Fill out your DE SL-1925-A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

DE SL-1925-A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.