DE SL-1925-A 2016-2026 free printable template

Show details

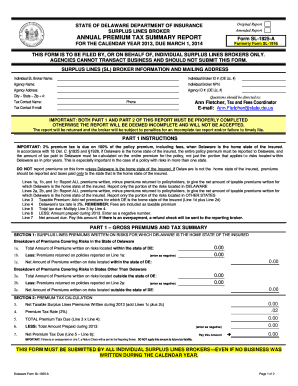

STATE OF DELAWARE DEPARTMENT OF INSURANCE SURPLUS LINES BROKER Direct any questions via email to: ANNUAL PREMIUM TAX AND FEES REPORT Surplus Lines Section FOR THE CALENDAR YEAR 2016, DUE MARCH 1,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign DE SL-1925-A

Edit your DE SL-1925-A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your DE SL-1925-A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit DE SL-1925-A online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit DE SL-1925-A. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DE SL-1925-A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out DE SL-1925-A

How to fill out DE SL-1925-A

01

Obtain the DE SL-1925-A form from the official website or your local Department of Employment office.

02

Fill out the personal information section, including your name, address, and contact details.

03

Provide information regarding your employment history, including your employer's name, your job title, and dates of employment.

04

Indicate the reason for filling out the form and any other relevant details that apply to your situation.

05

Review the completed form for any errors or missing information.

06

Sign and date the form before submission.

07

Submit the DE SL-1925-A form to the appropriate Department of Employment office via mail or in person.

Who needs DE SL-1925-A?

01

Individuals applying for unemployment insurance benefits.

02

Workers who have been laid off or terminated from their job.

03

Anyone who needs to document their work history for unemployment claims.

Fill

form

: Try Risk Free

People Also Ask about

What are surplus lines?

Surplus lines insurance is a special type of insurance that covers unique risks. It fills a gap in the standard market by covering things that most companies can't or won't insure.

How do you explain surplus lines?

Surplus lines insurance is a special type of insurance that covers unique risks. It fills a gap in the standard market by covering things that most companies can't or won't insure.

Why is there a surplus lines tax?

It essentially serves to warn the insured that they are buying insurance through a surplus lines carrier.

What is the purpose of surplus lines insurance?

Surplus lines insurance is coverage for specific risks that the standard or admitted market is either unable or unwilling to cover. While the admitted market is where most consumers find coverage, the surplus lines market is vital as a supplement for those consumers and businesses that cannot find coverage otherwise.

What is the purpose of surplus lines tax?

The Surplus Lines Deduction allows taxpayers to deduct from their premiums “sums collected to cover federal and other state taxes and examination fees” when calculating the premium amount subject to the tax.

What is the purpose of surplus?

A surplus describes the amount of an asset or resource that exceeds the portion that's actively utilized. A surplus can refer to a host of different items, including income, profits, capital, and goods. In the context of inventories, a surplus describes products that remain sitting on store shelves, unpurchased.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send DE SL-1925-A for eSignature?

When your DE SL-1925-A is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete DE SL-1925-A online?

pdfFiller makes it easy to finish and sign DE SL-1925-A online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for signing my DE SL-1925-A in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your DE SL-1925-A directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is DE SL-1925-A?

DE SL-1925-A is a form used by employers in California to report information related to labor relations and employee benefits.

Who is required to file DE SL-1925-A?

Employers in California who have employees and are subject to unemployment insurance requirements are required to file DE SL-1925-A.

How to fill out DE SL-1925-A?

To fill out DE SL-1925-A, employers should provide accurate details about their employees, including names, Social Security numbers, wages, and any other requested information.

What is the purpose of DE SL-1925-A?

The purpose of DE SL-1925-A is to ensure that employers report employee wage information for unemployment insurance and assist in maintaining accurate records for state employment services.

What information must be reported on DE SL-1925-A?

The information that must be reported on DE SL-1925-A includes the employee's name, Social Security number, total wages, and any other relevant details as specified in the form.

Fill out your DE SL-1925-A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

DE SL-1925-A is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.