Get the free DENIAL OF CREDIT

Show details

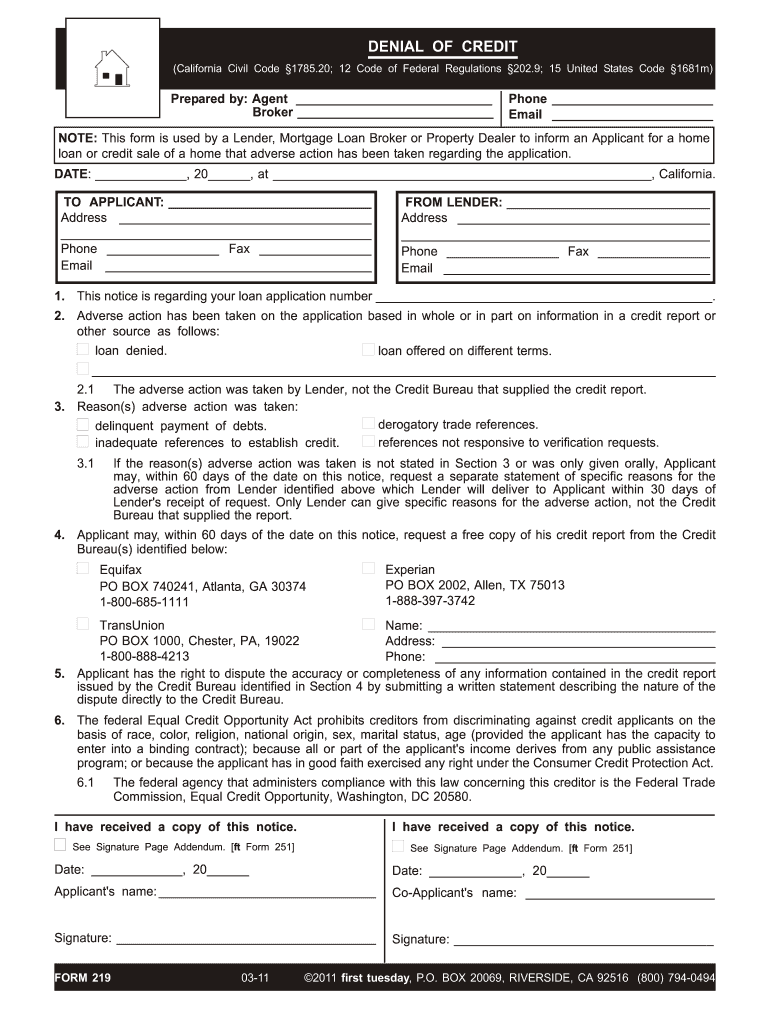

DENIAL OF CREDIT (California Civil Code 1785.20; 12 Code of Federal Regulations 202.9; 15 United States Code 1681 m)Prepared by: Agent Broker Phone Email NOTE: This form is used by a Lender, Mortgage

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign denial of credit

Edit your denial of credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your denial of credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing denial of credit online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit denial of credit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out denial of credit

How to fill out denial of credit:

01

Start by gathering all necessary documents and information regarding the credit application that you are denying. This includes the applicant's name, contact information, and any relevant account or application numbers.

02

Begin the denial of credit letter by providing a clear and concise explanation for the denial. Clearly state the reasons for the decision, whether it's due to insufficient credit history, low credit score, or any other specific factors.

03

Include any legal or regulatory requirements that apply to the denial of credit process. This may include mentioning any applicable laws or regulations that you are required to follow in informing the applicant about the denial.

04

Offer the applicant information on how they can obtain a copy of their credit report and credit score, if that was a factor in the denial. You may direct them to the relevant credit reporting agencies or provide them with contact information for further inquiries.

05

Explain the applicant's right to request reconsideration or to provide additional information that may affect the decision. Include any specific instructions on how they can go about this process and provide them with contact information to submit their request.

06

Close the denial of credit letter by offering any additional assistance or information that may be helpful to the applicant, such as providing resources for financial education or credit counseling services.

Who needs denial of credit?

01

Lenders and financial institutions may need to issue denial of credit to individuals who have applied for loans, mortgages, or credit cards but have been deemed ineligible or high-risk for credit approval.

02

Landlords or property management companies may require a denial of credit for rental applicants who do not meet their credit criteria or fail to pass a credit background check.

03

Retailers or merchants may need to issue denial of credit to customers who apply for store credit cards but do not meet the minimum credit requirements.

04

Credit reporting agencies may also issue denial of credit notifications to individuals who have been denied credit based on their credit history or credit score.

Overall, denial of credit is used by various organizations to inform individuals of the decision to deny their credit application and provide them with pertinent information regarding their credit eligibility.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute denial of credit online?

pdfFiller has made it easy to fill out and sign denial of credit. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make changes in denial of credit?

The editing procedure is simple with pdfFiller. Open your denial of credit in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit denial of credit in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your denial of credit, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

What is denial of credit?

Denial of credit is a notification sent to a borrower informing them that their application for credit has been denied.

Who is required to file denial of credit?

Creditors are required to file denial of credit when an applicant's request for credit is denied.

How to fill out denial of credit?

Denial of credit can be filled out by providing the necessary information about the applicant and the reasons for the denial.

What is the purpose of denial of credit?

The purpose of denial of credit is to inform the applicant of the decision and provide them with the reasons for the denial.

What information must be reported on denial of credit?

The denial of credit must include the applicant's name, address, credit information, and the reasons for denial.

Fill out your denial of credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Denial Of Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.