Get the free financial literacy

Show details

Financial Literacy & Budgeting 101 Alfie Guitar, Instructor, Executive Director and Cofounder of FLY Patrick Thee, CFP, Financial Counselor Erin McLeod, Goalkeeper for Canada Women's National Soccer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial literacy

Edit your financial literacy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial literacy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

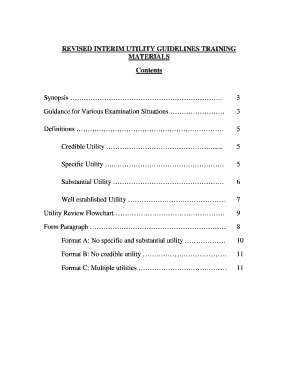

Editing financial literacy online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit financial literacy. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

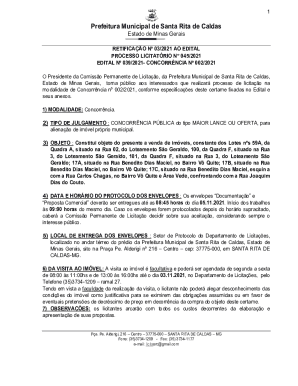

How to fill out financial literacy

How to fill out financial literacy

01

Start by understanding your current financial situation. Take a look at your income, expenses, debts, and savings.

02

Educate yourself about basic financial concepts such as budgeting, saving, investing, and debt management.

03

Set financial goals based on your needs and priorities. This could include saving for emergencies, retirement planning, or paying off debts.

04

Create a budget to track your income and expenses. Allocate your income towards essential expenses, savings, and discretionary spending.

05

Develop good saving habits by setting aside a portion of your income regularly. Consider automating your savings to make it easier.

06

Understand the different types of investment options available and start investing based on your risk tolerance and financial goals.

07

Learn about managing debt effectively. Make a plan to pay off high-interest debts first and avoid accumulating unnecessary debt.

08

Stay updated with changes in financial laws, regulations, and trends. This will help you make informed financial decisions.

09

Seek professional guidance if needed. Financial advisors can provide personalized advice based on your specific financial situation.

10

Continuously monitor and review your financial plan. Make adjustments as necessary to stay on track towards your financial goals.

Who needs financial literacy?

01

Everyone can benefit from financial literacy, regardless of their income level or occupation.

02

Young adults who are just starting their careers can build a strong financial foundation by learning about money management.

03

Individuals who are nearing retirement age can ensure they have enough savings and investments to support their future needs.

04

Entrepreneurs and small business owners need financial literacy to effectively manage their finances and make informed business decisions.

05

People who have accumulated debt can benefit from financial literacy to develop a plan to pay off their debts and become financially stable.

06

Families need financial literacy to manage their household finances, save for education or vacations, and plan for the future.

07

Students can benefit from financial literacy to understand student loans, budgeting for college expenses, and avoiding excessive debt.

08

Individuals who want to make smart financial decisions and improve their financial well-being can benefit from financial literacy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

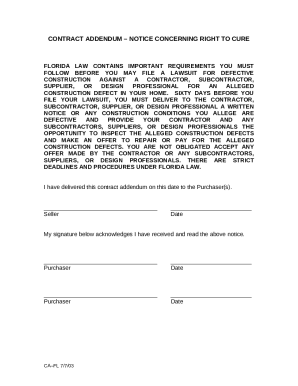

How can I edit financial literacy from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like financial literacy, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make edits in financial literacy without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing financial literacy and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How can I fill out financial literacy on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your financial literacy from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

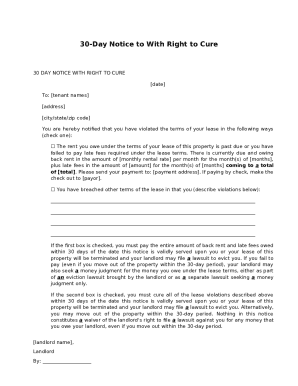

What is financial literacy?

Financial literacy is the ability to understand and effectively use various financial skills, including personal financial management, budgeting, and investing.

Who is required to file financial literacy?

Typically, individuals, organizations, or institutions involved in financial activities are required to file financial literacy.

How to fill out financial literacy?

To fill out financial literacy, one must gather relevant financial information, understand the reporting requirements, and complete the necessary forms accurately.

What is the purpose of financial literacy?

The purpose of financial literacy is to improve financial decision-making, increase financial stability, and promote overall financial well-being.

What information must be reported on financial literacy?

Financial literacy reports typically include income, expenses, assets, liabilities, investments, and other financial-related information.

Fill out your financial literacy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Literacy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.