CO Short Form Property Tax Exemption for Seniors - El Paso County 2015 free printable template

Show details

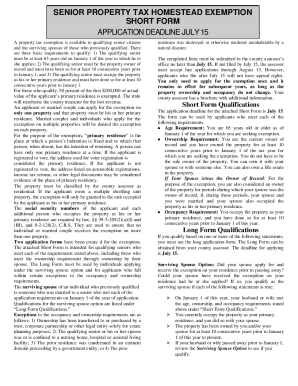

Gov/dpt. The filing deadline is July 1. El Paso County Steve Schleiker Assessor Attn. Senior Property Tax Exemption 1675 W. Garden of the Gods Rd. SENIOR PROPERTY TAX HOMESTEAD EXEMPTION SHORT FORM APPLICATION DEADLINE JULY 15 A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously qualified. There are three basic requirements to qualify 1 The qualifying senior must be at least 65 years old on January 1 of the year in which he or...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign el paso county property

Edit your el paso county property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your el paso county property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing el paso county property online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit el paso county property. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO Short Form Property Tax Exemption for Seniors - El Paso County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out el paso county property

How to fill out CO Short Form Property Tax Exemption for Seniors

01

Obtain the CO Short Form Property Tax Exemption for Seniors application from your local assessor's office or the official state website.

02

Read the application instructions thoroughly to understand the requirements and eligibility criteria.

03

Fill out your personal information, including your name, address, and contact details.

04

Provide information about your property, such as the property address and legal description.

05

Indicate your age and verify that you meet the minimum age requirement of 65 years by providing a copy of your identification.

06

List your income sources and total income for the previous year, ensuring it meets the income limit set for the exemption.

07

Sign and date the application to certify that all the information provided is accurate and complete.

08

Submit the completed application by mail or in person to your local assessor's office before the deadline.

Who needs CO Short Form Property Tax Exemption for Seniors?

01

Seniors aged 65 or older who own property in Colorado and meet specific income requirements need the CO Short Form Property Tax Exemption for Seniors.

02

Those who wish to reduce their property tax liability through this exemption must apply for it.

Fill

form

: Try Risk Free

People Also Ask about

What is the senior exemption for property taxes in El Paso?

Learn More about the Program. For qualifying seniors, this exemption reduces the property tax on the primary residence by exempting 50% of the first $200,000 in market value. For example: If your primary residence has a market value of $200,000, the first $100,000 will be exempt from taxation.

Do seniors get a discount on property taxes in Colorado?

A property tax exemption is available for senior Colorado residents or surviving spouses, provided they meet the requirements. You must apply by July 15 of the year in which you seek an exemption.

Does Colorado still have the senior property tax exemption?

A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified.

What is the property tax rebate in El Paso County?

The rebate amount can be up to $1,044 a year for applicants and if you apply in 2023, you could receive up to a $1,000 refundable tax credit.

Do senior citizens get a property tax break in Colorado?

A property tax exemption is available for senior Colorado residents or surviving spouses, provided they meet the requirements. You must apply by July 15 of the year in which you seek an exemption.

At what age do seniors stop paying property taxes in Colorado?

The three basic requirements are; 1) the qualifying senior must be at least 65 years old on January 1 of the year in which he or she qualifies; 2) the qualifying senior must be the owner of record, and must have been the owner of record for at least ten consecutive years prior to January 1; and 3) the qualifying senior

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my el paso county property directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your el paso county property and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send el paso county property for eSignature?

Once your el paso county property is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out el paso county property using my mobile device?

Use the pdfFiller mobile app to fill out and sign el paso county property. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is CO Short Form Property Tax Exemption for Seniors?

The CO Short Form Property Tax Exemption for Seniors is a program in Colorado that allows qualifying seniors to receive a reduction in their property taxes, providing financial relief to older homeowners.

Who is required to file CO Short Form Property Tax Exemption for Seniors?

Seniors aged 65 years or older who own and occupy their home as their primary residence are required to file the CO Short Form Property Tax Exemption for Seniors to receive the exemption.

How to fill out CO Short Form Property Tax Exemption for Seniors?

To fill out the CO Short Form Property Tax Exemption for Seniors, seniors need to complete the application form with their personal information, including their age, the property address, and any required documentation proving their eligibility, then submit it to their county assessor's office.

What is the purpose of CO Short Form Property Tax Exemption for Seniors?

The purpose of the CO Short Form Property Tax Exemption for Seniors is to help alleviate the financial burden of property taxes on senior homeowners, enabling them to remain in their homes as they age.

What information must be reported on CO Short Form Property Tax Exemption for Seniors?

The information that must be reported on the CO Short Form Property Tax Exemption for Seniors includes the applicant's name, age, property details, proof of ownership, and any additional eligibility criteria as specified on the form.

Fill out your el paso county property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

El Paso County Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.