CO Short Form Property Tax Exemption for Seniors - El Paso County 2018-2025 free printable template

Show details

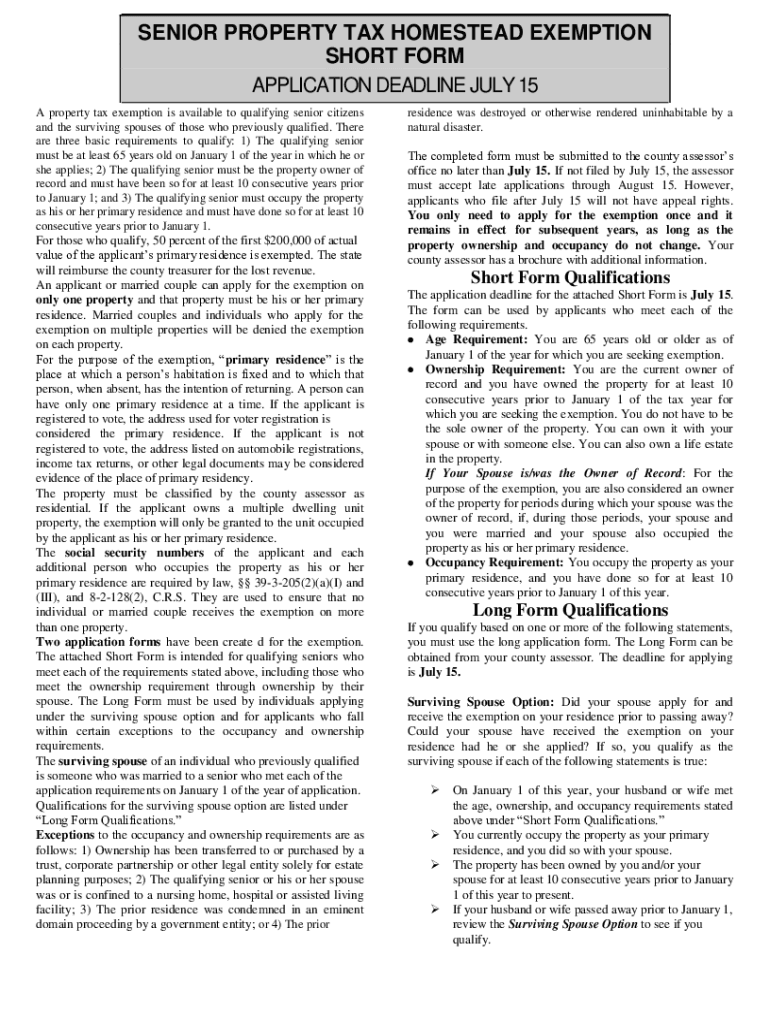

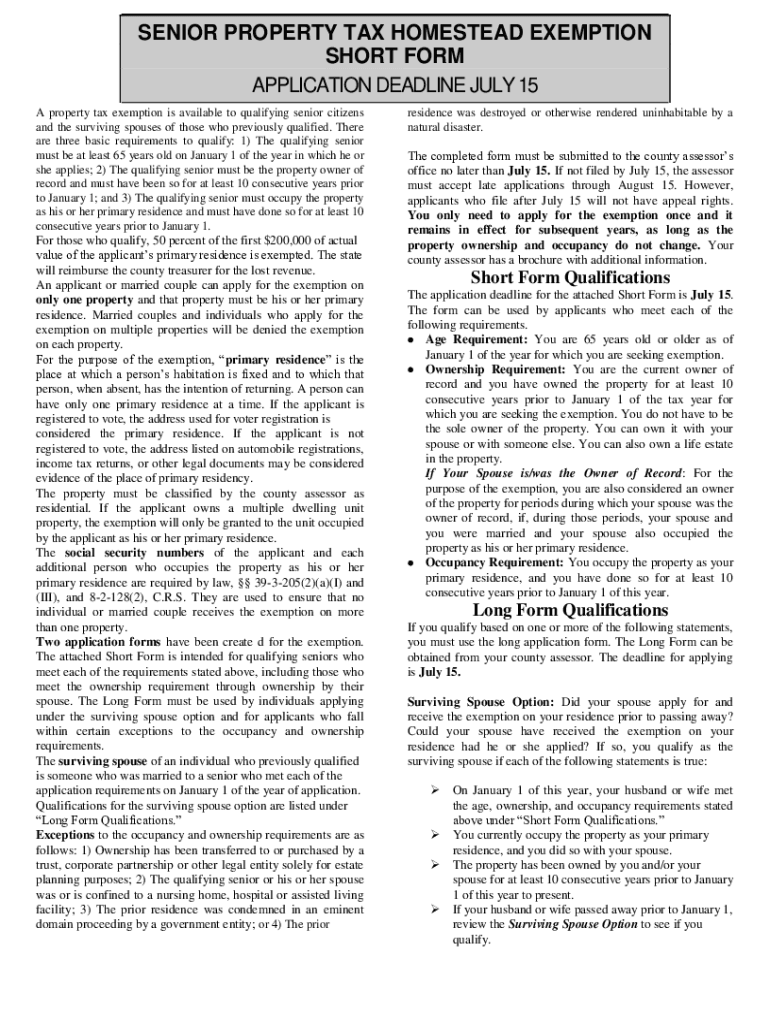

SENIOR PROPERTY TAX HOMESTEAD EXEMPTION SHORT FORM APPLICATION DEADLINE JULY 15 A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign colorado property tax exemption form

Edit your co property tax exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your colorado property tax exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit colorado property tax exemption online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit colorado property tax exemption. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO Short Form Property Tax Exemption for Seniors - El Paso County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out colorado property tax exemption

How to fill out CO Short Form Property Tax Exemption for Seniors

01

Obtain the CO Short Form Property Tax Exemption application from your local assessor's office or download it from the state website.

02

Complete the application form, providing necessary personal information such as name, address, and property details.

03

Verify that you meet eligibility requirements, which generally include being a senior citizen (over 65) and owning the property for which exemption is requested.

04

Attach any required documentation, such as proof of age and ownership of the property.

05

Review the completed application for accuracy and completeness.

06

Submit the application to your local assessor's office before the specified deadline, usually by a certain date in the year.

Who needs CO Short Form Property Tax Exemption for Seniors?

01

Seniors aged 65 or older who own property in Colorado and are seeking financial relief from property taxes.

Fill

form

: Try Risk Free

People Also Ask about

What is the senior exemption for property taxes in El Paso?

Learn More about the Program. For qualifying seniors, this exemption reduces the property tax on the primary residence by exempting 50% of the first $200,000 in market value. For example: If your primary residence has a market value of $200,000, the first $100,000 will be exempt from taxation.

Do seniors get a discount on property taxes in Colorado?

A property tax exemption is available for senior Colorado residents or surviving spouses, provided they meet the requirements. You must apply by July 15 of the year in which you seek an exemption.

Does Colorado still have the senior property tax exemption?

A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified.

What is the property tax rebate in El Paso County?

The rebate amount can be up to $1,044 a year for applicants and if you apply in 2023, you could receive up to a $1,000 refundable tax credit.

Do senior citizens get a property tax break in Colorado?

A property tax exemption is available for senior Colorado residents or surviving spouses, provided they meet the requirements. You must apply by July 15 of the year in which you seek an exemption.

At what age do seniors stop paying property taxes in Colorado?

The three basic requirements are; 1) the qualifying senior must be at least 65 years old on January 1 of the year in which he or she qualifies; 2) the qualifying senior must be the owner of record, and must have been the owner of record for at least ten consecutive years prior to January 1; and 3) the qualifying senior

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my colorado property tax exemption directly from Gmail?

colorado property tax exemption and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I get colorado property tax exemption?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the colorado property tax exemption. Open it immediately and start altering it with sophisticated capabilities.

How do I fill out the colorado property tax exemption form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign colorado property tax exemption and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is CO Short Form Property Tax Exemption for Seniors?

The CO Short Form Property Tax Exemption for Seniors is a program in Colorado that provides property tax relief to eligible senior citizens by exempting a portion of their property tax obligation.

Who is required to file CO Short Form Property Tax Exemption for Seniors?

Seniors aged 65 and older who own and occupy their property as their primary residence are required to file the CO Short Form Property Tax Exemption for Seniors.

How to fill out CO Short Form Property Tax Exemption for Seniors?

To fill out the CO Short Form Property Tax Exemption for Seniors, complete the required application form with personal information, proof of age, property details, and submit it to your county assessor's office.

What is the purpose of CO Short Form Property Tax Exemption for Seniors?

The purpose of the CO Short Form Property Tax Exemption for Seniors is to provide financial relief to senior citizens by reducing their property tax burden, allowing them to maintain their homes.

What information must be reported on CO Short Form Property Tax Exemption for Seniors?

The information that must be reported on the CO Short Form Property Tax Exemption for Seniors includes the applicant's name, age, address of the property, duration of ownership, and any previous exemptions received.

Fill out your colorado property tax exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Colorado Property Tax Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.