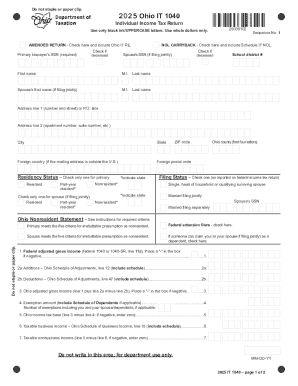

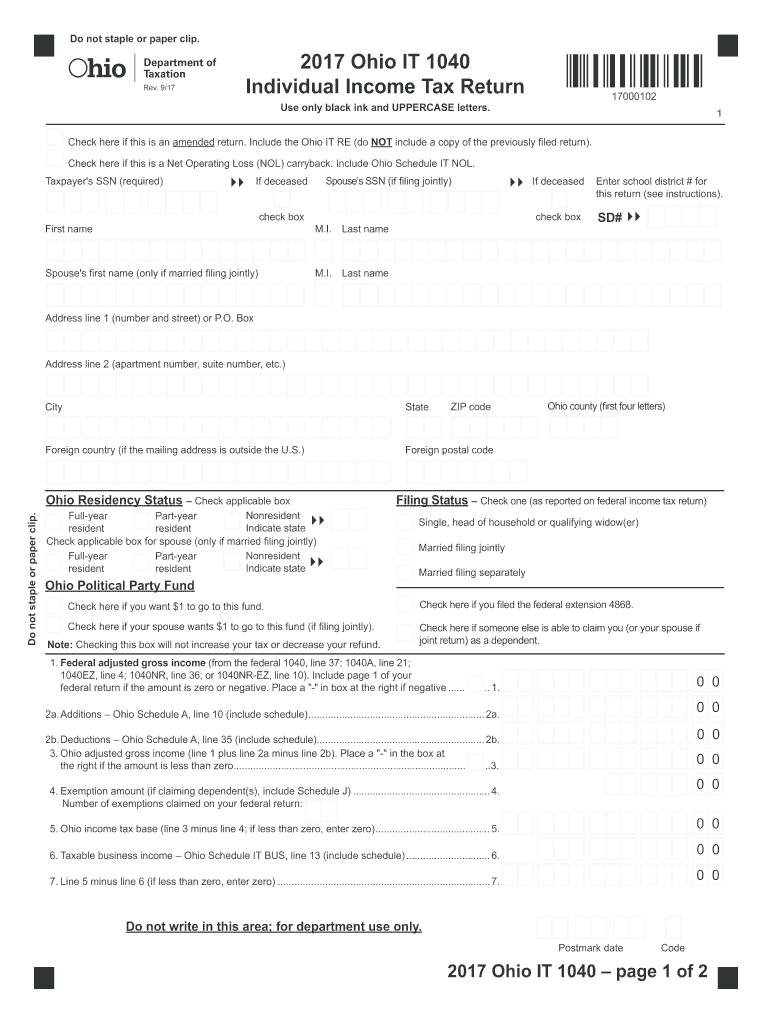

OH IT 1040 2017 free printable template

Instructions and Help about OH IT 1040

How to edit OH IT 1040

How to fill out OH IT 1040

About OH IT previous version

What is OH IT 1040?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about OH IT 1040

What should I do if I realize I've made a mistake on my ohio form 2017?

If you discover an error after submitting your ohio form 2017, you should file an amended form as soon as possible. This allows you to correct any misinformation and comply with tax regulations. Be sure to indicate that it is an amendment on the form to ensure proper processing.

How can I check the status of my submitted ohio form 2017?

To verify the receipt and processing status of your ohio form 2017, you can visit the Ohio Department of Taxation’s official website. There, you will find tools that allow you to input your information and track your submission effectively.

What legal considerations should I keep in mind regarding the e-signature on the ohio form 2017?

When it comes to submitting your ohio form 2017 electronically, e-signatures are generally accepted if they meet the required standards set by Ohio law. Make sure your signature complies with the legal criteria to avoid any issues with your submission.

Are there specific service fees associated with e-filing the ohio form 2017?

Yes, some tax preparation software may charge service fees for e-filing your ohio form 2017. It’s important to review these fees beforehand to ensure they fit within your budget, and be aware that you may not receive refunds if your submission is rejected.

What should I do if I receive an audit notice related to my ohio form 2017?

If you receive an audit notice regarding your ohio form 2017, it is essential to respond promptly and gather all relevant documentation. Prepare your records for review and consider consulting a tax professional for guidance to ensure compliance and clarity in the audit process.

See what our users say