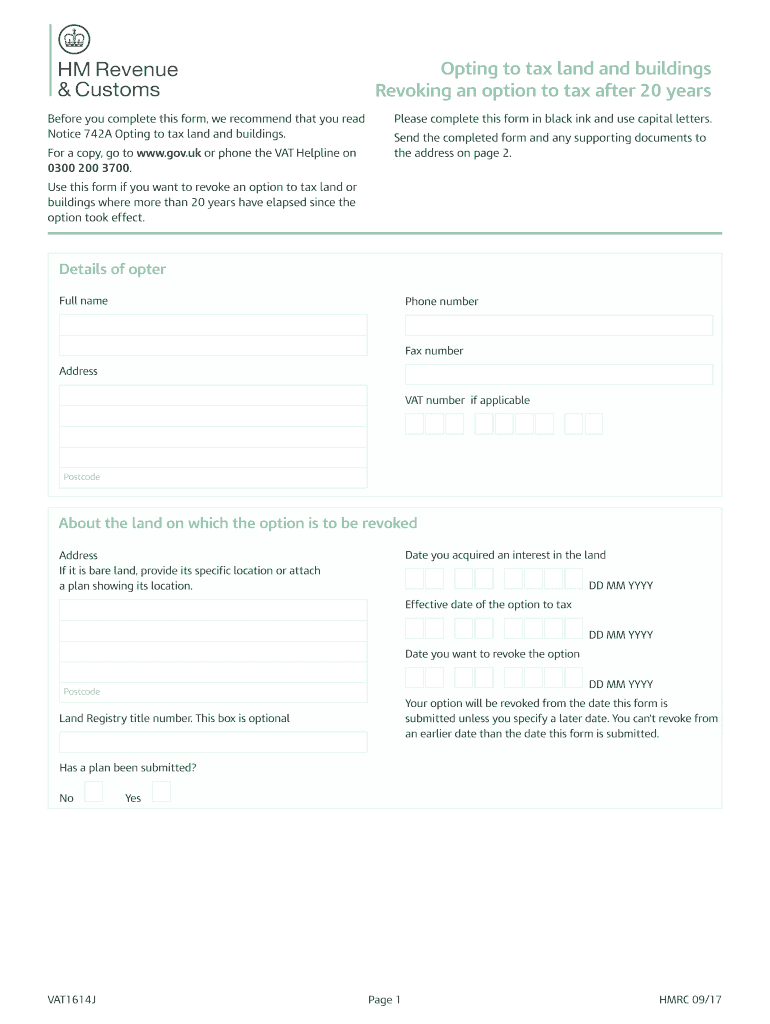

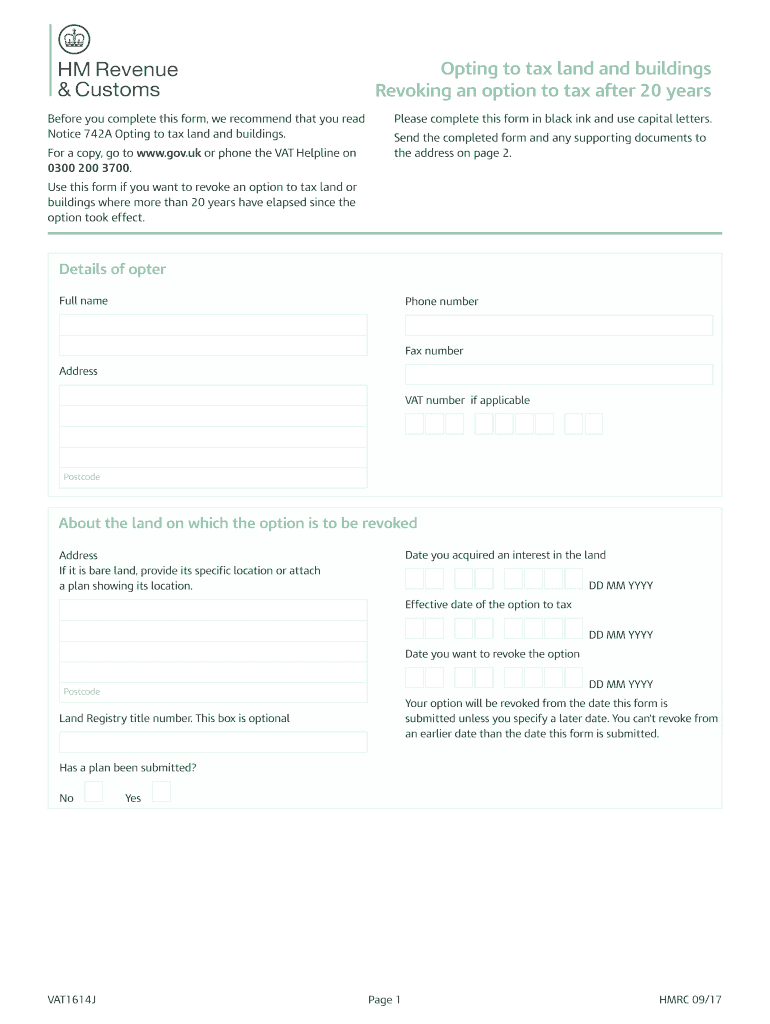

UK HMRC VAT1614J 2017 free printable template

Show details

Opting to tax land and buildings Revoking an option to tax after 20 years Before you complete this form, we recommend that you read Notice 742A Opting to tax land and buildings. For a copy, go to

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign vat1614a

Edit your vat1614a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vat1614a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing vat1614a online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit vat1614a. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC VAT1614J Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out vat1614a

How to fill out UK HMRC VAT1614J

01

Start by downloading the VAT1614J form from the HMRC website.

02

Fill in your VAT registration number at the top of the form.

03

Enter your name and address in the designated fields.

04

Provide details of the sale or transfer of goods, including quantities and values.

05

Indicate the relevant VAT periods and any other required dates.

06

Sign and date the form at the bottom to certify that the information provided is accurate.

07

Submit the completed form to HMRC via the specified method (post, online, etc.).

Who needs UK HMRC VAT1614J?

01

Businesses that are registered for VAT in the UK and are making sales or transfers that require VAT adjustments.

02

Companies that need to reclaim VAT on goods supplied during transfers or sales.

03

Organizations involved in VAT group registration or businesses making changes in their VAT accounting.

Fill

form

: Try Risk Free

People Also Ask about

How do you have a VAT number?

You must get help to apply for a VAT number. An application must be submitted to the local tax authorities using the right registration forms. This application should include documentation about your business, evidence of the authority of the legal representative, and detailed information about your planned activities.

Do I need a VAT number in the UK?

You must register if: your total VAT taxable turnover for the last 12 months was over £85,000 (the VAT threshold) you expect your turnover to go over £85,000 in the next 30 days.

How do I get a VAT number UK?

You can usually register for VAT online. You need a Government Gateway user ID and password to register for VAT . If you do not already have a user ID you can create one when you sign in for the first time. Registering for VAT also creates a VAT online account.

Where do I get a VAT exemption certificate?

How do you claim VAT Exemption? To claim for VAT exemption the supplier will usually ask you to sign a form declaring that the item is for a person with a disability or chronically sick. A Declaration form can be download from HM Revenue and Customs or from one of their local offices.

Do I need to register for VAT?

You must register if: your total VAT taxable turnover for the last 12 months was over £85,000 (the VAT threshold) you expect your turnover to go over £85,000 in the next 30 days.

How can I avoid paying VAT in UK?

You can notify HMRC online, or by completing form VAT7 available on GOV.UK. You can also voluntarily cancel your VAT registration if you believe your VAT taxable turnover will be below the deregistration threshold of £83,000 in the next 12 months.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send vat1614a for eSignature?

vat1614a is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit vat1614a in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your vat1614a, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I fill out the vat1614a form on my smartphone?

Use the pdfFiller mobile app to fill out and sign vat1614a on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is UK HMRC VAT1614J?

UK HMRC VAT1614J is a form used to apply for a VAT refund for VAT registered businesses that have incurred VAT on certain purchases or imports.

Who is required to file UK HMRC VAT1614J?

Businesses registered for VAT in the UK that wish to reclaim VAT on specific goods or services must file the VAT1614J form.

How to fill out UK HMRC VAT1614J?

To fill out VAT1614J, businesses need to provide details of the VAT incurred, the nature of the goods or services, and other relevant information as specified in the form.

What is the purpose of UK HMRC VAT1614J?

The purpose of the VAT1614J form is to facilitate the reclaiming of VAT paid on certain purchases or imports by businesses registered for VAT in the UK.

What information must be reported on UK HMRC VAT1614J?

Information required on VAT1614J includes details of the VAT amount to be reclaimed, purchase details, and any supporting documentation as necessary.

Fill out your vat1614a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

vat1614a is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.