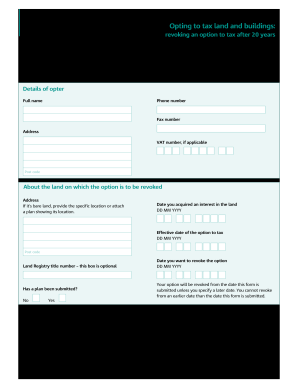

UK HMRC VAT1614J 2020 free printable template

Get, Create, Make and Sign UK HMRC VAT1614J

How to edit UK HMRC VAT1614J online

Uncompromising security for your PDF editing and eSignature needs

UK HMRC VAT1614J Form Versions

How to fill out UK HMRC VAT1614J

How to fill out UK HMRC VAT1614J

Who needs UK HMRC VAT1614J?

Instructions and Help about UK HMRC VAT1614J

Stop if you are about to buy a commercial building make sure you watch this video before you pay any fee eighty Music hi my name is Simon marriage from optimized counters and I want to talk to you about commercial buildings you may be subjective value and attacks and salt which you were not aware of so in this so my deck I'm going to give you an example of how you can mitigate v80 and indeed reduce your Stamp Duty Land Tax liability so lets get into the details alright so lets get into the detail then our value and attacks when buying a commercial building and indeed lets look at the consequences then that sir has on stamp duty land tax as well so lets go through before we do though it is worth you're watching another video which a link should be appearing above my head right now whereby you are looking to convert a commercial building into residential I talk about the SALT and v80 savings you can make when making this conversion so go ahead and watch that video once you've watched this one of course and there's another video of a reduction of v18 of 20 percent to 5 percent when you're doing different types of property developments and conversion that video is also worth washing, but again please watch this video first so lets talk about the AEG then and salt were going to focus on the fact that whenever you're buying a commercial building you need to read the small print the reason for it is that you could be paying 20 v8c on a commercial building without realizing if it is in the small print after all so make sure you do your due diligence when you're going through the purchasing process I also want to highlight the fact that residential SALT is a lot more than salt on non-residential which commercial buildings falls into as you can see here you've got an 8 banned for properties of 250000 pounds to 925 thousand pounds on a residential property versus just 5 on non-residential and that's why were seeing a lot more investors that are looking to buy commercial buildings, so this quick example then is a property that is worth 250 thousand pounds and is going to be subject to it stamped on duty land tax liability of just 2000 pounds not a great deal but as I said if you have not read this small print you could have a major problem on your hand why is it well v18 if you've got a property value of 250000 pounds commercial building you could have a nasty surprise of 50000 pounds bat that you have to pay and that has a consequence of STL cheers well increasing from that to thousands to 4500 so you also been you now have a cash outflow of three hundred four thousand five hundred compared to two hundred fifty-two thousand pounds which is a significant outflow because you haven't looked at the small print so make sure you do that there have been a number of clients that unfortunately have had that issue, so I've created an online portal where it helped you to understand how you can save SALT when you're buying a property value added tax when you're buying...

People Also Ask about

How do you have a VAT number?

Do I need a VAT number in the UK?

How do I get a VAT number UK?

Where do I get a VAT exemption certificate?

Do I need to register for VAT?

How can I avoid paying VAT in UK?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit UK HMRC VAT1614J on a smartphone?

How do I edit UK HMRC VAT1614J on an iOS device?

How do I edit UK HMRC VAT1614J on an Android device?

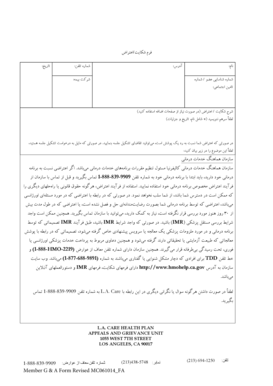

What is UK HMRC VAT1614J?

Who is required to file UK HMRC VAT1614J?

How to fill out UK HMRC VAT1614J?

What is the purpose of UK HMRC VAT1614J?

What information must be reported on UK HMRC VAT1614J?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.