MI FIS 0261 2014 free printable template

Show details

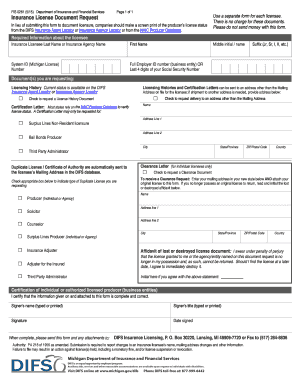

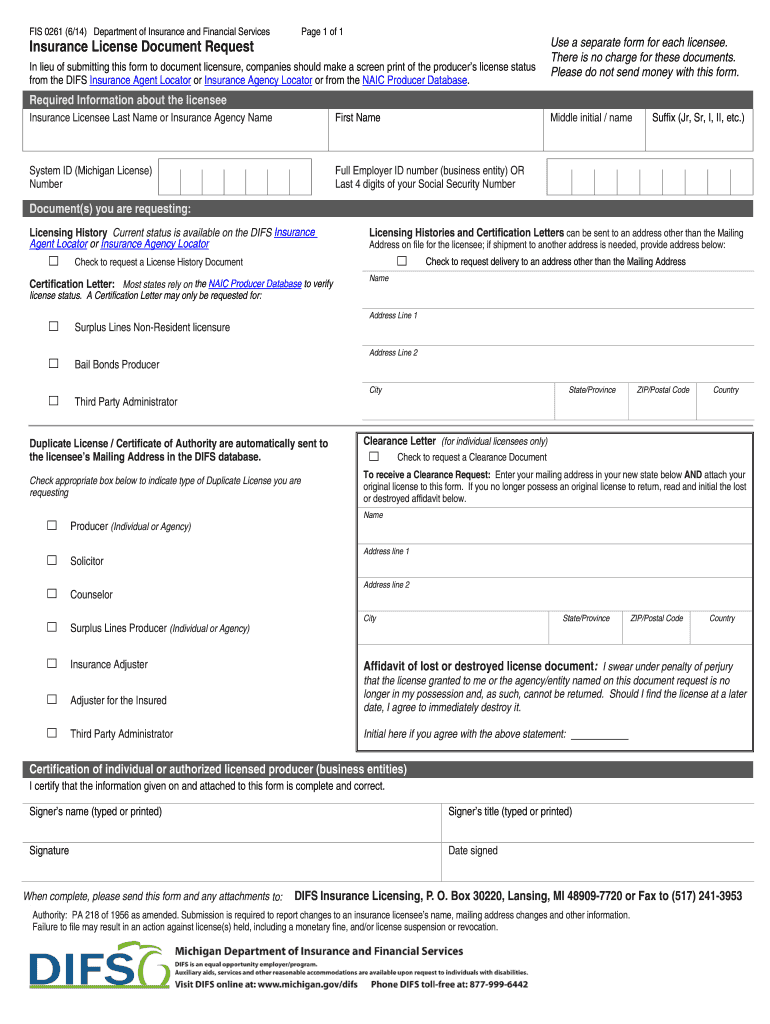

FIS 0261 6/14 Department of Insurance and Financial Services Page 1 of 1 Insurance License Document Request In lieu of submitting this form to document licensure companies should make a screen print of the producer s license status from the DIFS Insurance Agent Locator or Insurance Agency Locator or from the NAIC Producer Database. Use a separate form for each licensee. There is no charge for these documents. Please do not send money with this form. Required Information about the licensee...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI FIS 0261

Edit your MI FIS 0261 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI FIS 0261 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MI FIS 0261 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MI FIS 0261. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI FIS 0261 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI FIS 0261

How to fill out MI FIS 0261

01

Start by gathering all necessary personal and financial information.

02

Download the MI FIS 0261 form from the official website or obtain a hard copy.

03

Fill in your personal details such as name, address, and contact information in the designated sections.

04

Provide accurate financial information including income, expenses, and assets as required.

05

Complete any additional sections that pertain to your specific situation or requirement.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form at the bottom as required.

08

Submit the form according to the instructions provided, either electronically or by mail.

Who needs MI FIS 0261?

01

Individuals applying for certain financial assistance programs.

02

Applicants seeking loans, grants or benefits that require financial disclosure.

03

Anyone needing to report their financial situation to comply with specific regulations.

Fill

form

: Try Risk Free

People Also Ask about

How can I get Michigan tax forms mailed to me?

Monday-Friday 8:30 a.m. - 4:30 p.m. To request Michigan tax forms to be mailed to you: Current and prior year Michigan tax forms may be obtained by one of the following methods: Downloading the desired form from our web site or by calling 1-800-827-4000 and placing your request.

What is mi1040?

The most common Michigan income tax form is the MI-1040. This form is used by Michigan residents who file an individual income tax return.

Where can I get federal state and local tax forms?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

Where can I get federal and Michigan tax forms?

In addition, current year commonly used forms will continue to be available at Michigan Department of Treasury offices, most public libraries, Northern Michigan post offices, and Michigan Department of Health and Human Services (MDHHS) county offices.

What is the consent to rate in Michigan?

CONSENT TO RATE The insurer identifies that it would refuse to insurer the employer if it could not rate it at a higher than standard rate for the work classes that pertain to it. 2. The insurer identifies the employer's unique characteristics compared to other risks of its type.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my MI FIS 0261 directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your MI FIS 0261 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I complete MI FIS 0261 online?

pdfFiller has made it easy to fill out and sign MI FIS 0261. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I fill out the MI FIS 0261 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign MI FIS 0261 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is MI FIS 0261?

MI FIS 0261 is a specific form used for reporting financial information in the state of Michigan.

Who is required to file MI FIS 0261?

Entities that meet certain financial criteria set by the state of Michigan are required to file MI FIS 0261.

How to fill out MI FIS 0261?

To fill out MI FIS 0261, you will need to provide the required financial information, ensuring accuracy and following the provided instructions on the form.

What is the purpose of MI FIS 0261?

The purpose of MI FIS 0261 is to provide the state with accurate financial data for regulation and assessment purposes.

What information must be reported on MI FIS 0261?

The information that must be reported on MI FIS 0261 includes financial statements, income details, and other relevant financial disclosures as per the state regulations.

Fill out your MI FIS 0261 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI FIS 0261 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.