PR Form 483.20 2017 free printable template

Show details

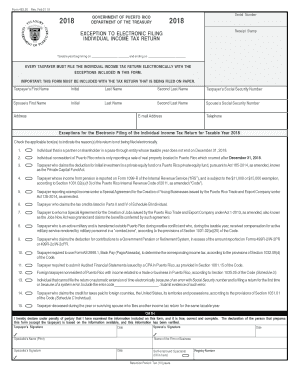

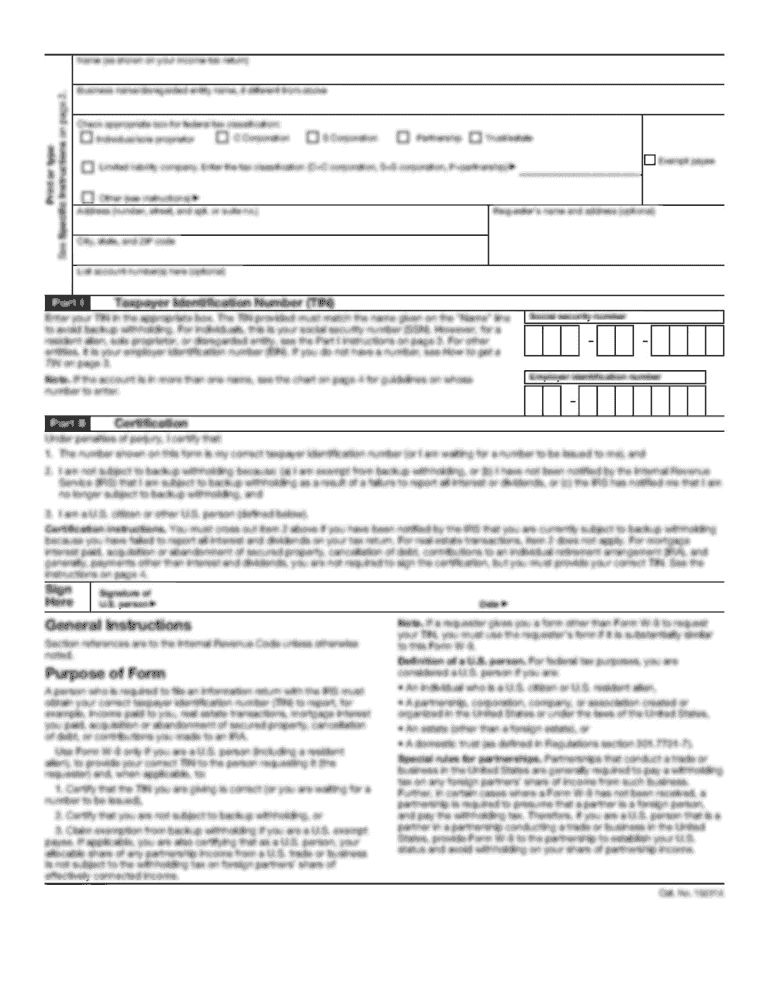

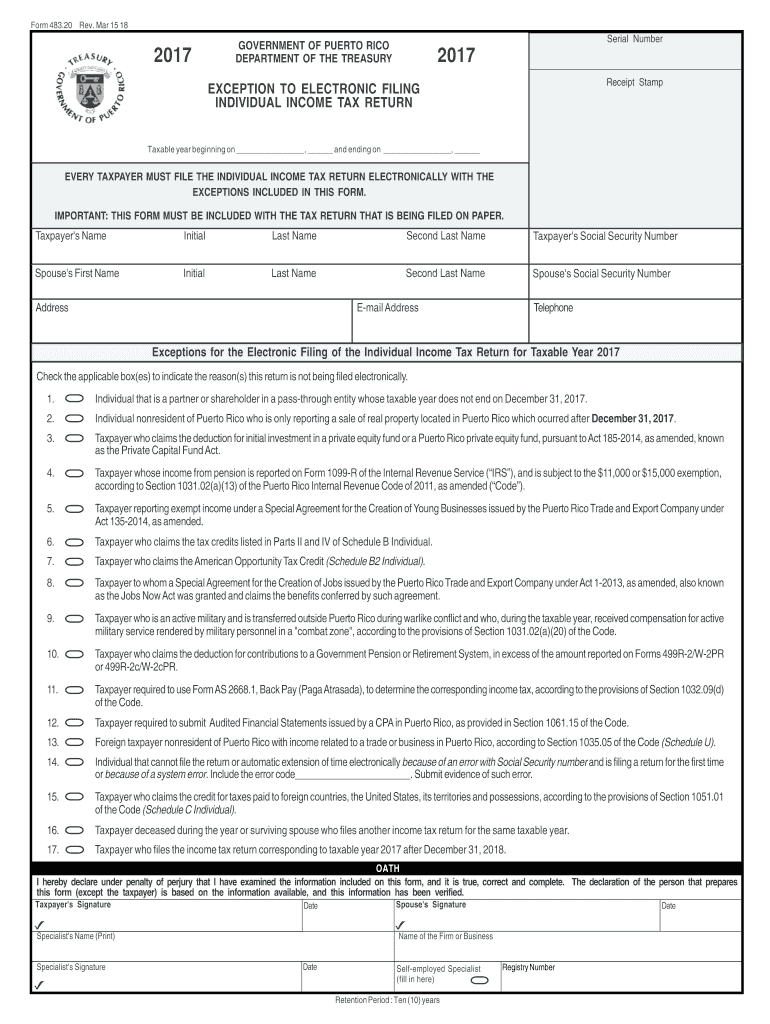

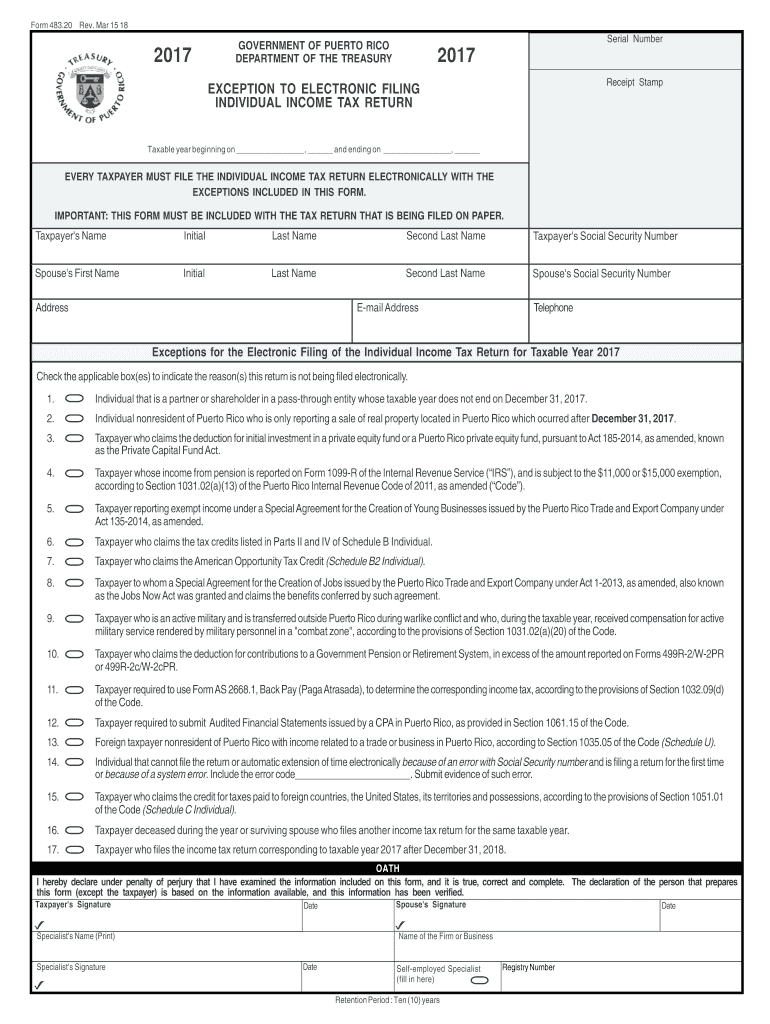

Form 483.20 Rev. Mar 15 182017Rev. 4 Nov 15GOVERNMENT OF PUERTO RICO DEPARTMENT OF THE TREASURYSerial Number2017Receipt StampEXCEPTION TO ELECTRONIC FILING INDIVIDUAL INCOME TAX RETURN Taxable year

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PR Form 48320

Edit your PR Form 48320 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PR Form 48320 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PR Form 48320 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit PR Form 48320. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PR Form 483.20 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PR Form 48320

How to fill out PR Form 483.20

01

Obtain the PR Form 483.20 from the relevant authority or website.

02

Fill in the applicant's personal information, including name and contact details.

03

Provide details about the purpose of the application in the designated section.

04

Include any required supporting documents and attach them to the form.

05

Review the form for completeness and accuracy, ensuring all fields are filled out.

06

Sign and date the form at the specified section.

07

Submit the completed form to the appropriate office or online portal.

Who needs PR Form 483.20?

01

Individuals applying for a specific program or status as defined by the authority that requires PR Form 483.20.

02

Organizations or institutions assisting applicants who need to submit the form on their behalf.

Fill

form

: Try Risk Free

People Also Ask about

What are the benefits of an LLC in Puerto Rico?

A Puerto Rico Limited Liability Company (LLC) has the following benefits: 100% Foreign Membership: Foreigners can own 100% of a LLC in Puerto Rico. Limited Liability: Members' liabilities are limited to their capital investment. One Member: The minimum number of members is one to form a LLC.

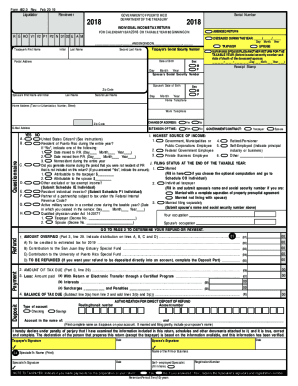

Do I need to file a Puerto Rico tax return?

Generally, if you are a Puerto Rico bona fide resident, you must file a Puerto Rico tax return. If you are not a bona fide resident of Puerto Rico, you must file both a Puerto Rico tax return and a U.S. tax return. If you are a member of the United States Armed Forces, special tax rules may be applied.

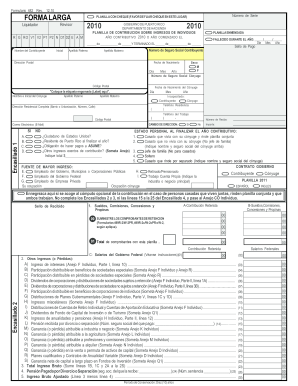

How are LLCS taxed in Puerto Rico?

If your LLC is taxed as a Puerto Rico corporation, you'll need to pay corporate income tax. Puerto Rico's corporate tax rate is 37.5%. However, under the Puerto Rico Incentives Code (Act 60), businesses based in Puerto Rico only need to pay a 4% corporate income tax on goods and services exported from the commonwealth.

What are the rules for LLC in Puerto Rico?

Filing and forming an LLC in Puerto Rico requires a $250 filing fee. Under Puerto Rico law, an LLC uses a limited liability company agreement, or LLCA, to govern the internal affairs and administration of the LLC. This is valid regardless of what it is called, but the law says that they must be written.

Is income earned in Puerto Rico taxable in the US?

If you're a bona fide resident of Puerto Rico during the entire tax year, you generally aren't required to file a U.S. federal income tax return if your only income is from sources within Puerto Rico.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the PR Form 48320 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your PR Form 48320 in minutes.

Can I edit PR Form 48320 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign PR Form 48320 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Can I edit PR Form 48320 on an Android device?

You can edit, sign, and distribute PR Form 48320 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is PR Form 483.20?

PR Form 483.20 is a form used in the jurisdiction of Puerto Rico for reporting certain financial and business activities, often related to tax compliance and regulatory obligations.

Who is required to file PR Form 483.20?

Individuals and entities, including businesses operating in Puerto Rico that are subject to specific tax reporting requirements, are required to file PR Form 483.20.

How to fill out PR Form 483.20?

To fill out PR Form 483.20, follow the instructions provided by the Puerto Rico Department of Treasury, include all required financial information, and ensure that all sections of the form are completed accurately.

What is the purpose of PR Form 483.20?

The purpose of PR Form 483.20 is to gather necessary information for tax assessment and compliance purposes, ensuring that individuals and businesses adhere to local tax regulations.

What information must be reported on PR Form 483.20?

PR Form 483.20 must report financial information including income, expenses, and other relevant data pertaining to the taxpayer's activities, as well as identification details of the taxpayer.

Fill out your PR Form 48320 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PR Form 48320 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.