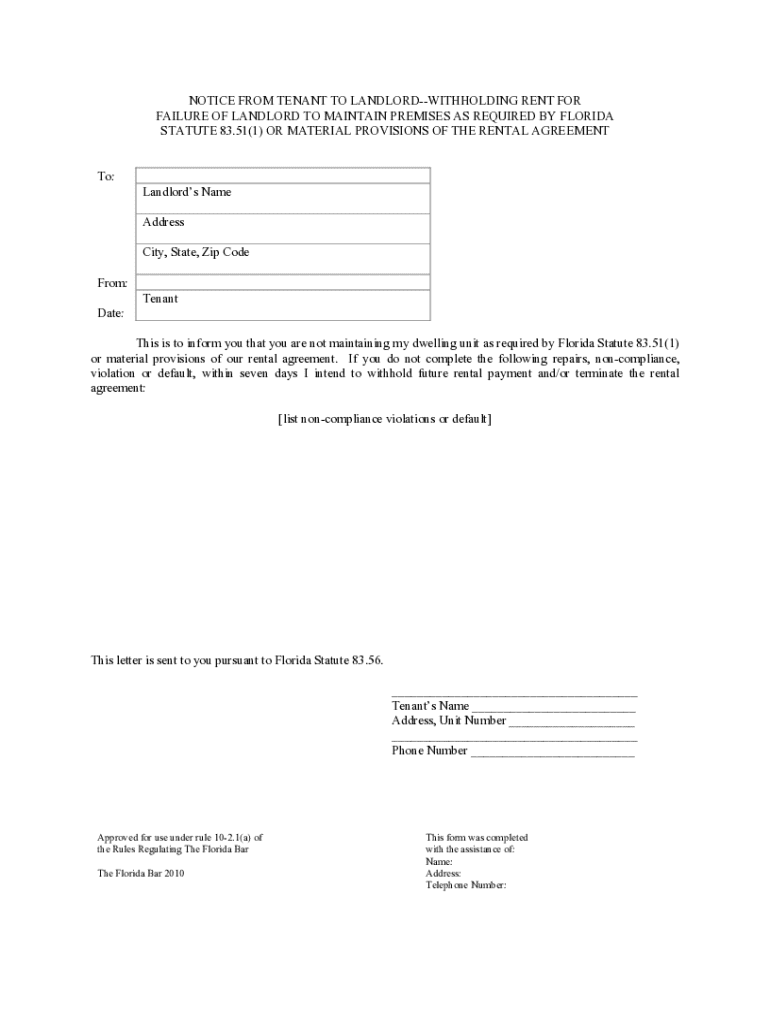

FL Form 4 2010 free printable template

Show details

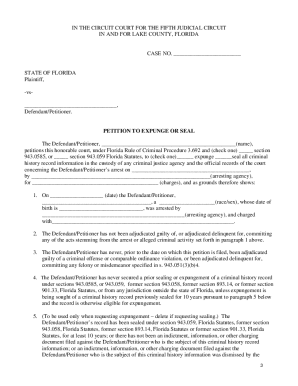

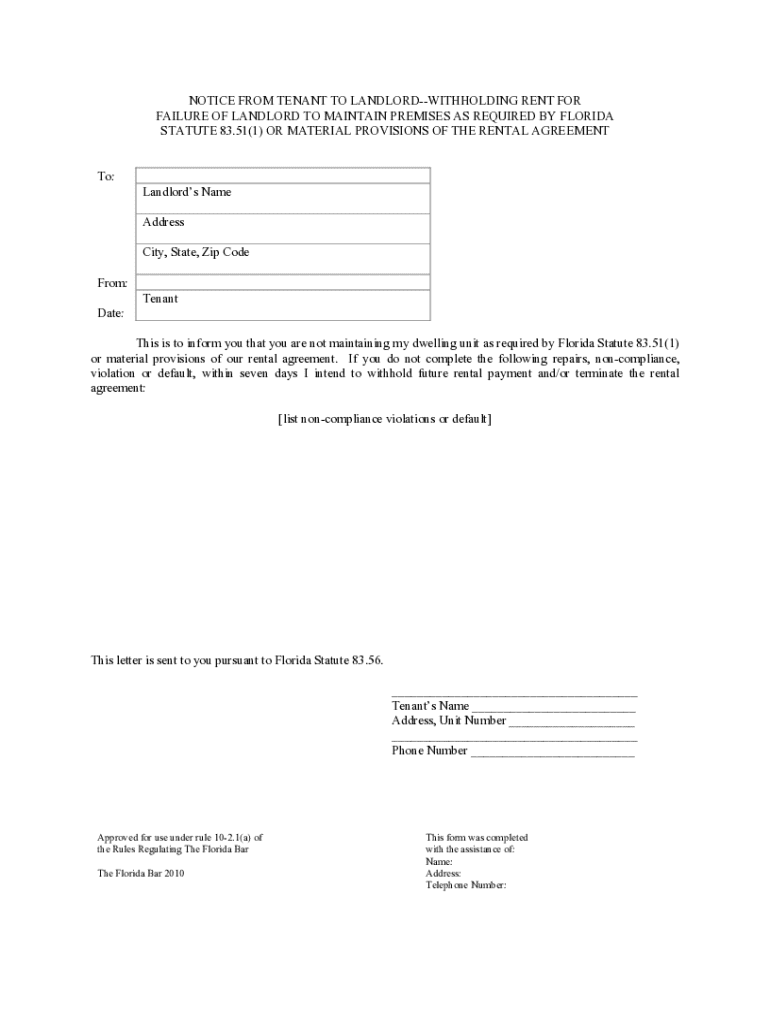

FORM 4 NOTICE FROM TENANT TO LANDLORD--WITHHOLDING RENT FOR FAILURE OF LANDLORD TO MAINTAIN PREMISES AS REQUIRED BY FLORIDA STATUTE 83.51(1) OR MATERIAL PROVISIONS OF THE RENTAL AGREEMENT INSTRUCTIONS

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL Form 4

Edit your FL Form 4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL Form 4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing FL Form 4 online

Follow the steps down below to use a professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit FL Form 4. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL Form 4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL Form 4

How to fill out FL Form 4

01

Begin by downloading FL Form 4 from the official website or obtaining a physical copy from the relevant court.

02

Fill in the case number at the top of the form if applicable.

03

Provide your name and the name of the other party in the appropriate sections.

04

Indicate what type of relief you are seeking (e.g., modification, enforcement of an existing order).

05

Clearly state the facts supporting your request in the designated section.

06

Review any instructions on the form for additional requirements and information needed.

07

Sign and date the form at the bottom.

08

Make copies of the completed form for your records and for the other party.

09

File the form with the appropriate court, along with any required filing fees or supporting documents.

Who needs FL Form 4?

01

Individuals involved in family law cases who need to request a modification or enforcement of a court order.

02

Parents seeking custody or child support adjustments.

03

Anyone looking to change terms of a divorce settlement or other family-related legal matters.

Fill

form

: Try Risk Free

People Also Ask about

Do I claim 1 or 0 on W4 if single?

If you are single and do not have any children, as well as don't have anyone else claiming you as a dependent, then you should claim a maximum of 1 allowance. If you are single and someone is claiming you as a dependent, such as your parent, then you can claim 0 allowances.

Is it okay to claim 1 on W4?

You can claim anywhere between 0 and 3 allowances on the W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

What does withholding 4 mean?

A W-4 is the IRS document that you complete for your employer to determine how much should be withheld from your paycheck for federal income taxes. Accurately completing your W-4 can help you avoid overpaying your taxes throughout the year, or even owing a large balance at tax time.

Do I claim 0 or 1 on my w4?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

What is required for Chapter 4 withholding?

Chapter 4 withholding requires a withholding agent to withhold 30% on withholdable payments made to an entity that is an FFI unless the withholding agent is able to treat the FFI as a participating FFI, deemed-compliant FFI, or exempt beneficial owner.

How to fill out a W-4 withholding form?

How to fill out a W-4: step by step Step 1: Enter your personal information. Step 2: Account for all jobs you and your spouse have. Step 3: Claim your children and other dependents. Step 4: Make other adjustments. Step 5: Sign and date your form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send FL Form 4 to be eSigned by others?

Once your FL Form 4 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit FL Form 4 in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your FL Form 4, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I edit FL Form 4 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign FL Form 4 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is FL Form 4?

FL Form 4 is a legal form used in family law proceedings, typically pertaining to the financial disclosures required in divorce or custody cases.

Who is required to file FL Form 4?

Both parties involved in a family law case, such as divorcing spouses, are usually required to file FL Form 4 to ensure full financial transparency.

How to fill out FL Form 4?

To fill out FL Form 4, individuals should provide accurate financial information as requested in the form, including income, expenses, assets, and liabilities, and submit it to the appropriate court.

What is the purpose of FL Form 4?

The purpose of FL Form 4 is to facilitate the disclosure of financial information between parties to ensure fair division of assets, determination of support obligations, and resolution of financial issues in family law cases.

What information must be reported on FL Form 4?

FL Form 4 requires reporting of various financial details, including income sources, monthly expenses, assets, debts, and any other relevant financial information that impacts the family law case.

Fill out your FL Form 4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL Form 4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.