FL CLK/CT 862 2018 free printable template

Show details

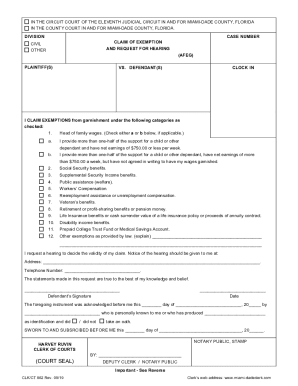

IN THE CIRCUIT COURT OF THE ELEVENTH JUDICIAL CIRCUIT IN AND FOR MIAMI-DADE COUNTY FLORIDA IN THE COUNTY COURT IN AND FOR MIAMI-DADE COUNTY FLORIDA. CASE NUMBER DIVISION CLAIM OF EXEMPTION AND REQUEST FOR HEARING CIVIL OTHER AFEG PLAINTIFF S VS. DEFENDANT S CLOCK IN checked Head of family wages. IN THE CIRCUIT COURT OF THE ELEVENTH JUDICIAL CIRCUIT IN AND FOR MIAMI-DADE COUNTY FLORIDA IN THE COUNTY COURT IN AND FOR MIAMI-DADE COUNTY FLORIDA. CASE NUMBER DIVISION CLAIM OF EXEMPTION AND...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL CLKCT 862

Edit your FL CLKCT 862 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL CLKCT 862 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit FL CLKCT 862 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit FL CLKCT 862. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL CLK/CT 862 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL CLKCT 862

How to fill out FL CLK/CT 862

01

Obtain the FL CLK/CT 862 form from the appropriate court or online resource.

02

Fill in the case number in the designated field.

03

Provide your name and contact information in the 'Petitioner' section.

04

Indicate the name of the respondent in the relevant section.

05

Clearly state your request or motion in the 'Relief Sought' area.

06

Sign and date the form at the bottom.

07

Review the completed form for accuracy before submission.

08

Submit the form to the court clerk's office, either in person or through electronic filing if permitted.

Who needs FL CLK/CT 862?

01

Individuals involved in a legal proceeding in Florida who need to make a formal request to the court.

02

Petitioners seeking to modify or enforce a court order.

03

Respondents who need to respond to a motion filed against them.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get a workmans comp exemption in Florida?

Workers' compensation exemptions must be renewed each year. The exemption takes 30 days to be effective.

Who qualifies for head of household in Florida?

Florida head-of-family exemption A head of family is a person who provides more than one-half of the support for a child or other person. Wages in a bank account that belong to a head of family retain their protection from being seized for six months, even if the wages are mixed with money from other sources.

Who qualifies for tax exemption in Florida?

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to receive a homestead exemption that would decrease the property's taxable value by as much as $50,000.

How can I stop a garnishment in Florida?

The garnished debtor can file either a claim of exemption with the court or a motion to dissolve the wage garnishment and assert the exemption in the motion. After the debtor has filed a claim of head of household exemption, the creditor may contest the exemption by filing a denial of the exemption.

Can you file head of household Florida?

In Florida, a debtor is considered to be head of household if their earnings provide more than half of the financial support for another person to whom they have either a legal or moral obligation of support.

When should I file Homeowners exemption?

Normal filing period: To receive the full exemption on the coming annual tax bill, you must file before 5 p.m. on February 15. Late filing period: If a claim is filed after February 15 and before 5 p.m. on Dec 10, then only 80% of the exemption may be granted.

When should I file an exemption in Florida?

IF YOU HAVE A VALID EXEMPTION, YOU SHOULD FILE THE FORM FOR CLAIM OF EXEMPTION IMMEDIATELY TO KEEP YOUR WAGES, MONEY, OR PROPERTY FROM BEING APPLIED TO THE COURT JUDGMENT. THE CLERK CANNOT GIVE YOU LEGAL ADVICE. IF YOU NEED LEGAL ASSISTANCE YOU SHOULD SEE A LAWYER.

How do I apply for workers comp exemption in Florida?

In order to apply for or renew an exemption from workers' compensation law, the exemption applicant must complete and submit a Notice of Election to be Exempt application online to the Florida Division of Workers' Compensation.

What funds are exempt from garnishment in Florida?

Here are the most important exemptions from creditors under Florida law: Head of household wages. Annuities and life insurance. Homestead (up to 1/2 acre in a city and 160 acres in the county) Retirement accounts, including Roth IRA, IRA, 401k. Disability income. Prepaid college funding. Social security.

Can a sole proprietor be workers comp exempt in Florida?

Sole proprietors and Partners are not considered “employees” and are automatically excluded from workers' compensation coverage by law; they do not have to file for an exemption.

How do I file head of household exemption in Florida?

How do I file for head of household? File a claim for exemptions and request for a court hearing. The Claim must be filed with the court and sent to the bank's attorney as well. Usually, 4-10 weeks later there will be a court hearing to determine if the claim of exemptions will be granted.

Why do I need a workers comp exemption in Florida?

The purpose of filing an exemption is for an officer of a corporation or member of a limited liability company to exclude themselves from the workers' compensation laws. Upon issuance of a Certificate of Election to be Exempt, the officer or member is not an employee and may not recover workers' compensation benefits.

What income Cannot be garnished in Florida?

Florida Wage Garnishment Laws All of your disposable earnings less than or equal to $750 a week are totally exempt from attachment or garnishment. So, if you're a head of family and are making less than $750 per week, creditors can't garnish your wages in Florida.

How does Florida property tax exemption work?

THE HOMESTEAD EXEMPTION In the state of Florida, a $25,000 exemption is applied to the first $50,000 of your property's assessed value if your property is your permanent residence and you owned the property on January 1 of the tax year. This exemption applies to all taxes, including school district taxes.

How do I get workman's comp exemption in Florida?

In order to apply for or renew an exemption from workers' compensation law, the exemption applicant must complete and submit a Notice of Election to be Exempt application online to the Florida Division of Workers' Compensation.

How do I file a claim of exemption in Florida?

You may claim your exemptions from garnishment by filing an affidavit with the court describing the exemption and your claim to it. Your affidavit also must be sent to the judgment creditor and any attorney for the judgment creditor.

What is the deadline for homestead exemption in Florida 2022?

March 1 is the deadline to file a timely exemption application.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit FL CLKCT 862 online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your FL CLKCT 862 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I sign the FL CLKCT 862 electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your FL CLKCT 862 in minutes.

Can I create an electronic signature for signing my FL CLKCT 862 in Gmail?

Create your eSignature using pdfFiller and then eSign your FL CLKCT 862 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is FL CLK/CT 862?

FL CLK/CT 862 is a form used in Florida for reporting certain financial information related to trusts and estates.

Who is required to file FL CLK/CT 862?

Individuals or entities that manage trusts or estates in Florida are typically required to file FL CLK/CT 862 when they have financial information that needs to be reported.

How to fill out FL CLK/CT 862?

To fill out FL CLK/CT 862, one must provide specific financial details as outlined in the form's instructions, including identifying information about the trust or estate and any relevant financial data.

What is the purpose of FL CLK/CT 862?

The purpose of FL CLK/CT 862 is to ensure transparency and accountability in the management of trusts and estates in Florida by requiring the reporting of financial information.

What information must be reported on FL CLK/CT 862?

The information that must be reported on FL CLK/CT 862 includes identifying details of the trust or estate, financial transactions, and any income or distributions that occurred during the reporting period.

Fill out your FL CLKCT 862 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL CLKCT 862 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.