FL CLK/CT 862 2019-2025 free printable template

Show details

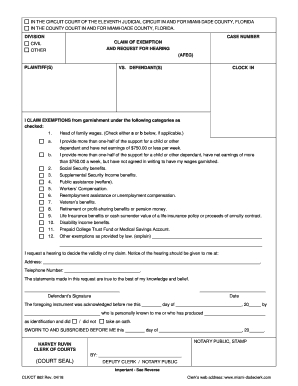

IN THE CIRCUIT COURT OF THE ELEVENTH JUDICIAL CIRCUIT IN AND FOR MIAMI-DADE COUNTY FLORIDA IN THE COUNTY COURT IN AND FOR MIAMI-DADE COUNTY FLORIDA. CASE NUMBER DIVISION CLAIM OF EXEMPTION AND REQUEST FOR HEARING CIVIL OTHER AFEG PLAINTIFF S VS. DEFENDANT S CLOCK IN checked Head of family wages. IN THE CIRCUIT COURT OF THE ELEVENTH JUDICIAL CIRCUIT IN AND FOR MIAMI-DADE COUNTY FLORIDA IN THE COUNTY COURT IN AND FOR MIAMI-DADE COUNTY FLORIDA. CASE NUMBER DIVISION CLAIM OF EXEMPTION AND...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign florida claim exemption request form

Edit your florida claim exemption request hearing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your florida claim exemption request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing florida claim exemption request fill online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit florida clk claim form printable. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL CLK/CT 862 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out clk ct request form blank

How to fill out FL CLK/CT 862

01

Obtain the FL CLK/CT 862 form from the official court website or the local courthouse.

02

Read the instructions carefully to understand the requirements and purpose of the form.

03

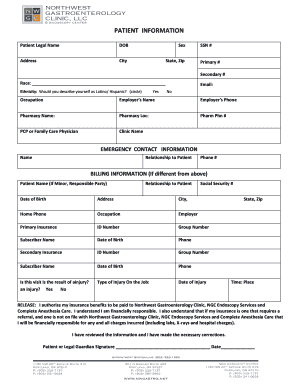

Fill out the top section with your personal information including name, address, and contact details.

04

Provide the case number if applicable, or indicate whether this is a new case.

05

Follow the prompts to fill out any additional required information accurately.

06

Review the entire form for completeness and accuracy.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate court office by mail or in person.

Who needs FL CLK/CT 862?

01

Individuals involved in legal proceedings in Florida who need to submit a motion or request to the court.

02

Attorneys representing clients who need to file specific legal documents.

03

Anyone seeking to access or modify court records related to their case.

Fill

florida claim exemption form pdf

: Try Risk Free

People Also Ask about fl claim exemption form online

How long does it take to get a workmans comp exemption in Florida?

Workers' compensation exemptions must be renewed each year. The exemption takes 30 days to be effective.

Who qualifies for head of household in Florida?

Florida head-of-family exemption A head of family is a person who provides more than one-half of the support for a child or other person. Wages in a bank account that belong to a head of family retain their protection from being seized for six months, even if the wages are mixed with money from other sources.

Who qualifies for tax exemption in Florida?

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to receive a homestead exemption that would decrease the property's taxable value by as much as $50,000.

How can I stop a garnishment in Florida?

The garnished debtor can file either a claim of exemption with the court or a motion to dissolve the wage garnishment and assert the exemption in the motion. After the debtor has filed a claim of head of household exemption, the creditor may contest the exemption by filing a denial of the exemption.

Can you file head of household Florida?

In Florida, a debtor is considered to be head of household if their earnings provide more than half of the financial support for another person to whom they have either a legal or moral obligation of support.

When should I file Homeowners exemption?

Normal filing period: To receive the full exemption on the coming annual tax bill, you must file before 5 p.m. on February 15. Late filing period: If a claim is filed after February 15 and before 5 p.m. on Dec 10, then only 80% of the exemption may be granted.

When should I file an exemption in Florida?

IF YOU HAVE A VALID EXEMPTION, YOU SHOULD FILE THE FORM FOR CLAIM OF EXEMPTION IMMEDIATELY TO KEEP YOUR WAGES, MONEY, OR PROPERTY FROM BEING APPLIED TO THE COURT JUDGMENT. THE CLERK CANNOT GIVE YOU LEGAL ADVICE. IF YOU NEED LEGAL ASSISTANCE YOU SHOULD SEE A LAWYER.

How do I apply for workers comp exemption in Florida?

In order to apply for or renew an exemption from workers' compensation law, the exemption applicant must complete and submit a Notice of Election to be Exempt application online to the Florida Division of Workers' Compensation.

What funds are exempt from garnishment in Florida?

Here are the most important exemptions from creditors under Florida law: Head of household wages. Annuities and life insurance. Homestead (up to 1/2 acre in a city and 160 acres in the county) Retirement accounts, including Roth IRA, IRA, 401k. Disability income. Prepaid college funding. Social security.

Can a sole proprietor be workers comp exempt in Florida?

Sole proprietors and Partners are not considered “employees” and are automatically excluded from workers' compensation coverage by law; they do not have to file for an exemption.

How do I file head of household exemption in Florida?

How do I file for head of household? File a claim for exemptions and request for a court hearing. The Claim must be filed with the court and sent to the bank's attorney as well. Usually, 4-10 weeks later there will be a court hearing to determine if the claim of exemptions will be granted.

Why do I need a workers comp exemption in Florida?

The purpose of filing an exemption is for an officer of a corporation or member of a limited liability company to exclude themselves from the workers' compensation laws. Upon issuance of a Certificate of Election to be Exempt, the officer or member is not an employee and may not recover workers' compensation benefits.

What income Cannot be garnished in Florida?

Florida Wage Garnishment Laws All of your disposable earnings less than or equal to $750 a week are totally exempt from attachment or garnishment. So, if you're a head of family and are making less than $750 per week, creditors can't garnish your wages in Florida.

How does Florida property tax exemption work?

THE HOMESTEAD EXEMPTION In the state of Florida, a $25,000 exemption is applied to the first $50,000 of your property's assessed value if your property is your permanent residence and you owned the property on January 1 of the tax year. This exemption applies to all taxes, including school district taxes.

How do I get workman's comp exemption in Florida?

In order to apply for or renew an exemption from workers' compensation law, the exemption applicant must complete and submit a Notice of Election to be Exempt application online to the Florida Division of Workers' Compensation.

How do I file a claim of exemption in Florida?

You may claim your exemptions from garnishment by filing an affidavit with the court describing the exemption and your claim to it. Your affidavit also must be sent to the judgment creditor and any attorney for the judgment creditor.

What is the deadline for homestead exemption in Florida 2022?

March 1 is the deadline to file a timely exemption application.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in florida claim exemption request printable?

With pdfFiller, it's easy to make changes. Open your florida claim exemption request hearing create in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I fill out florida claim exemption form printable using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign florida clkct862 exemption printable and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I fill out florida clkct 862 claim exemption form get on an Android device?

Complete your florida claim exemption form blank and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is FL CLK/CT 862?

FL CLK/CT 862 is a form used in Florida for the reporting of certain types of financial transactions and information related to the operations of corporations and partnerships.

Who is required to file FL CLK/CT 862?

Any corporation or partnership operating in Florida that meets the filing requirements set forth by the Florida Department of State is required to file FL CLK/CT 862.

How to fill out FL CLK/CT 862?

To fill out FL CLK/CT 862, you need to provide accurate information about your business, including financial data, ownership structure, and any other required disclosures as specified in the form's instructions.

What is the purpose of FL CLK/CT 862?

The purpose of FL CLK/CT 862 is to provide transparency in financial reporting for corporations and partnerships, ensuring compliance with state regulations and aiding in the assessment of business activities.

What information must be reported on FL CLK/CT 862?

FL CLK/CT 862 requires reporting of information such as business income, expenditures, financial assets, liabilities, and details about the officers or partners of the entity.

Fill out your florida claim exemption form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fl Claim Exemption Request Printable is not the form you're looking for?Search for another form here.

Keywords relevant to fl claim exemption request search

Related to florida ct862 exemption request form print

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.