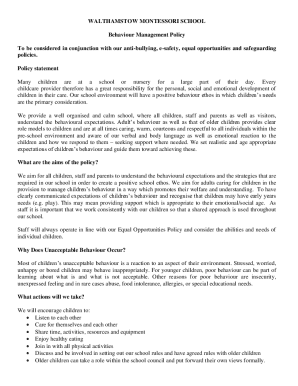

Get the free tax guide for foreigners - Agenzia delle Entrate

Show details

Annex 1Fax letter of commitment, referred to in paragraph 3.1.7 of the measure, by the permanent establishment to meet the payment obligations, filing tax returns and keeping the records referred

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax guide for foreigners

Edit your tax guide for foreigners form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax guide for foreigners form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax guide for foreigners online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax guide for foreigners. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

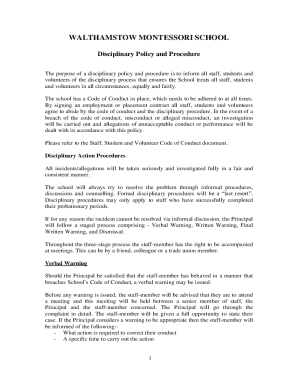

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax guide for foreigners

How to fill out tax guide for foreigners

01

Gather all necessary documents for filing taxes as a foreigner, including tax identification number, passport, and any relevant income statements.

02

Determine whether you are classified as a resident or non-resident for tax purposes, as this will affect your tax obligations.

03

Familiarize yourself with the tax laws and regulations in the country where you are living or earning income as a foreigner.

04

Fill out the appropriate tax forms, providing accurate information about your income, deductions, and exemptions.

05

Include any supporting documents, such as receipts or proof of income, to substantiate your tax claims.

06

Double-check your completed tax guide for any errors or missing information before submitting it to the appropriate tax authorities.

07

Follow any additional instructions or requirements specified by the tax authorities for foreigners filing taxes.

08

Keep copies of your filled tax guide and any related documents for your records.

09

If applicable, make any necessary tax payments or arrange for tax refunds as instructed by the tax authorities.

10

Consider seeking professional assistance or advice from a tax accountant or consultant specializing in foreign tax issues.

Who needs tax guide for foreigners?

01

Foreigners living or working in a foreign country who have income that is subject to taxation.

02

Individuals who want to ensure compliance with tax laws and regulations to avoid any potential penalties or legal issues.

03

Anyone who wants to take advantage of any tax benefits, deductions, or exemptions available to foreigners.

04

Non-resident foreigners who receive income from a foreign country and are required to file a tax return in that country.

05

Foreign students or researchers studying or working abroad who may have tax obligations in both their home country and the country of study or work.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete tax guide for foreigners online?

With pdfFiller, you may easily complete and sign tax guide for foreigners online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an eSignature for the tax guide for foreigners in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your tax guide for foreigners and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I edit tax guide for foreigners on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing tax guide for foreigners, you need to install and log in to the app.

What is tax guide for foreigners?

Tax guide for foreigners is a comprehensive document that outlines the tax obligations and requirements for individuals who are not citizens or residents of a particular country.

Who is required to file tax guide for foreigners?

Foreigners who earn income within a specific country are typically required to file a tax guide for foreigners.

How to fill out tax guide for foreigners?

To fill out a tax guide for foreigners, individuals must provide information about their income, expenses, and any applicable tax credits or deductions.

What is the purpose of tax guide for foreigners?

The purpose of the tax guide for foreigners is to ensure that individuals who are not citizens or residents of a country pay the appropriate amount of taxes on income earned within that country.

What information must be reported on tax guide for foreigners?

Information that must be reported on a tax guide for foreigners includes income earned within the country, any applicable deductions or credits, and details about any assets or investments.

Fill out your tax guide for foreigners online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Guide For Foreigners is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.