Canada 3003-02A 2018 free printable template

Show details

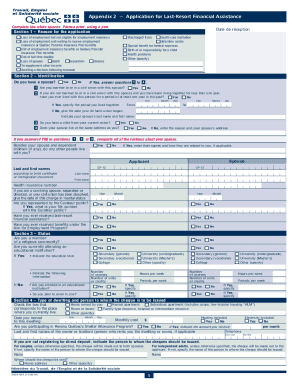

Appendix 2 Application for LastResort Financial AssistanceGuide The Individual and Family Assistance Act provides for two last resort financial assistance programs: the Social Solidarity Program and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada 3003-02A

Edit your Canada 3003-02A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada 3003-02A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada 3003-02A online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada 3003-02A. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada 3003-02A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada 3003-02A

How to fill out Canada 3003-02A

01

Begin by downloading the Canada 3003-02A form from the official website.

02

Read the instructions carefully before filling out the form.

03

Provide your personal information in the designated fields, including your name, address, and contact details.

04

Fill in your employment details, including your job title, employer's name, and duration of employment.

05

Indicate your reasons for applying and any relevant documentation.

06

Ensure that all information is accurate and complete to avoid delays.

07

Review the form thoroughly before submitting.

08

Submit the completed form according to the instructions provided, either electronically or by mailing it to the specified address.

Who needs Canada 3003-02A?

01

Individuals applying for a specific permit, visa, or program under Canadian regulations.

02

Employers seeking to support employees with application processes.

03

Any applicant who has been instructed to complete this form as part of their immigration or employment procedures.

Fill

form

: Try Risk Free

People Also Ask about

What is last-resort financial assistance Quebec?

Last-resort financial assistance programs include the Social Assistance Program, aimed at people who do not have a severely limited capacity for employment and the Social Solidarity Program, which is designed for people with a severely limited capacity for employment.

Who qualifies for welfare in Quebec?

demonstrate that your resources (money, property, earnings, benefits and income) are equal to or less than the scales set by regulation (How the benefit is calculated); reside in Quebec; be married or have already been married or be the parent of a dependent child.

How long does it take to get social assistance in Quebec?

You will receive a notice of decision by mail within five business days of receiving all the documents essential to the assessment of your application. If your application is accepted, the notice will tell you how much benefit you will receive.

How much is welfare per month in Quebec?

Amount for 1 adult Calculation including an adjustment: Basic benefit: $1,102. Adjustment: $103. Total benefit: $1,205.

How to apply for welfare in Quebec?

Due to a change in your situation, you must apply for financial assistance. Special rules apply. To find out more, call an agent using our toll-free number: 1 877 767-8773. Use the form Simplified application for last-resort financial assistance for persons who hold claim slips (3004A) (PDF 463 Kb).

What are the new rules for welfare in Quebec 2023?

In 2023, the basic benefit is $1,211 per month, which is $14,532 for a period of one year. This basic benefit is indexed each year. Adjustments can be added to the basic benefit, such as: An adjustment for a single person ($337 per month, for a total of $4,044 per year)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get Canada 3003-02A?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the Canada 3003-02A in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out Canada 3003-02A using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign Canada 3003-02A. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I fill out Canada 3003-02A on an Android device?

Complete Canada 3003-02A and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is Canada 3003-02A?

Canada 3003-02A is a specific form used by the Canada Revenue Agency (CRA) for reporting certain financial information, typically related to income tax obligations.

Who is required to file Canada 3003-02A?

Individuals or entities that meet specific income thresholds or have particular tax obligations as determined by the CRA are required to file Canada 3003-02A.

How to fill out Canada 3003-02A?

To fill out Canada 3003-02A, applicants should provide accurate financial data, including income details and deductions, and follow the CRA guidelines for each section of the form.

What is the purpose of Canada 3003-02A?

The purpose of Canada 3003-02A is to ensure compliance with tax laws by providing the CRA with the necessary financial information to assess tax liabilities.

What information must be reported on Canada 3003-02A?

Information that must be reported includes total income, deductions, applicable credits, and other relevant financial details as outlined in the instructions accompanying the form.

Fill out your Canada 3003-02A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada 3003-02a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.