CA CDTFA-501-WG (formerly BOE-501-WG) 2019 free printable template

Show details

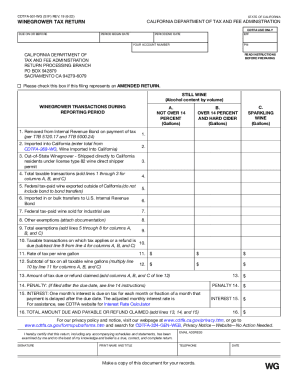

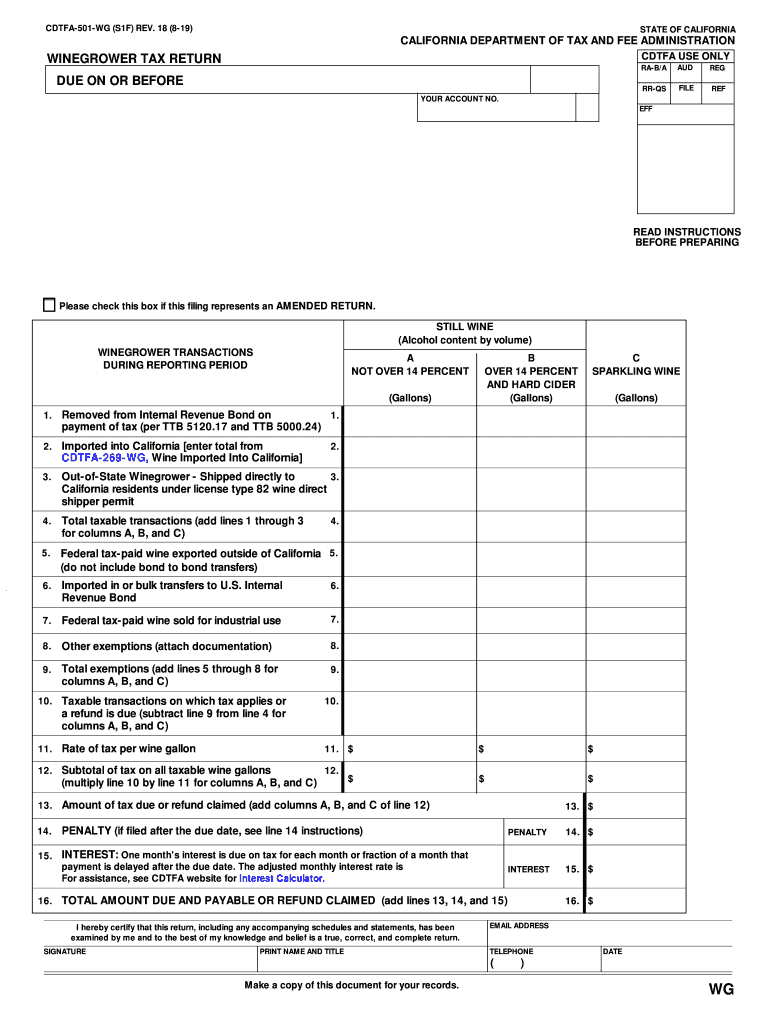

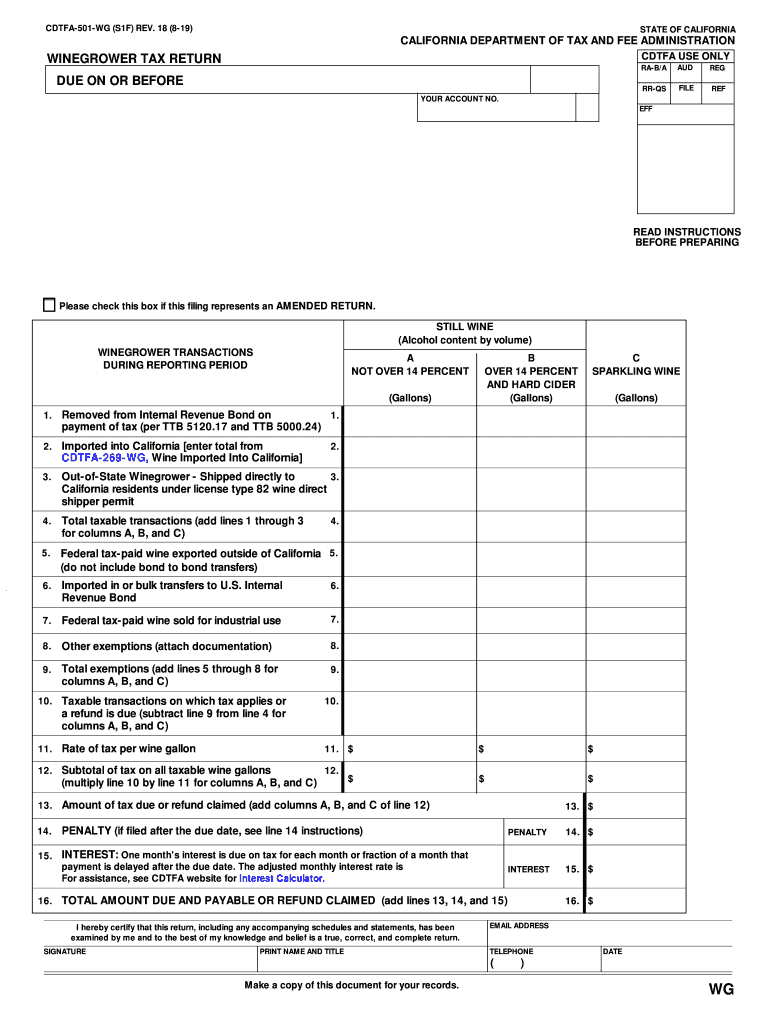

CDTFA501WG (S1F) REV. 17 (418)STATE OF CALIFORNIACALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION CDTF USE ONLYWINEGROWER TAX RETURN DUE ON OR BEFORE FRIDAY/AAUDREGRRQSFILEREFYOUR ACCOUNT NO. CALIFORNIA

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA CDTFA-501-WG formerly BOE-501-WG

Edit your CA CDTFA-501-WG formerly BOE-501-WG form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA CDTFA-501-WG formerly BOE-501-WG form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA CDTFA-501-WG formerly BOE-501-WG online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA CDTFA-501-WG formerly BOE-501-WG. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CDTFA-501-WG (formerly BOE-501-WG) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA CDTFA-501-WG formerly BOE-501-WG

How to fill out CA CDTFA-501-WG (formerly BOE-501-WG)

01

Obtain the CA CDTFA-501-WG form from the California Department of Tax and Fee Administration (CDTFA) website.

02

Provide your business information at the top of the form, including your business name, address, and account number.

03

State the period for which you are reporting tax information, ensuring the dates are accurate.

04

Complete Section 1 by detailing the sales or transactions that are subject to tax.

05

Fill in Section 2, listing any exemptions that might apply to the transactions recorded in Section 1.

06

In Section 3, calculate the tax due by applying the appropriate tax rates to the taxable sales.

07

Review your entries for accuracy, ensuring all calculations are correct.

08

Sign and date the form, certifying that all information provided is true and complete.

09

Submit the completed form as per CDTFA guidelines, either electronically or via mail.

Who needs CA CDTFA-501-WG (formerly BOE-501-WG)?

01

Retailers and businesses engaged in selling tangible personal property in California who are required to report sales tax.

02

Entities seeking to claim refunds for overpaid sales tax.

03

Businesses that need to document their sales tax obligations for compliance with California tax laws.

Fill

form

: Try Risk Free

People Also Ask about

Does California have a sales tax exemption certificate?

If you are selling to a customer who has an exempt status, you must collect a California Sales Tax Exemption certificate and keep it on file. If you are audited, you will be expected to produce this as proof that you sold an exempt item.

Can CDTFA garnish wages?

A levy or garnishment is the taking of property to satisfy a liability. CDTFA has the authority to levy/garnish your property (such as bank accounts, wages, real estate, and accounts receivable) if you do not pay Page 15 11 the amount due or make arrangements to settle your debt.

What kind of tax is CDTFA?

The California Department of Tax and Fee Administration (CDTFA) administers California's sales and use, fuel, tobacco, alcohol, and cannabis taxes, as well as a variety of other taxes and fees that fund specific state programs.

What is the finality penalty for CDTFA?

If you received a Notice of Determination (billing), but failed to pay the amount due by the due date, you will generally be assessed a 10 percent “finality” penalty. Under certain circumstances, we may waive the 10 percent “finality” penalty.

What is the statute of limitations for CDTFA?

At any time within three years after any tax or any amount of tax required to be collected becomes due and payable and at any time within three years after the delinquency of any tax or any amount of tax required to be collected, or within the period during which a lien is in force as the result of the recording of an

What is CDTFA sales tax?

The statewide tax rate is 7.25%. In most areas of California, local jurisdictions have added district taxes that increase the tax owed by a seller.

How do I get a limited access code for CDTFA?

This code can be located or obtained from the following sources: Correspondence received from the CDTFA. Contacting our customer service representatives at 800-400-7115, Monday through Friday, 7:30 a.m. to 5:00 p.m. Pacific time, excluding state holidays.

How do I set up a sales tax account in California?

How do you register for a sales tax permit in California? You can register for a California sales tax permit online at the California Department of Tax and Fee Administration (CDTFA) by clicking Register then Register a New Business Activity. Alternatively, you may register in person at one of their field offices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete CA CDTFA-501-WG formerly BOE-501-WG online?

With pdfFiller, you may easily complete and sign CA CDTFA-501-WG formerly BOE-501-WG online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out the CA CDTFA-501-WG formerly BOE-501-WG form on my smartphone?

Use the pdfFiller mobile app to fill out and sign CA CDTFA-501-WG formerly BOE-501-WG. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit CA CDTFA-501-WG formerly BOE-501-WG on an iOS device?

Create, modify, and share CA CDTFA-501-WG formerly BOE-501-WG using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is CA CDTFA-501-WG (formerly BOE-501-WG)?

CA CDTFA-501-WG is a form used by the California Department of Tax and Fee Administration (CDTFA) to report information regarding the sale or use of items that may be subject to sales tax. This form was previously known as BOE-501-WG.

Who is required to file CA CDTFA-501-WG (formerly BOE-501-WG)?

Individuals or businesses that have engaged in transactions that involve the purchase or use of taxable items in California are required to file CA CDTFA-501-WG.

How to fill out CA CDTFA-501-WG (formerly BOE-501-WG)?

To fill out CA CDTFA-501-WG, you must provide details such as the names and addresses of the buyers, the descriptions of the items sold, sale prices, and the total tax collected. It's important to follow the form's instructions carefully.

What is the purpose of CA CDTFA-501-WG (formerly BOE-501-WG)?

The purpose of CA CDTFA-501-WG is to ensure compliance with California sales tax laws by collecting information about taxable transactions and ensuring that the appropriate amount of sales tax is reported and paid.

What information must be reported on CA CDTFA-501-WG (formerly BOE-501-WG)?

The information that must be reported on CA CDTFA-501-WG includes the seller's information, details of the taxable transactions, total sales amount, and the amount of sales tax collected.

Fill out your CA CDTFA-501-WG formerly BOE-501-WG online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA CDTFA-501-WG Formerly BOE-501-WG is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.