AU B957 2005 free printable template

Show details

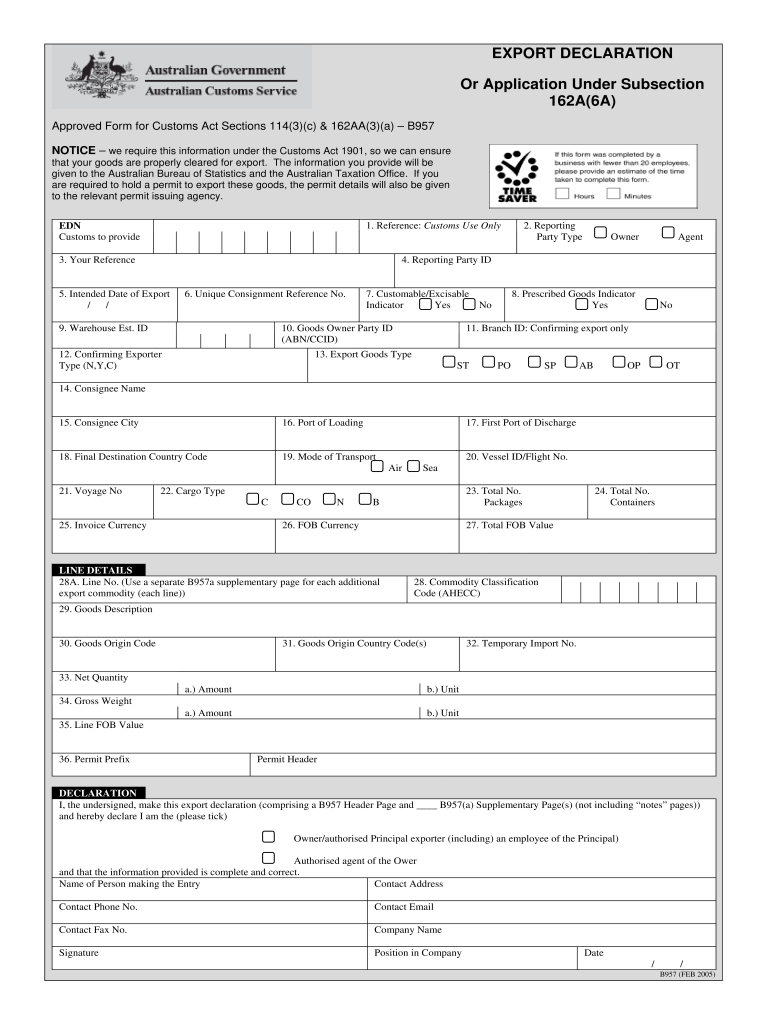

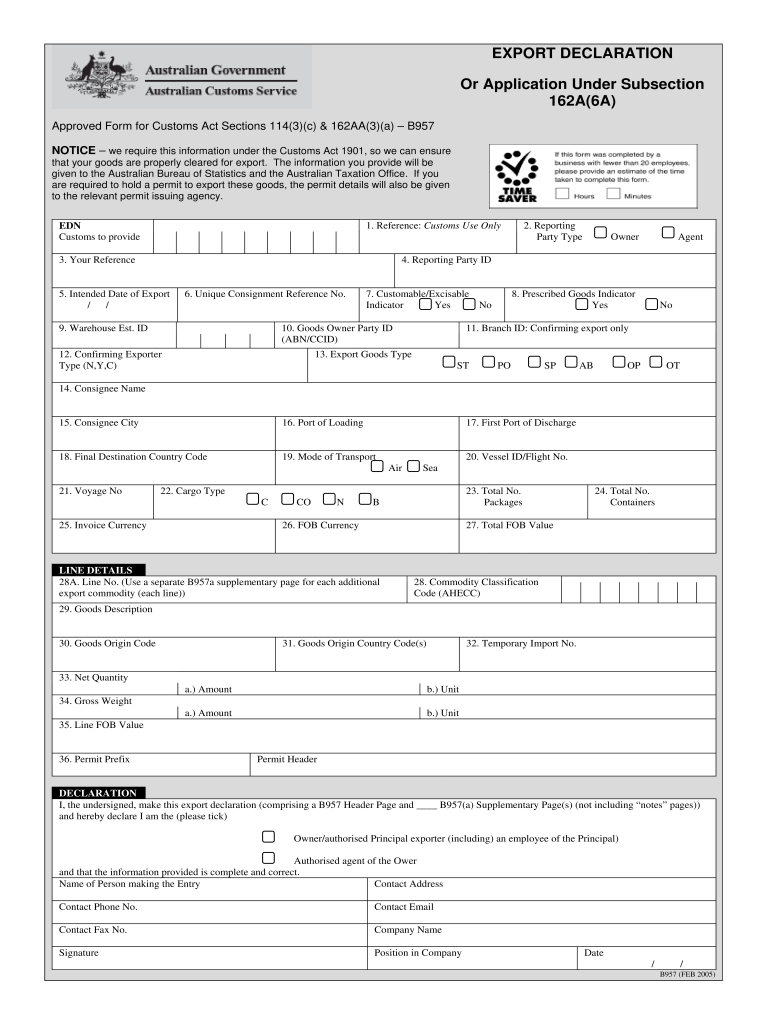

EXPORT DECLARATION Or Application Under Subsection 162A(6A) Approved Form for Customs Act Sections 114(3)(c) & 162AA(3)(a) B957 NOTICE we require this information under the Customs Act 1901, so we

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AU B957

Edit your AU B957 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU B957 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AU B957 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit AU B957. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU B957 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU B957

How to fill out AU B957

01

Gather all necessary documents and information related to your claim.

02

Download or obtain the AU B957 form from the relevant government website or office.

03

Begin filling out the form, starting with your personal details such as name, address, and contact information.

04

Provide details about the situation or incident that led to your claim.

05

Indicate the type of claim you are filing, being specific about the nature of the claim.

06

Include any required supporting documentation, ensuring all copies are clear and legible.

07

Review all filled sections for completeness and accuracy.

08

Sign and date the form before submitting it according to the provided instructions.

Who needs AU B957?

01

Individuals and businesses seeking to lodge a claim for specific types of incidents or financial compensation under Australian law.

02

Anyone who has experienced a loss or event that qualifies under the regulations applicable to AU B957.

Fill

form

: Try Risk Free

People Also Ask about

Who is responsible for filing EEI?

Who Can File the EEI? There are three parties that can file the EEI data with AES: the U.S. Principal Party in Interest (USPPI), the USPPI's authorized agent or the authorized agent of the Foreign Principal Party in Interest (FPPI). The USPPI is typically the U.S. exporter, and the FPPI is typically the foreign buyer.

What is the meaning of export declaration?

An export declaration is a form that is submitted by an exporter at the port of export. It provides information about the goods being shipped, including type, number, and value. This information is used by customs to control exports, in addition to compiling statistical information about a country's foreign trade.

What is export declaration?

Export Declarations An Export Declaration is a statement made to us by the exporter, owner of the goods, or their agent. The statement provides us with information about the goods and the export transaction. You must complete all mandatory fields on the Export Declaration before the export of goods.

Who files export declaration?

An export declaration is a form that is submitted by an exporter at the port of export. It provides information about the goods being shipped, including type, number, and value. This information is used by customs to control exports, in addition to compiling statistical information about a country's foreign trade.

Where do I get an export declaration number?

In order to obtain and EDN (Export Declaration Number), an exporter (or an exporter's agent) must lodge an export declaration with the Customs using the prescribed format. The two ways to lodge the declaration include: Manually: The document is prepared manually and submitted at one of the counters of the Customers.

What is an export declaration form?

An export declaration is a type of form submitted at the port, providing details about the goods that are bound for export. The export declaration is required each time goods are exported to a country outside the EU, and the document is used by the customs authority to control exports.

Who should export declaration?

Primary liability to file this declaration is on the person in-charge of the vessel or craft. This declaration must be filed before the departure of the vessel or craft. (Section 41). Section 148 allows all acts to be done by a person in-charge of conveyance, to be done by his agent also.

Why export declaration is important?

What Is the Importance of Export Declaration? The customs must know what goods are being exported to ensure that the consignments don't contain any prohibited goods. It also needs to ensure that the restricted goods are being exported only after obtaining the required certificates.

How do I get a shipper's export declaration form?

Get the up-to-date shipper export declaration 2022 now. For sale by the Superintendent of Documents Government Printing Office Washington DC 20402 and local Customs District Directors. The Correct Way to Fill Out the Shipper s Export Declaration is available from the U.S. Census Bureau Washington DC 20233.

Is export declaration form mandatory?

As per the extant provisions, an exporter is required to submit the SDF form along with Shipping Bills for export of goods.

How do I complete an export declaration UK?

The declaration will need to include: the customs procedure code.You also need to provide information like: the departure point and destination. the consignee and consignor. the type, amount and packaging of your goods. the transport methods and costs. currencies and valuation methods. certificates and licences.

What is a shipper's export declaration form?

An export declaration, or shippers export declaration (SED), is an official document that contains details of goods that are being exported or imported. It is generally completed by the exporter and introduced to port authorities at the time of export.

What is an export declaration?

An export declaration is a type of form submitted at the port, providing details about the goods that are bound for export. The export declaration is required each time goods are exported to a country outside the EU, and the document is used by the customs authority to control exports.

What is the purpose of the Shipper's export Declaration?

A Shipper's Export Declaration is a document that must accompany International Shipments from the USA. This document serves as a record of US exports and is used to compile trade statistics. For loads, if the shipments are shipped to multiple destinations, each shipment requires a Shipper's Export Declaration.

What is a UK export declaration?

The National Export System is an electronic based system which allows exporters to lodge an export entry with Customs before their goods leave the UK. It is connected to the Custom Handling of Import and Export (CHIEF) system, which records the movement of goods, automatically checks for entry errors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find AU B957?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the AU B957. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for signing my AU B957 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your AU B957 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete AU B957 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your AU B957. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is AU B957?

AU B957 is a form used by businesses in Australia to report certain tax information to the Australian Taxation Office (ATO).

Who is required to file AU B957?

Businesses that make certain types of transactions or have specific reporting obligations under Australian tax law are required to file AU B957.

How to fill out AU B957?

To fill out AU B957, businesses need to provide required information about their transactions, ensuring accuracy and compliance with ATO guidelines.

What is the purpose of AU B957?

The purpose of AU B957 is to ensure that the ATO receives accurate and timely information regarding certain tax-related activities of businesses.

What information must be reported on AU B957?

The information that must be reported on AU B957 includes details of financial transactions, tax withheld, and other relevant data as specified by the ATO.

Fill out your AU B957 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU b957 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.