AU B957 2010 free printable template

Show details

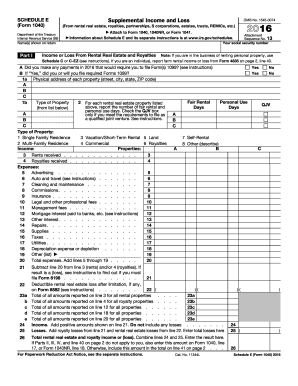

EXPORT DECLARATION Or Application Under Subsection 162A(6A) Approved Form for Customs Act Sections 114(3)(c) & 162AA(3)(a) B957 NOTICE — we require this information under the Customs Act 1901, so

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AU B957

Edit your AU B957 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU B957 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

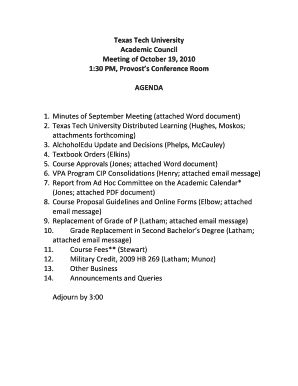

Editing AU B957 online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AU B957. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

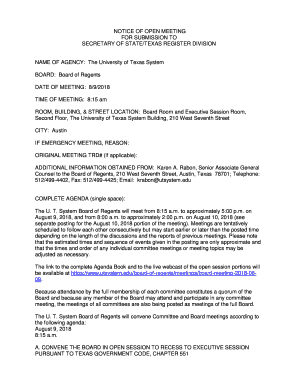

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU B957 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU B957

How to fill out AU B957

01

Gather all necessary documentation related to your application.

02

Download the AU B957 form from the official website.

03

Fill out your personal details, including name, address, and contact information.

04

Provide detailed answers to the specific sections, ensuring all required information is included.

05

Review the form for accuracy and completeness.

06

Sign and date the form as required.

07

Submit the completed form along with any supporting documents to the appropriate authority.

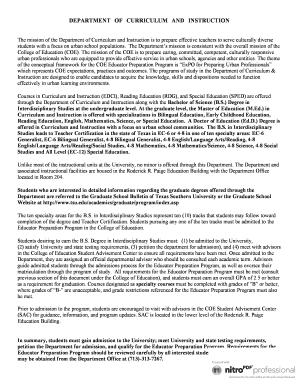

Who needs AU B957?

01

Individuals who are applying for a specific type of permit or license in Australia.

02

Businesses requiring compliance documentation for regulatory purposes.

03

Applicants for immigration, work, or residency visas relevant to the AU B957 form.

Instructions and Help about AU B957

Fill

form

: Try Risk Free

People Also Ask about

What documents do I need to export to Australia?

Some of these documents needed to clear customs include: commercial licence, bill of lading, Certificate of Origin, and insurance certificates. In many cases, it is also necessary to apply for an import and export licence or obtain permission from the relevant authorities before exporting.

Why do I need an export declaration number?

Export declarations provide Customs and Border Protection with details about goods intended for export. The Integrated Cargo System (ICS) processes the information provided and issues an Export Declaration Number (EDN) consisting of nine alphanumeric characters.

How do I get an export clearance number?

In order to obtain and EDN (Export Declaration Number), an exporter (or an exporter's agent) must lodge an export declaration with the Customs using the prescribed format. The two ways to lodge the declaration include: Manually: The document is prepared manually and submitted at one of the counters of the Customers.

Why is an export declaration required?

What Is the Importance of Export Declaration? The customs must know what goods are being exported to ensure that the consignments don't contain any prohibited goods. It also needs to ensure that the restricted goods are being exported only after obtaining the required certificates.

Is export declaration mandatory?

A US shipper's export declaration is required if a shipper sends anything with a value of more than $2,500 to an address outside of the US.

Who is responsible for export declaration?

I) Export declaration First the exporter/declarant presents the goods, his export declarationEN••• and, where necessary, his export license at the customs office responsible for the place where he is established or where the goods are packed or loaded for export (Article 221 (2) UCC Implementing Act).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send AU B957 to be eSigned by others?

To distribute your AU B957, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I get AU B957?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific AU B957 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I execute AU B957 online?

Filling out and eSigning AU B957 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

What is AU B957?

AU B957 is a specific form used for reporting purposes in the context of Australian tax compliance, specifically for businesses and individuals involved in certain transactions.

Who is required to file AU B957?

Businesses and individuals who engage in specified activities or transactions that fall under the reporting requirements as outlined by the Australian Taxation Office (ATO) are required to file AU B957.

How to fill out AU B957?

To fill out AU B957, one must follow the instructions provided by the ATO, which typically include completing the relevant sections of the form with accurate information regarding the transactions and ensuring all required fields are filled out correctly.

What is the purpose of AU B957?

The purpose of AU B957 is to facilitate the reporting of certain financial transactions to ensure compliance with tax laws and regulations, allowing for better tracking and management of tax obligations.

What information must be reported on AU B957?

AU B957 requires reporting of details such as the nature of the transaction, amounts involved, relevant parties, and any other information as stipulated by the ATO to ensure complete and accurate reporting.

Fill out your AU B957 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU b957 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.