Get the free Deposit Account Rules & Regulations - Fifth Third Bank

Show details

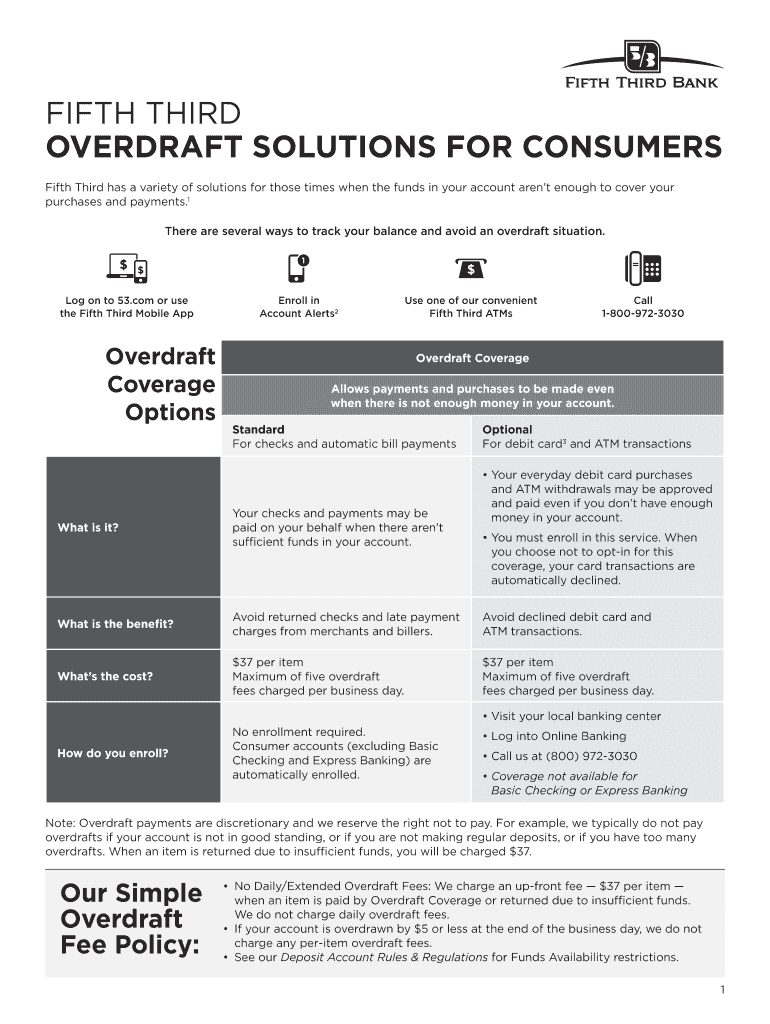

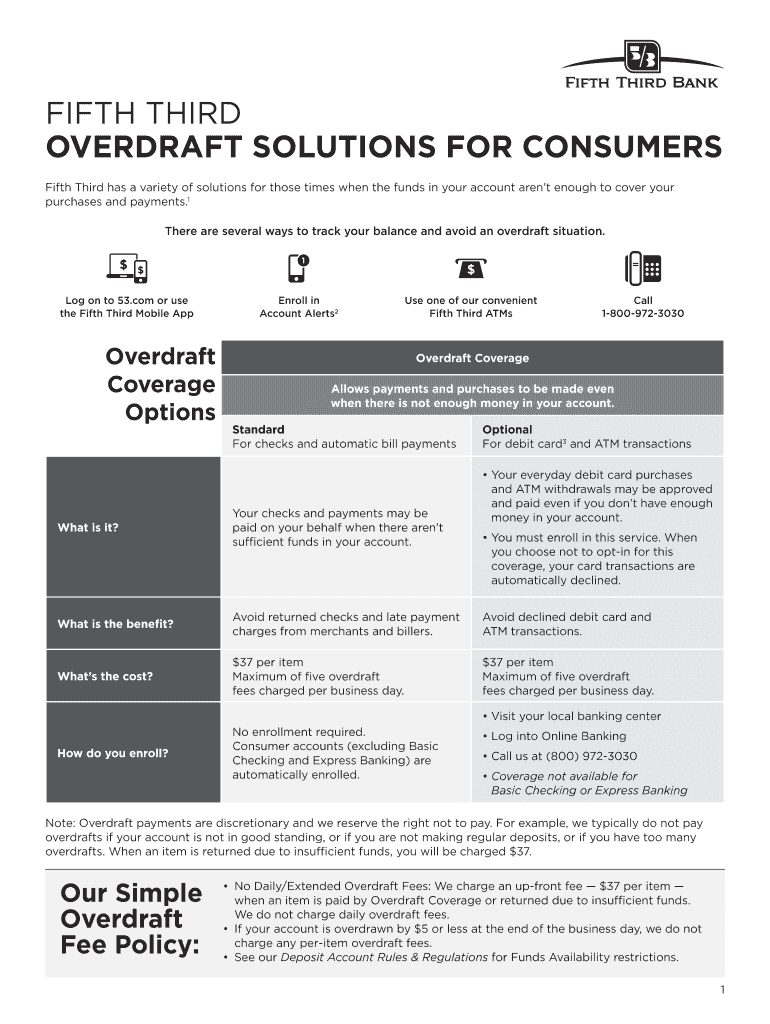

FIFTH THIRD

OVERDRAFT SOLUTIONS FOR CONSUMERS

Fifth Third has a variety of solutions for those times when the funds in your account aren't enough to cover your

purchases and payments.1

There are several

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deposit account rules ampamp

Edit your deposit account rules ampamp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deposit account rules ampamp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deposit account rules ampamp online

To use the professional PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit deposit account rules ampamp. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deposit account rules ampamp

How to fill out deposit account rules ampamp

01

To fill out deposit account rules, follow these steps:

02

Start by gathering all the necessary information and documents related to the deposit account rules, such as the account terms and conditions, legal requirements, and any specific guidelines provided by the bank or financial institution.

03

Understand the purpose and objectives of the deposit account rules to ensure accurate and comprehensive information is included.

04

Divide the deposit account rules into different sections or categories based on the content and structure, such as account opening procedures, account maintenance, interest rates, fees and charges, withdrawal and termination rules, etc.

05

Write each point clearly and concisely, using simple language that is easily understandable for the target audience.

06

Include all the necessary details and instructions to avoid confusion or misinterpretation, such as specific identification requirements, minimum balance criteria, transaction limits, etc.

07

Ensure compliance with applicable legal and regulatory requirements, keeping in mind any changes or updates that may impact the deposit account rules.

08

Review the draft of the deposit account rules carefully for accuracy, consistency, and completeness.

09

Get feedback from internal or external stakeholders, such as legal advisors or compliance officers, to ensure the deposit account rules meet all necessary standards and requirements.

10

Make any necessary revisions or amendments based on the feedback received and final review.

11

Obtain final approval from relevant authorities or decision-makers before implementing the deposit account rules.

12

Once the deposit account rules are finalized, communicate and distribute them to the target audience, such as account holders or potential customers, using appropriate channels and mediums.

13

Regularly review and update the deposit account rules as needed, considering changes in banking practices, legal requirements, or customer feedback.

Who needs deposit account rules ampamp?

01

Deposit account rules are needed by various stakeholders, including:

02

- Banks and financial institutions: They require deposit account rules to establish clear guidelines and procedures for opening, maintaining, and terminating accounts, as well as to comply with legal and regulatory requirements.

03

- Account holders: These rules provide account holders with a comprehensive understanding of the terms and conditions associated with deposit accounts, including interest rates, fees, withdrawal limits, and rights and obligations.

04

- Regulators and auditors: Deposit account rules help regulators and auditors ensure that banks and financial institutions adhere to the prescribed standards, monitor compliance, and protect the interests of customers.

05

- Legal advisors and compliance officers: They rely on deposit account rules to provide legal guidance and ensure compliance with applicable laws and regulations governing banking and financial services.

06

- Potential customers: Prospective account holders may refer to deposit account rules to assess the suitability of a bank or financial institution's offerings and compare their terms and conditions with those of other providers.

07

- Internal stakeholders: Various departments within a bank or financial institution, such as customer service, operations, and risk management, may need access to deposit account rules to guide their day-to-day activities and decision-making.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete deposit account rules ampamp online?

Filling out and eSigning deposit account rules ampamp is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make changes in deposit account rules ampamp?

The editing procedure is simple with pdfFiller. Open your deposit account rules ampamp in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit deposit account rules ampamp on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share deposit account rules ampamp from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is deposit account rules ampamp?

Deposit account rules ampamp refer to the regulations and guidelines governing the operation and management of deposit accounts in financial institutions.

Who is required to file deposit account rules ampamp?

Financial institutions are required to file deposit account rules ampamp as part of their compliance obligations.

How to fill out deposit account rules ampamp?

Deposit account rules ampamp can be filled out by following the specific instructions provided by the regulatory authorities and ensuring all required information is accurately reported.

What is the purpose of deposit account rules ampamp?

The purpose of deposit account rules ampamp is to ensure transparency, accountability, and integrity in the management of deposit accounts.

What information must be reported on deposit account rules ampamp?

Information such as account holders' details, account balances, interest rates, fees, and any associated risks must be reported on deposit account rules ampamp.

Fill out your deposit account rules ampamp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deposit Account Rules Ampamp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.