Who needs a Texas Employer New Hire Reporting Form?

This form is used by business owners and contractors in the state of Texas. The Federal and state law demands employers provide information about all newly hired workers to the Texas Employer New Hire Reporting Operations Center.

What is the purpose of the Texas Employer New Hire Reporting Form?

Employers have to send the information about each new hiring to the Hire Reporting Operations Center to avoid fraud and tax evasion.

What documents must accompany the Texas Employer New Hire Reporting Form?

The employer doesn’t have to accompany this form with other documents.

When should I submit the Texas Employer New Hire Reporting Form?

The employer has to complete and send the form within 20 calendar days of the new employee’s first day of work. The estimated time for completing the form is 10 minutes.

What information should be provided in the Texas Employer New Hire Reporting Form?

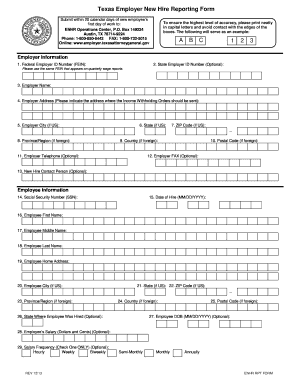

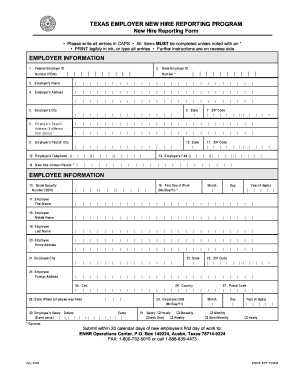

The employer must add the following information:

Information about the employer: Federal Employer ID number, employer name, address

Information about the employee: social security number, date of hire, first and last name, address, state where the employee was hired, employee date of birth, employee’s salary, salary frequency (hourly, weekly, biweekly, semi-monthly, monthly, annually)

What do I do with the Texas Employer New Hire Reporting Form after its completion?

The completed form is forwarded to the Texas Employer New Hire Reporting Operations Center. The employer also can submit the form by fax, telephone or the internet.