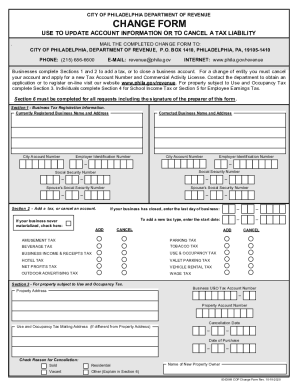

PA DoR 83-E669 2017 free printable template

Get, Create, Make and Sign PA DoR 83-E669

Editing PA DoR 83-E669 online

Uncompromising security for your PDF editing and eSignature needs

PA DoR 83-E669 Form Versions

How to fill out PA DoR 83-E669

How to fill out PA DoR 83-E669

Who needs PA DoR 83-E669?

Instructions and Help about PA DoR 83-E669

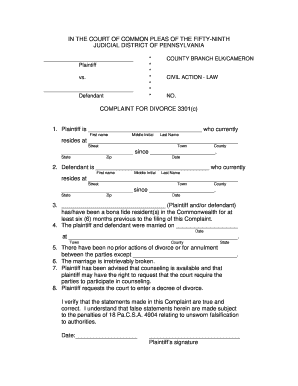

Hi this is how to file for divorce org and today were going to go over how to file for divorce in the state of Idaho now just getting right into it step one you're gonna need to download the Idaho divorce papers lucky for you, they're free right on our website, so you got to do is click on this link I'll bring you to the next page which will give you a nice little explanation of all the forms and a nice video that will tell you exactly what the divorce papers are so once you do that download those papers you can get started and the person that has decided to file for divorce must fill out the following forms and submit it to the Idaho circuit court clerks office in your county and if you don't know where that is you can just click on this link and find it exactly where it is so the forms that you're going to have to need to complete now if you look we have all every thing that is in green or the forms needed when divorcing with minor children so any children under 18 you need to follow these forms if not just the black ones, and you're good, so you'll need you to do the complaint for divorce summons child support affidavit child support worksheet parenting plans and pay the filing fee of any in Idaho every County ranges its one of those states where every county kind of decides everything on their own but at the lowest you'll have to pay seventy-six stars and at the highest will be a hundred and twenty-nine, so it just depends on your county and if you have children the clerk will provide you with a certificate to attend parental classes now I know this sounds ridiculous, but you need to attend these classes in order to complete your divorce when you get to your hearing you'll be one of the forms that will be required as a certificate that you'll get at the very end that proves that you in fact went to the classes step 3 now you have to tell your spouse that you are filing for a divorce, so you're going to need to serve them now you're going to have to serve your spouse the following forms basically all the that you filed up here, but you're going to add this form certificate to enter parental program so that you have children they're going to have to do it to an acknowledgement of service by defense in defendant in consent it's a long one, but they need it, and you're also the important reason why is that you need to give this to them as for step four you will need to wait to receive this form back from your spouse till need to be completed and signed you can go over there and bother him or her to get this back you can have it mailed to you whatever it is you need to get this completed back so that you can file it with the clerks' office so after that it gets pretty easy you and your spouse will need to wait twenty days and from the first filing of this and complete the following forms in the meantime sworn stipulation divorce decree and the child support transmittal if you have children follow these forms to the clerk bring two and be sure to...

People Also Ask about

How to file Philadelphia wage tax return?

How much does it cost to transfer a deed in Philadelphia?

How long does it take to transfer deed Philadelphia?

How much does it cost to transfer property Deeds in PA?

Who must file a Philadelphia tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find PA DoR 83-E669?

Can I create an electronic signature for the PA DoR 83-E669 in Chrome?

How do I fill out PA DoR 83-E669 on an Android device?

What is PA DoR 83-E669?

Who is required to file PA DoR 83-E669?

How to fill out PA DoR 83-E669?

What is the purpose of PA DoR 83-E669?

What information must be reported on PA DoR 83-E669?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.