PA DoR 83-E669 2006 free printable template

Show details

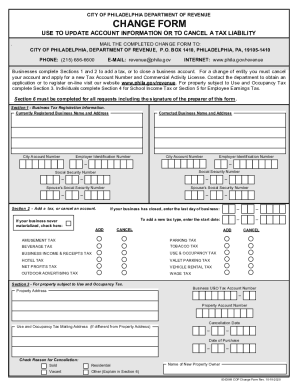

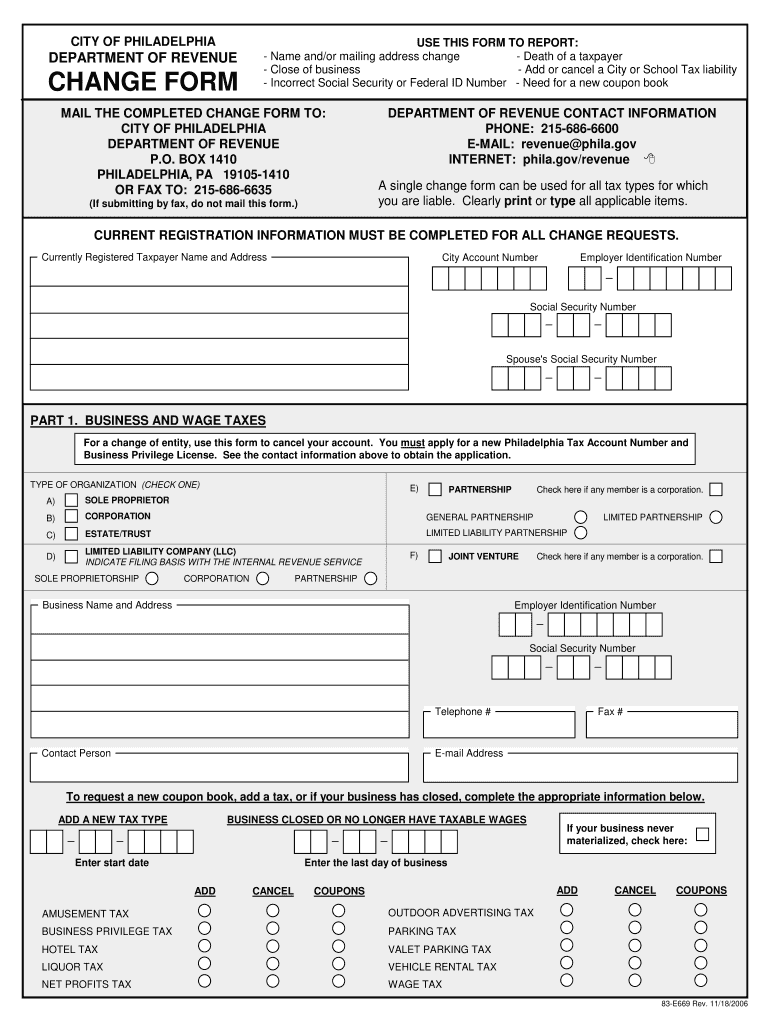

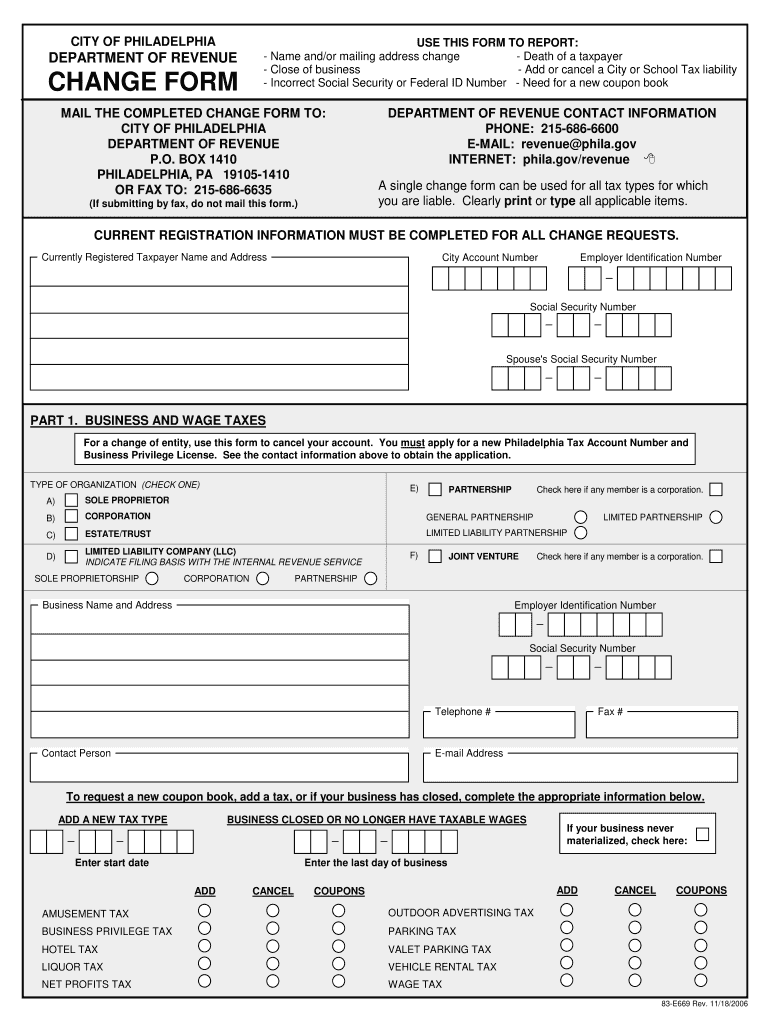

CITY OF PHILADELPHIA DEPARTMENT OF REVENUE CHANGE FORM USE THIS FORM TO REPORT: Name and/or mailing address Chang — Death of a taxpayer Close of business — Add or cancel a City or School Tax liability

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA DoR 83-E669

Edit your PA DoR 83-E669 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA DoR 83-E669 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA DoR 83-E669 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit PA DoR 83-E669. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA DoR 83-E669 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA DoR 83-E669

How to fill out PA DoR 83-E669

01

Obtain the PA DoR 83-E669 form from the appropriate state department website or office.

02

Fill out personal identification information, including your name, address, and contact details in the designated fields.

03

Provide the relevant financial information required, including income, expenses, and any other necessary financial disclosures.

04

Carefully review the instructions for any specific eligibility requirements or documentation needed to support your application.

05

Sign and date the form where indicated to certify the accuracy of the information provided.

06

Submit the completed form through the specified submission method, which may be by mail or online.

Who needs PA DoR 83-E669?

01

Individuals or entities who are applying for certain financial assistance programs or benefits offered by the Pennsylvania Department of Revenue.

02

Taxpayers seeking to claim specific exemptions, deductions, or credits as stipulated by state regulations.

03

Residents or businesses affected by economic changes who need to report their financial status.

Instructions and Help about PA DoR 83-E669

Fill

form

: Try Risk Free

People Also Ask about

How do I get a tax ID number in PA?

The registration is done by filing form PA-100 with PDOR. You can get an EIN/TIN by mail, fax, or through the online application form on the IRS's website. It takes four days to get an EIN by fax, four weeks by mail, and around 15 minutes when done online.

How do you file Philadelphia city taxes?

You can use the IRS Modernized e-Filing program to file some City of Philadelphia taxes. The Department of Revenue has approved tax preparation software packages from several companies.Filing returns through Modernized e-Filing (MeF) Business Income & Receipts Tax (BIRT) Net Profits Tax (NPT) School Income Tax (SIT)

How do I file my local income tax return in Philadelphia?

How to file City taxes Filing returns online. All Philadelphia taxes can be filed online. Filing returns through Modernized e-Filing (MeF) You can use the IRS Modernized e-Filing program to file some City of Philadelphia taxes. Filing paper returns.

Does Philly have a city income tax?

The new BIRT income tax rate becomes effective for tax year 2023, for returns due and taxes owed in 2024. Starting on July 1, the new resident rate for the Wage and Earnings taxes is 3.79%. The rates were previously 3.8398%.

How do I obtain a City of Philadelphia tax account number?

Visit the Philadelphia Tax Center to open a Philadelphia tax account online for most City business taxes. Continue to use our eFile/ePay website to open other tax accounts until October 2022.

How do I find my PA account number?

Account Number: Your checking account number can be found on your checks to the right of the nine-digit routing number. This number uniquely identifies your account with your financial institution.

Do I have to file a City of Philadelphia tax return?

You must pay the Earnings Tax if you are a: Philadelphia resident with taxable income who doesn't have the City Wage Tax withheld from your paycheck. A non-resident who works in Philadelphia and doesn't have the City Wage Tax withheld from your paycheck.

Do I need to file a local tax return in PA?

When To File: Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by April 18, 2022. Even if you have employer withholding or are not expecting a refund, you must still file a return.

How to file Philadelphia City taxes?

How to file City taxes Filing returns online. All Philadelphia taxes can be filed online. Filing returns through Modernized e-Filing (MeF) You can use the IRS Modernized e-Filing program to file some City of Philadelphia taxes. Filing paper returns.

How do I get a birt number in Philadelphia?

The application for the Commercial Activity License (CAL) and Business Tax Account number (BIRT) is a combination application. You can apply online or in person in the basement of the Municipal Services building. If you apply online, it will take time for the city to process your application.

Do I need to file Philadelphia City tax return?

Individuals engaged in any for-profit activity within the city of Philadelphia must file a BIRT return. Additionally, individuals who maintain a Commercial Activity License (CAL) must file a BIRT return, even if they didn't actively engage in any business.

Who Must File Philadelphia city tax return?

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

Do I need to file a Philadelphia city tax return?

Individuals engaged in any for-profit activity within the city of Philadelphia must file a BIRT return. Additionally, individuals who maintain a Commercial Activity License (CAL) must file a BIRT return, even if they didn't actively engage in any business.

Who Must File Philadelphia City tax return?

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

Who has to file a Philadelphia school income tax return?

All Philadelphia residents, even those who live in the City a portion of the calendar year, are required to file the School Income Tax return and failure to do so can subject one to substantial fines and other penalties.

Do I have to pay Philadelphia city tax?

All Philadelphia residents owe the City Wage Tax, regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get PA DoR 83-E669?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific PA DoR 83-E669 and other forms. Find the template you want and tweak it with powerful editing tools.

Can I edit PA DoR 83-E669 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share PA DoR 83-E669 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I fill out PA DoR 83-E669 on an Android device?

On Android, use the pdfFiller mobile app to finish your PA DoR 83-E669. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is PA DoR 83-E669?

PA DoR 83-E669 is a form used for reporting specific financial and taxation information to the Pennsylvania Department of Revenue. It is utilized primarily for tax compliance purposes.

Who is required to file PA DoR 83-E669?

Entities or individuals who are subject to certain taxes or do business in Pennsylvania are required to file PA DoR 83-E669. This includes corporations, partnerships, and other business structures that meet the criteria set by the Pennsylvania Department of Revenue.

How to fill out PA DoR 83-E669?

To fill out PA DoR 83-E669, obtain the form from the Pennsylvania Department of Revenue website. Complete the required sections with accurate financial data, including income, expenses, and any other necessary information, then submit it according to the filing instructions provided.

What is the purpose of PA DoR 83-E669?

The purpose of PA DoR 83-E669 is to ensure compliance with Pennsylvania tax laws by collecting necessary financial information from taxpayers, which aids in the assessment and collection of state taxes.

What information must be reported on PA DoR 83-E669?

The information that must be reported on PA DoR 83-E669 includes gross income, deductions, net income, tax credits, and any other relevant financial data as specified in the form's instructions.

Fill out your PA DoR 83-E669 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA DoR 83-e669 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.