CA Form 3885L 2017 free printable template

Show details

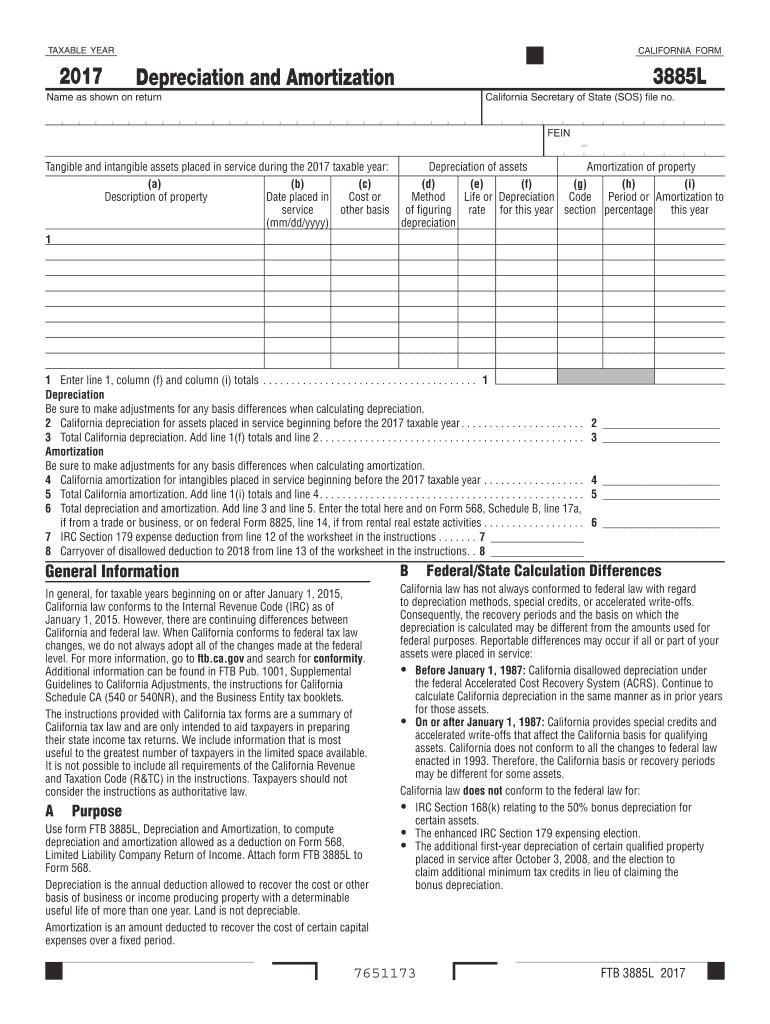

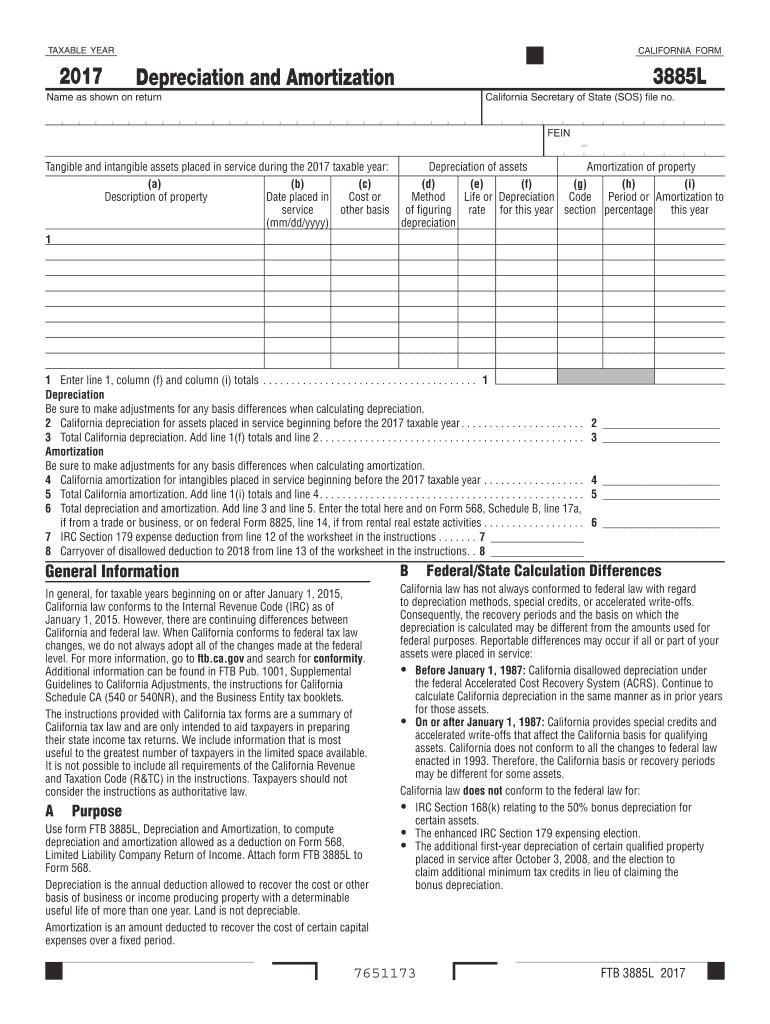

TAXABLEYEAR2017CALIFORNIAFORM3885LDepreciation and AmortizationName as shown on return California Secretary of State (SOS) file no.

intangible and intangible assets placed in service during the 2017

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA Form 3885L

Edit your CA Form 3885L form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA Form 3885L form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA Form 3885L online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CA Form 3885L. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA Form 3885L Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA Form 3885L

How to fill out CA Form 3885L

01

Gather all necessary information such as your business name, address, and tax identification number.

02

Identify the section of the form that pertains to your specific business type (individual, corporation, partnership).

03

Complete the 'Taxpayer Identification Information' section accurately.

04

Fill out the 'Property Information' section, detailing any property placed in service during the tax year.

05

Specify the correct asset class and depreciation method for each asset.

06

Calculate the total depreciation amounts and ensure they are consistent across the form.

07

Review the form for accuracy and completeness before submission.

08

Sign and date the form where indicated.

Who needs CA Form 3885L?

01

Businesses or individuals who have acquired depreciable property during the tax year.

02

Taxpayers who wish to claim a deduction for depreciation on their California state tax returns.

03

Corporations, partnerships, and sole proprietors that need to report property placed in service.

Fill

form

: Try Risk Free

People Also Ask about

Does California allow special depreciation?

California conforms to federal law (IRC Sec. 167 and IRC Sec. 168), as of California's current federal conformity date , allowing taxpayers to depreciate assets utilizing the modified accelerated cost recovery system (MACRs) for assets placed in service after 1986.

What is the limit for bonus depreciation in 2022?

With the Bonus Depreciation limit of 100 percent through 2022, businesses have greater incentive to make near-term purchases. Before the TCJA, was passed, the bonus depreciation limit varied from year to year.

Does California allow for bonus depreciation?

California does not conform to the federal special or bonus depreciation for qualified property acquired and placed in service.

Can you take Section 179 and bonus depreciation on the same vehicle?

For example, if you depreciate one 4-year asset like a heavy-duty truck, you must depreciate all 4-year assets purchased that year. Fortunately, you do have the flexibility to use both Section 179 and bonus depreciation in the same year.

What is the bonus depreciation percentage in California?

IRC Section 168(k) relating to the 50% bonus depreciation deduction for certain assets.California law does not conform to federal law for the following: Tax YearAmount1st Tax Year$3,6702nd Tax Year5,8773rd Tax Year3,454Each Succeeding Year2,139

Can I take bonus depreciation without Section 179?

A company can take both Section 179 and Bonus Depreciation allowances, but Section 179 must be applied first, and any amount over the $1,080,000 limit to Section 179 may then be taken in bonus depreciation. For tax year 2022, the Bonus Depreciation allowance is 100%.

What is the limit for CA Section 179?

For California purposes, the maximum IRC Section 179 expense deduction allowed is $25,000. This amount is reduced if the cost of all IRC Section 179 property placed in service during the taxable year is more than $200,000.

What are the new rules regarding bonus depreciation?

The rules and limits for bonus depreciation have changed over the years, and the latest ones are scheduled to expire in 2023. In 2022, bonus depreciation allows for 100% upfront deductibility of depreciation; this depreciates 20% in each subsequent year until its final year in 2026.

Does CA allow 179 depreciation?

For California purposes, the maximum IRC Section 179 expense deduction allowed is $25,000. This amount is reduced if the cost of all IRC Section 179 property placed in service during the taxable year is more than $200,000.

Does California recognize qualified improvement property?

Qualified Improvement Property (QIP) For California purposes, the useful like of QIP is generally 39 years (40 years under Alternative Depreciation System [ADS]).

Which states do not allow bonus depreciation?

No tax, no deductions: Nevada, South Dakota, Wyoming, and Washington have no corporate income tax, so section 179 deductions and bonus depreciation don't apply. Section 179: All U.S. states and the District of Columbia except Ohio allow section 179 deductions.

What depreciation method does California use?

The only acceptable methods of depreciation for California tax purposes are: Straight-line. Declining balance. Sum-of-the-years-digits method.

Does ca allow bonus depreciation?

Does California require an addback of federal bonus depreciationdeductions? California requires an addback of the amount by which depreciation claimed for federal purposes exceeds the allowable California depreciation deduction, which is computed without regard to federal bonus depreciation.

Do you have to take 179 before bonus depreciation?

IRS rules require that most businesses apply Section 179 first, followed by bonus depreciation.

What is the limit for CA bonus depreciation?

Section 179 or Bonus Depreciation for assets exceeding California limit of $25k. My business has two assets with basis of $39k and $14k placed into service in 2020. I can take full 179 deductions on my Federal return, but only $25k max total 179 deduction on my California return.

What is 3885 a form?

Purpose. Use form FTB 3885A, Depreciation and Amortization Adjustments, only if there is a difference between the amount of depreciation and amortization allowed as a deduction using California law and the amount allowed using federal law.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit CA Form 3885L from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including CA Form 3885L. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit CA Form 3885L online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your CA Form 3885L to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out the CA Form 3885L form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign CA Form 3885L and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is CA Form 3885L?

CA Form 3885L is a tax form used in California for the purpose of reporting and calculating the amount of the enterprise zone credits, specifically the California business investment incentives.

Who is required to file CA Form 3885L?

Businesses that have claimed enterprise zone credits in California are required to file CA Form 3885L.

How to fill out CA Form 3885L?

To fill out CA Form 3885L, taxpayers need to provide information regarding their enterprise zone activities, including the type and amount of credits claimed, business information, and any supporting documentation as required.

What is the purpose of CA Form 3885L?

The purpose of CA Form 3885L is to allow businesses to report and claim tax credits related to investments in designated enterprise zones within California.

What information must be reported on CA Form 3885L?

Information that must be reported on CA Form 3885L includes the business name, address, federal tax identification number, types of credits being claimed, the amounts, and details of the investments made in the enterprise zones.

Fill out your CA Form 3885L online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA Form 3885l is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.