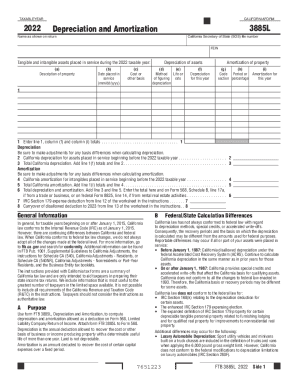

CA Form 3885L 2023-2025 free printable template

Get, Create, Make and Sign depreciation on california form

How to edit california depreciation sample online

Uncompromising security for your PDF editing and eSignature needs

CA Form 3885L Form Versions

How to fill out form 3885l

How to fill out CA Form 3885L

Who needs CA Form 3885L?

Video instructions and help with filling out and completing california depreciation and amortization

Instructions and Help about depreciation return california

In this video were gonna talk about what section 179 is how it works and why it's important for you to know about ITF you have your own business make sure to watch this whole video from start to finish because that's in this video I'll be showing you some examples on-screen how this deduction works and how you might be able to reduce your taxable income what's up guys its Mike and shopper if you're new this channel Just want to take a moment and say welcome highly consider subscribing because every single week on this channel I produce new videos tattooing to help you with your finances your taxes investments and things thatsgonna help you with your career and your everyday life okay guys today I'm going to attempt something crazy which is to try to explain the section 179 deduction in plain English and this video is actually requested by one of the subscribers of this channel so Jeff my brother is going to give you a big shoutout and say thank you for recommending this topic this is a very cool tax topic to be talking about its often very complicated, but I'm going to try to break it down into plain English obviously guys I can't take every request that you guys give me, but I felt that this was a really important tax topic for you to know about especially if you own your own business or someday you think you're thinking of starting your own business this can really help you and if you're not an accountant I understand a lot of you who watch this channel are not accountants so what you know why should you even watch this well if you really want to know some tax deductions business owners have this is the one of the best ones to know about so to produce this video I had to write a series of notes and good news guys in the description section down below and also put it in the comment section down below I'm going to include link to the document I typed up that gives you a basic summary of the section179 deduction, and I've even included on that document a direct link to the Republication 946 and 179 in this video were just going to cover the basics so that you have a general basic understanding of what it is and why you would want to use it so lets start with why do you want to use section 179 well if you're a business owner or like I said maybe considering becoming a business owner someday section 179 which is a tax deduction will allow you to reduce your taxable business income, and sometimes I've seen nit reduced peoples taxable income in their business all the way to zero so at the end of the year they paid no tax and its completely legal okay so what dissection 179 sections 179 is actually an election that allows you to accelerate the depreciation on an asset, and you're like what the heck I probably already lost you guys or maybe lost most of you so every time I say the word depreciation think of that as an expense and an expense in a business that's what an expense reduces the taxable income of a business so when I say the word depreciation...

People Also Ask about california depreciation amortization form

Is California depreciation different from federal?

Does Section 179 apply to state?

Does California allow 100 bonus depreciation?

Does California conform to federal depreciation?

Does California conform to 179 depreciation?

Does CA allow special depreciation allowance?

What is bonus depreciation for California?

Does CA allow Section 179 for vehicles?

Does California allow special depreciation?

Does California allow accelerated depreciation?

Does California allow Section 179 depreciation?

What depreciation method does California use?

Does California accept federal bonus depreciation?

What depreciation method does CA use?

Does California follow federal depreciation?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit taxableyear ca get in Chrome?

How do I edit taxableyear and california straight from my smartphone?

How do I complete the depreciation ca on an iOS device?

What is CA Form 3885L?

Who is required to file CA Form 3885L?

How to fill out CA Form 3885L?

What is the purpose of CA Form 3885L?

What information must be reported on CA Form 3885L?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.