CA SPP-328 2014-2026 free printable template

Show details

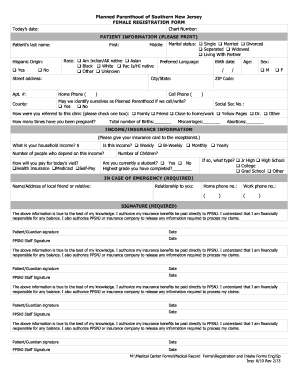

State Military Reserve

Annual Uniform and

Travel Allowance Form

California Military and Veterans Code Extract 328:

(a) The purpose of this section is to help defray the uniform and travel costs paid

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ca allowance full form

Edit your CA SPP-328 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA SPP-328 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA SPP-328 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA SPP-328. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out CA SPP-328

How to fill out CA SPP-328

01

Obtain the CA SPP-328 form from the appropriate source.

02

Read the instructions carefully to understand what information is required.

03

Fill in your personal details such as name, address, and contact information in the designated sections.

04

Provide all relevant financial information as requested on the form.

05

Review the form to ensure all fields are completed accurately.

06

Sign and date the form where indicated.

07

Submit the completed form to the appropriate agency or department as instructed.

Who needs CA SPP-328?

01

Individuals applying for specific California state programs.

02

Those seeking financial assistance or benefits through state services.

03

Residents of California who meet the eligibility criteria for the services linked to the form.

Fill

form

: Try Risk Free

People Also Ask about

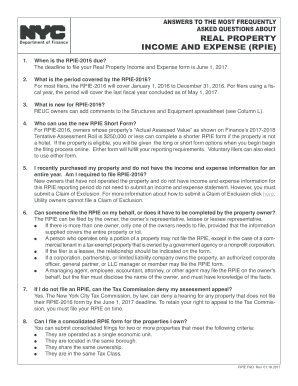

How much can you claim back on travel expenses?

You can only claim the total of your actual expenses. For example if you received $1500 worth of travel allowances from your employer during the year, but the cost of your travel was $1,000, you can only claim $1,000 worth of travel deductions on your return.

How much travel expense can I claim?

List of travel expenses Plane, train, and bus tickets between your home and your business destination. Baggage fees. Laundry and dry cleaning during your trip. Rental car costs. Hotel and Airbnb costs. 50% of eligible business meals. 50% of meals while traveling to and from your destination.

What deductions can I claim without receipts?

10 Deductions You Can Claim Without Receipts Home Office Expenses. This is usually the most common expense deducted without receipts. Cell Phone Expenses. Vehicle Expenses. Travel or Business Trips. Self-Employment Taxes. Self-Employment Retirement Plan Contributions. Self-Employed Health Insurance Premiums. Educator expenses.

What is the IRS standard allowance for travel expenses?

Annual high-low rates. For purposes of the high-low substantiation method, the per diem rates in lieu of the rates described in Notice 2021-52 (the per diem substantiation method) are $297 for travel to any high-cost locality and $204 for travel to any other locality within CONUS.

What is the difference between a travel allowance and a travel reimbursement?

A car allowance is a periodic stipend paid to an employee for the use of a vehicle and is usually taxable. A mileage reimbursement is a cents-per-mile rate multiplied by the employee's monthly mileage amount. If equal to or less than the IRS standard rate, a mileage reimbursement is non-taxable.

How do I claim travel deductions on my taxes?

If you're self-employed, you can deduct travel expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship), or if you're a farmer, on Schedule F (Form 1040), Profit or Loss From Farming.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CA SPP-328 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your CA SPP-328 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit CA SPP-328 in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing CA SPP-328 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I complete CA SPP-328 on an Android device?

Use the pdfFiller mobile app to complete your CA SPP-328 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is CA SPP-328?

CA SPP-328 is a specific form used in California for reporting certain business tax information to the state's tax authority.

Who is required to file CA SPP-328?

Businesses that meet specific criteria concerning sales and use tax, income tax, or other applicable taxes in California are required to file CA SPP-328.

How to fill out CA SPP-328?

To fill out CA SPP-328, provide the required business information, financial details, and any necessary supporting documentation as outlined in the form instructions.

What is the purpose of CA SPP-328?

The purpose of CA SPP-328 is to ensure compliance with state tax regulations and to report income or expenses related to specific types of businesses operating in California.

What information must be reported on CA SPP-328?

The information to be reported on CA SPP-328 includes business identification details, tax identification numbers, financial data pertaining to income or sales, and any applicable exemption claims.

Fill out your CA SPP-328 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA SPP-328 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.