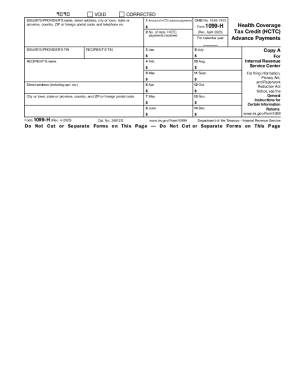

IRS 1099-H 2019 free printable template

Instructions and Help about IRS 1099-H

How to edit IRS 1099-H

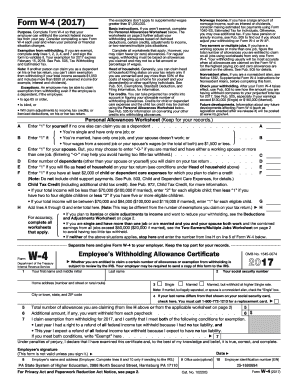

How to fill out IRS 1099-H

About IRS 1099-H 2019 previous version

What is IRS 1099-H?

When am I exempt from filling out this form?

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1099-H

What should I do if I realize I've made a mistake after filing my 1099 h form?

If you discover an error after filing your 1099 h form, you can submit a corrected version to ensure accurate reporting. It's important to clearly indicate on the form that it is a correction. Keep records of both the original and corrected submissions for your reference.

How can I verify if my submitted 1099 h form has been processed?

To verify the status of your 1099 h form, you can check with the IRS or use tracking services if you filed electronically. If you encounter common e-file rejection codes, these can usually be resolved by correcting the specified issues and resubmitting the form.

Are e-signatures accepted when filing a 1099 h form?

Yes, e-signatures are generally accepted for filing a 1099 h form, but it's essential to ensure that the electronic platform you choose complies with IRS regulations. Retaining records of the e-signature is also crucial for compliance and auditing purposes.

What steps should I take if I receive a notice from the IRS regarding my 1099 h form?

If you receive an IRS notice concerning your 1099 h form, carefully read the correspondence for specific instructions. Prepare any necessary documentation to support your case, and respond promptly to avoid further complications or penalties.

What common mistakes should I avoid when filing the 1099 h form?

Common mistakes when filing the 1099 h form include incorrect taxpayer identification numbers, mismatched names, and failing to report all required information. Double-checking all entries and using validation tools can help minimize these errors.